by Charlotte Adams

Automation is everywhere you look — in the hangar and repair shop as well as the cockpit. For the repair shops, line maintenance operations, MROs, and airline support departments that make the best use of it, computer technology gives a competitive edge in this tight-margin business. Benefits include lower costs, higher efficiencies, and greater capacity.

Automation is everywhere you look — in the hangar and repair shop as well as the cockpit. For the repair shops, line maintenance operations, MROs, and airline support departments that make the best use of it, computer technology gives a competitive edge in this tight-margin business. Benefits include lower costs, higher efficiencies, and greater capacity.

But automation isn’t static. In aviation maintenance as in other industries automation continues driving towards higher-speed, lower-cost processing and to deeper levels of integration both within individual software systems and between enterprise maintenance software and complementary aftermarket applications.

Perhaps the highest-profile trend in the aviation maintenance software market is the integration of mobile devices with core software and the proliferation of Web apps that can allow maintenance technicians to log their hours and sign off on work more quickly yet be trackable by managers in near real time. As a result, traditionally paper-intensive maintenance operations promise to become less costly and more efficient.

Ultramain

Ultramain offers a suite of integrated, but user-selectable, applications oriented around an “ePaper” strategy, according to Mark McCausland, company president. The latest release, ULTRAMAIN v9, was designed for paperless use, he says.

The company provides a series of mobile products – Mobile Mechanic, efbTechLogs, eCabin, Mobile Inventory, and Mobile Executive – that work together with ULTRAMAIN’s M&E/MRO suite as well as with other maintenance systems, he says. Headquartered in Albuquerque, N.M., the company has units in Ireland, India, and Hong Kong. It is mainly focused on the commercial aviation sector.

Ultramain notes three recent go-lives, one of which involved a line maintenance MRO in Mexico, serving 70 airlines with 23 destinations in that country. The latest involved a large international carrier that initiated efbTechLogs for its 777 fleet.

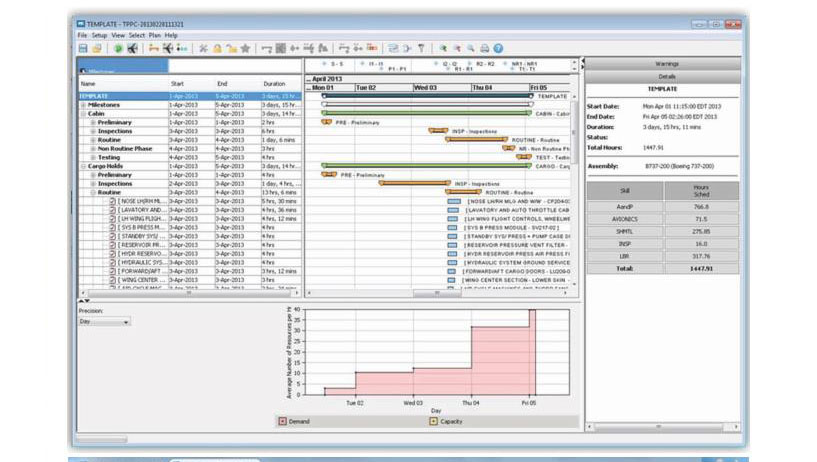

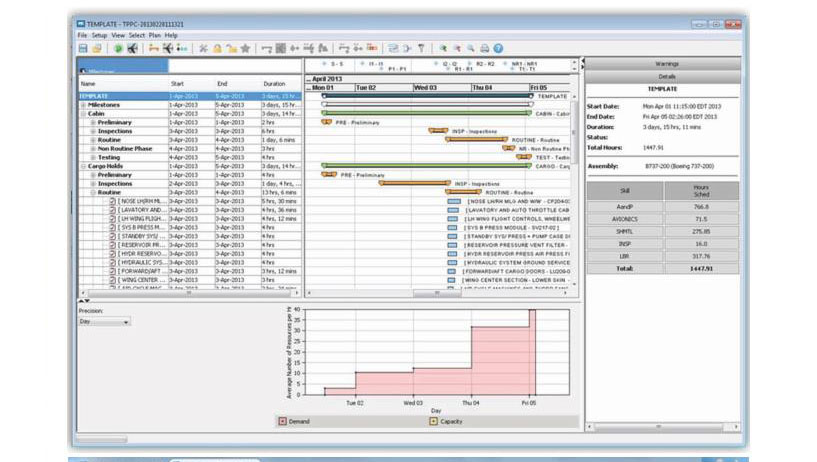

Ultramain software also incorporates optimization into functions such as fleet planning, maintenance scheduling, labor resourcing, and hangar bay usage. It includes cost accounting functions throughout its maintenance and supply applications, McCausland says, and “comes with off-the-shelf integration capabilities … with financial systems such as Oracle and SAP.”

TRAX

Miami-based TRAX has introduced a new Web product called eMRO, a mobile MRO solution usable on any platform, it says. The software is “totally mobile” in that “all functions can be used on mobiles.” And since eMRO is “pure Web,” there is no installed client,” it says.

Most of TRAX’s customers are passenger and cargo airlines although “pure” MROs like Lufthansa Technik Philippines and Turkish Technic also use the software. The company regards Swiss Aviation, SAP, Mxi Technologies, and IFS as competitors.

Both eMRO and the company’s legacy platform, TRAX Maintenance, provide materials management, resource management, technical publications, fleet management, component management, and EDI functions.

Commsoft

Commsoft, a UK-based software developer with a wide-ranging, global customer base, also stresses Web alignment and mobile applications although managing director, Nick Godwin, notes that the trend toward cloud and mobile technologies “is evolving more slowly in reality than optimistic theoretical predictions” imply in the context of the larger environment.

Automation is everywhere you look — in the hangar and repair shop as well as the cockpit. For the repair shops, line maintenance operations, MROs, and airline support departments that make the best use of it, computer technology gives a competitive edge in this tight-margin business. Benefits include lower costs, higher efficiencies, and greater capacity.

Automation is everywhere you look — in the hangar and repair shop as well as the cockpit. For the repair shops, line maintenance operations, MROs, and airline support departments that make the best use of it, computer technology gives a competitive edge in this tight-margin business. Benefits include lower costs, higher efficiencies, and greater capacity. [/imageframe][separator style_type=”none” top_margin=”” bottom_margin=”20″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”” class=”” id=””][/one_third][one_third last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][title size=”2″ content_align=”left” style_type=”underline” sep_color=”” margin_top=”” margin_bottom=”” class=”” id=””]IssueHighlights:[/title][checklist icon=”” iconcolor=”#81d742″ circle=”no” circlecolor=”” size=”18px” class=”” id=””][li_item icon=””]Editor’s Notebook[/li_item][li_item icon=””]Intelligence: News[/li_item][li_item icon=””]Intelligence: About People[/li_item][li_item icon=””]Intelligence: Aviation Electronics News[/li_item][li_item icon=””]Setting the Standard[/li_item][li_item icon=””]Borescopes from Basic to Bodacious[/li_item][li_item icon=””]Parts, Parts, … Who has the Parts?[/li_item][li_item icon=””]Smart Assets[/li_item][/checklist][/one_third][one_third last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][imageframe lightbox=”no” gallery_id=”” lightbox_image=”” style_type=”bottomshadow” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”http://www.avm-mag.com/wp-content/uploads/2016/01/AVM_Calendar_2016_FINAL_v10_LORES.pdf” linktarget=”_blank” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]

[/imageframe][separator style_type=”none” top_margin=”” bottom_margin=”20″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”” class=”” id=””][/one_third][one_third last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][title size=”2″ content_align=”left” style_type=”underline” sep_color=”” margin_top=”” margin_bottom=”” class=”” id=””]IssueHighlights:[/title][checklist icon=”” iconcolor=”#81d742″ circle=”no” circlecolor=”” size=”18px” class=”” id=””][li_item icon=””]Editor’s Notebook[/li_item][li_item icon=””]Intelligence: News[/li_item][li_item icon=””]Intelligence: About People[/li_item][li_item icon=””]Intelligence: Aviation Electronics News[/li_item][li_item icon=””]Setting the Standard[/li_item][li_item icon=””]Borescopes from Basic to Bodacious[/li_item][li_item icon=””]Parts, Parts, … Who has the Parts?[/li_item][li_item icon=””]Smart Assets[/li_item][/checklist][/one_third][one_third last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][imageframe lightbox=”no” gallery_id=”” lightbox_image=”” style_type=”bottomshadow” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”http://www.avm-mag.com/wp-content/uploads/2016/01/AVM_Calendar_2016_FINAL_v10_LORES.pdf” linktarget=”_blank” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]  [/imageframe][separator style_type=”none” top_margin=”” bottom_margin=”20″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”” class=”” id=””][fusion_text]NEW – the large fold out 2016 Wall planner was inserted into the Dec/Jan issue but you can also click/view above.[/fusion_text][/one_third][/fullwidth]

[/imageframe][separator style_type=”none” top_margin=”” bottom_margin=”20″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”” class=”” id=””][fusion_text]NEW – the large fold out 2016 Wall planner was inserted into the Dec/Jan issue but you can also click/view above.[/fusion_text][/one_third][/fullwidth]