Driven by e-commerce and express services, especially in the Asia Pacific region, the passenger-to-freighter (P2F) conversion market looks good, especially in the narrow-body niche. Although air cargo transport is cyclical and subject to trade politics, volumes are still growing and OEM forecasts are optimistic.

Although the basic processes are well understood, conversions involve major design changes to the OEM aircraft that will affect the original aircraft’s weight and balance, flight characteristics, loads, and major systems, says Victor Burnett, director of engineering for Airborne Tampa/Pemco Conversions. The complexity of the task underscores the need for skilled A&Ps, he says. “Aircraft modification shops have to be proactive with recruiting and training mechanics.”

“Chinese integrators are aggressively expanding their narrow-body fleet[s] to address demand from e-commerce, and the range and payload of our A320/321 P2F solutions are well-suited for the regional operation routes that serve this e-commerce sector,” says Adrian Lim, vice president, Engineering & Development Center, with ST Engineering’s Aerospace sector.

He sees the main driver for air cargo traffic as retail e-commerce, dominated by relatively small and lightweight packages. ST Engineering, the world’s largest P2F aircraft conversion house, has converted more than 400 aircraft and is the only provider to offer both Boeing and Airbus conversions via its own STCs, he says.

There are now 17 active and developing narrow-body PTF conversion programs for eight aircraft types, says Angus Mackay, principal with ICF. Vallair, which has launched the first A321 projects, forecasts a 20-year demand for 1,100 narrow-body freighters through P2F conversions. “All future narrow-body freighters will be PTF-converted aircraft,” Mackay says.

The 737-800 converted freighters, with a handful of deliveries so far, and the A321 converted freighters — still in development — are expected to go head-to-head for the future narrow-body conversion crown. As of January 2019, Aeronautical Engineers Inc. (AEI), Boeing, and IAI had more than 120 orders and options for converted 737-800s, according to IBA. AEI has orders and commitments for 111 737-800 conversions and thinks it will convert 600-700 of the airplanes over a 40-year period, according to Robert Convey, senior vice president of sales and marketing for the company.

Further into the future we can expect cargo drones. “Given an increasing global demand for air freight, coupled with a shortage in air crew, we believe that unmanned freighters will provide a viable solution as well as tangible benefits such as lower cost of operation,” Lim says. “For a start, we are looking [at] incorporating a single-pilot cockpit into our conversion solution. … The obvious benefit is a reduction in air crew cost by up to 50 percent.”

Moreover, if the passenger-to-freighter conversion can be executed simultaneously with the single-pilot cockpit conversion, downtime can be significantly reduced, he says. Single-pilot cockpit conversions “can also help boost the residual value and sales of the new-generation freighters.”

experts in the initial phases of a conversion project is key. Laser Aviation image.

freighter gives it a second life. AEI image.

Vallair is launching A321 conversions with Elbe Flugzeugwerke — a joint venture (JV) of ST Aerospace and Airbus — and 321 Precision Conversions, a JV of Precision Aircraft Solutions and Air Transport Services Group (ATSG). Prototypes are expected by late 2019 or early 2020,” says Peter Koster, Vallair’s head of cargo conversions.

As long as aircraft types are popular in the passenger market, however, their elders have an edge. The 757 remains strong —with an estimated feedstock of more than 230 airplanes — and 737-300 and -400 programs are ongoing. Precision Aircraft Solutions, with its Chinese and U.S. partners, dominates the 757-200 conversion market, offering full-freight and combi solutions, and has converted around 100 aircraft, ICF says.

Pemco has 737-300, 737-400, and 737-700 programs. It has more than 150 conversions to date, according to ICF. AEI has programs for the 737-300, 737-400, 737-800, and the MD-80 family. But many customers are waiting for 737-800 feedstock prices to get below $10 million, Convey says.

Pemco recently completed a 737-400F conversion at the facility of its partner Coopesa in Costa Rica for Mistral Air. Coopesa, a heavy maintenance specialist, has been performing P2F modifications for more than 20 years, the company says, and is planning to move to a new facility and expand its scope beyond the 737-300 and -400. All of its P2F projects have included heavy checks, AD notes, modifications, and painting.

Cost-Benefit

The cost-benefit of conversion is that “basically you’re giving an aircraft a second economic life,” Koster says. A conversion can add another 20 to 25 years of service. Converted freighters can be offered at “incredibly competitive price points,” with “significantly lower capital outlays and shorter lead time[s]” for airlines, compared to buying new-production freighters, Lim says.

Converted passenger aircraft are a good fit for the narrow-body freighter market because they are not heavily utilized – they may only fly for 2-4 hours a day, five days a week, Convey says.

A used 737-800 — 18 to 20 years old — may sell for $13-16 million, he says. The conversion may cost as much as $3.7 million, plus $1.5 million for maintenance. So you have a $20-million converted freighter. (The cost of a new 737-800 passenger jet is around $45 million, he says.)

Wide-body freighters support trunk routes between hubs, whereas narrow-bodies service secondary routes, Koster explains. New-production freighters are typically wide-bodies because they spend much more time in the air and need to maximize fuel efficiency. He expects that narrow-bodies will play an increasing role, exploiting air transport links and secondary airports closest to the customer.

Future Rivals

From an engineering perspective, conversion technologies are relatively mature, Mackay says. “Supply chain efficiencies and evolving production partnerships are increasingly driving down total costs.” Thus innovations are largely restricted to aircraft configuration options, including operating weight upgrades, spare engines, live animal carriage capability, and various combi passenger and freight options, he says.

The 737-800/A321 rivalry will offer customers a wide array of choices. At the outset the Boeing jet has some built-in advantages. A handful of 737-800 conversions have been delivered while the A321 projects are still in development. And since Boeing aircraft historically have dominated the narrow-body conversion sector, there may be a comfort factor for some carriers. And they might not want to support mixed fleets. There also are far more 737-800s than A321s. For these customers the 737-800 in a sense competes with its predecessors, but the -300s may be too small, the -400s running out of feedstock, and the -900s too expensive for them.

Koster considers the A321 to be the “logical and only follow-on to the 757.” The Precision A321-200PCF can carry 95 percent of the 757’s volume while burning at least 20 percent less fuel, according to Precision.

Vallair says the main differentiator between the A321 and 737-800 platforms is that the A321 is bigger — it can carry 14 full-sized containers in the main cargo deck; customers also have the flexibility to choose a containerized or bulk lower deck compartment. Precision’s design also comes with an optional Telair “sliding carpet,” conveyor-belt-like, bulk cargo loading system.

The latest version of Telair’s loading technology, however, also includes containers made of “state-of-the-art materials to achieve low weight and extreme durability,” according to Telair. This system was certified last year for all current production and in-service 737s, Telair says.

It Ain’t Easy

P2F conversions involve “basically modifying the whole aircraft interior and parts of its fuselage,” Lim explains. “Without a doubt, the engineering and design work is massive in scale and yet intricate in nature.”

Depending on whether the platform is a narrow- or wide-body aircraft, a passenger plane undergoes between 800 to 1,250 critical tasks during the conversion process, he says. Floor structures have to be reinforced to carry heavier loads and larger doors have to be installed to allow loading and offloading of cargo pallets. Barriers also are retrofitted to prevent cargo movement during flight, along with an additional cargo handling system, he says.

another layer of complexity. AEI image.

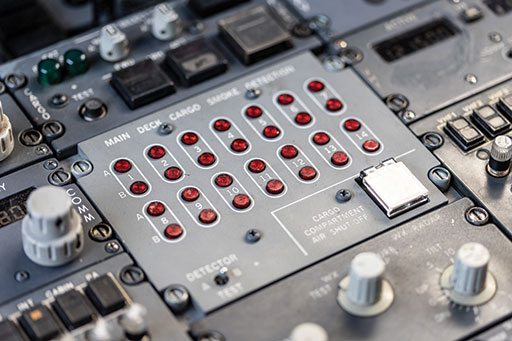

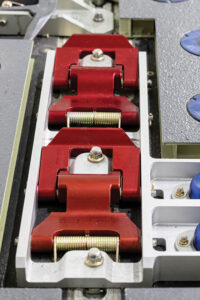

Conversion projects include full P2F, combi, and quick-change configurations, Burnett, says, and Pemco does all three. These basic configurations all require the installation of the main cargo door, floor reinforcement, interior modification, and a cargo handling system. The PMA conversion kit is huge, Burnett notes. It includes everything from the cargo door and surrounding fuselage reinforcement, to the flooring, and to interior components such as the liner (interior skin), sidewall panels, ceiling panels, and smoke detection systems.

And each P2F project is different, he explains. The interiors of used passenger jets, for example, can vary considerably within the same model and type in areas such as the number and locations of galleys and lavs. This variation must be accounted for in the conversion.

Considering the FAA-required inspections and FAA airworthiness directives that are combined with a conversion project, “a modification shop will need to be very strong in all aspects of aircraft modification and safety,” he adds. “Engineering and material logistics are also at the core of having a conversion package.”

Besides technical competencies, a close working relationship and support from the OEMs are “absolutely critical to the safe completion of such conversions,” Lim says. “Modifications to each subsystem will likely impact the others and start a cascade of change.” To avoid the need for corrective actions and AOG situations during operation, each modification must be fully analyzed with the aid of OEM engineering data. “For instance, if any sensor[s] need to be relocated, their functionality can only be fully and safely restored with OEM support.”

Three-quarters or more of the work is on the cargo door and the surround structure of the door, AEI’s Convey says. AEI emphasizes the reliability and robustness of its cargo door, as the same basic design has been used in nearly 500 conversions.

Another important factor is to minimize the number of unknowns, Burnett says. Otherwise, “conversion projects can easily grow out of control.” It’s necessary to start with a good statement of work and to get input from all subject-matter experts in the initial phases of a project. It’s also important to identify maintenance issues and part lead times early in the process. Converted aircraft are typically around 15 years old. But even more important than age is the number of flight cycles on the aircraft, he says.

Laser

Scanning

It may not be a household name, but Laser Aviation plays an important role in the business of understanding the airplane you’re working with – making measurements of aircraft exteriors and interiors to submillimeter accuracy. The 3D model files produced by non-contact scanning can be fed into engineering programs like Catia, Design X, or SolidWorks, saving time and money compared to converting 2D drawings into 3D images.

For approximately $75,000 — including scanning the full interior and exterior of an aircraft — “We can save customers 30 to 35 percent of the cost in the design phase,” says president, Mike Mullett, referring to the conversion development work after the original interior has been removed but before any other physical changes have been made. This laser scanning and mapping technology has been used in conversions, completions, and in special-mission aircraft modifications. Work is typically completed in two to five days.

The company, for example, supported Pemco in developing a cargo conversion design for a 737-700 passenger jet. The aircraft scan, which included flaps deployed in all settings, “enabled the engineers to do their loading and other calculations within a 3D solid model,” he says.

Earlier work involved a USAF special-mission project, where an older aircraft provided the platform for specific equipment that required “as built” drawings, Mullett recalls. Although no such drawings existed, Laser Aviation was able to provide the 3D data that allowed the equipment to be moved from a 737-200 to a 737-700, he says.

Laser Aviation uses a single-beam laser tracker to establish the exact XYZ coordinates of points around the exterior of the aircraft that are temporarily tagged with magnets, or “monuments.” As the solid model is created, the data captured has the aircraft coordinate system clearly defined from the start, allowing engineers to know where each point is in the 3D model.