by James Careless

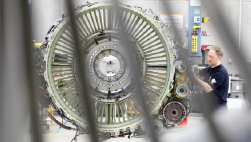

OEMs are aggressively invading MRO markets, by leveraging the emergence of new aircraft as an opportunity to force airlines to use OEM MRO services—at OEM high prices. But it is possible for airlines and non-OEM MROS to hold back the invaders, by banding together in joint partnerships.

OEMs are aggressively invading MRO markets, by leveraging the emergence of new aircraft as an opportunity to force airlines to use OEM MRO services—at OEM high prices. But it is possible for airlines and non-OEM MROS to hold back the invaders, by banding together in joint partnerships.

This is the core message contained in the “2014 MRO Survey” compiled by management consultancy Oliver Wyman. Entitled “Signs of New Life” and based on interviews with airlines, MROs, OEMs and financing/leasing firms—and available for free online at www.oliverwyman.com the 2014 MRO survey provides tangible suggestions for airlines and non-OEM MROs to keep the profit-minded OEMS from taking over the global industry.

Putting the Stakes In Context

According to the aviation consulting firm ICF International (formerly ICF SH&E), in 2013 the world’s MROs supported 123,000 civilian and military aircraft flying about 97 million hours annually, with business and commercial aviation making up 26 percent and 22 percent of the aircraft flown.

Now for the money. In 2013, the global MRO market earned $131 billion, with about 46 percent ($60.7 billion) being earned by air transport MROs. North America remained the number one MRO market in 2013 (31 percent of the world demand, in terms of revenue). Asia/Pacific edged out Europe for the first time (27 percent and 26 percent respectively), followed by the Middle East (7 percent), South America (5 percent), and Africa (4 percent).

Looking ahead, ICF International predicts that air transport MRO spending will grow 3.9 percent annually to 2023, when it will hit $89 billion. As this is happening, older aircraft such as the A330, B747-B, B767, and B777 will be phased out in favor of new, fuel-efficient models like the A350WXB, B777X and B787.

For airlines and non-OEM MROs, this trend is of fundamental concern, because OEMs Airbus and Boeing are doing everything they can to sew up the after-sales MRO on these aircraft for themselves. Their chances of success will improve once the world’s carriers are reliant on just a trio of their planes.

Even without that edge, the OEMs are already succeeding. In 2014 “Original equipment manufacturers won the market for high-value, aftermarket aviation services, leaving independent maintenance, repair, and overhaul providers scouting for paths to evolve and grow,” declared the Oliver Wyman 2014 MRO Survey. This is no mere guess: “In our annual survey of airlines, MROs, and OEMs, we confirmed the disparity in engine and component maintenance for new, modern fleets.”

To say the least, the OEMs’ successful push into MRO work is a seismic shift from how they used to view the after-sales market. “For years, the OEMs seemed to regard MRO work as being beneath them,” said Wayne Plucker, Frost & Sullivan’s Industry Manager for Aerospace & Defense.

Now that the global air transport MRO market is worth more than $60 billion annually and growing, their attitude has changed. With all this revenue available, “Airbus, Boeing and Bombardier can see the very real advantages of providing such after-market support,” Plucker said, “not just for the money it brings, but the chance it offers to keep customers buying their aircraft when fleet renewal time comes.”

The MRO Squeeze Play

The only way the OEMs can truly dominate the MRO market is by keeping non-OEM MROs from being able to work within the market. Given the number of commercial aircraft currently licensed for non-OEM servicing, this is difficult to achieve.