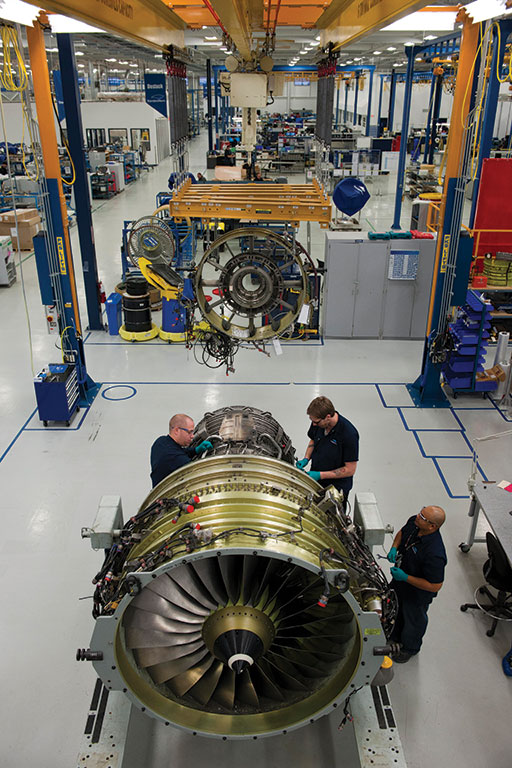

As the U.S. economy rebounds, global air traffic mushrooms, and aircraft production sizzles, engine MRO enjoys the best of both worlds – deferred aircraft retirements plus demand for work on newer powerplants. Maintenance providers, including traditional MROs, are adding capacity, expanding cooperation with OEMs, enlarging global networks, customizing workscopes, and acquiring smaller players to increase market share.

But challenges loom. A short list includes new engine issues, supply chain problems, and related parts shortages as well as the capacity-straining convergence of MRO demand for older and newer engines. Rising labor costs and the skilled labor pinch as well as macro issues such as trade wars, Brexit, interest rates, oil prices, climate change, and regulation are also factors to track.

“The consideration in the market is whether there is enough MRO capacity to cover the ESVs [engine shop visits] — some premature — on the newer fleet whilst sustaining the mature fleets,” observes Carl Glover, AAR’s vice president, sales & marketing – Americas. “We see this as an opportunity for airlines to work with us on used content maximization for inventory spares and engine leasing.”

Oliver Wyman estimates that the engine MRO market will grow from $32.7 billion in 2018 to $52.6 billion in 2028. But the good times will roll unevenly. Spending, for example, will tilt toward narrow-bodies in the next decade.

Asia, especially China, will drive growth. By 2028, Oliver Wyman says, the aggregate demand from Asia Pacific, China, and India will more than double that in North America.

The aftermarket is hot. There is a “general expectation” that MRO revenues will grow at a compound annual growth rate-escalated (CAGR-escalated) of 7-10 percent over the next decade, notes Leo Koppers, senior vice president of MRO programs with MTU Maintenance.

Proudfoot

Managing Director, Proudfoot

At least one of the engine OEMs is seeking outside help to deal with supply chain challenges. “A major engine OEM” dealing in both commercial and military engines recently hired Proudfoot, a transformation expert specializing in “Lean Forward,” its brand of the efficiency methodology, says Dennis Santare, managing director of the firm’s new, cross-industry MRO practice, which it defines as “maintenance and repair operations.”

This client – like other OEMs – faces supply chain challenges associated with the “aggressive ramp-up required from airframers like Boeing and Airbus,” he says. It wants to improve on-time delivery in both production and support. “We are helping them accelerate their operational excellence efforts while the ramp-up happens.”

One of the headaches is that some suppliers don’t want to invest in technology required to build new parts, Santare says. Proudfoot helps advise on supply chain decisions to optimize the base as well as minimizing waste across the entire value chain.

“The supply chain for engine MROs is struggling to keep up with the high demand [for] shop visits,” says Rune Veenstra, the chief business officer with MRO, Aero Norway. The forecasted increase in shop visits for CFM56-5B and -7B engines over the next five years “will create high pressure in the engine shops if suppliers are not able to reduce TAT [turnaround time],” or if the supply of spare parts lags demand.

“There have been examples recently of OEM material shortages in gas path airfoils that have spiked demands for spare engine leases,” notes Carl Glover, AAR’s vice president, sales & marketing – Americas. “The key consideration is the allocation of engine shop capacity to newer engine variants [while] sustaining older-engine maintenance demands.”

Golden Opportunity

Notwithstanding the challenges of working with OEMs, confidence is growing that — faced with production and logistics headaches – the OEMs could use MRO support.

OEMs are reaching out. CFM International inked a much-hailed openness agreement with IATA — though no one is sure what it means. And GE Aviation and Pratt & Whitney are expanding their networks. On the other hand, “you can see vertical integration” on the production side, says Marc Wilken, head of product sales & engine lease and services for Lufthansa Technik (LHT). “As the supply chain is significantly squeezed, OEMs are trying to reintegrate some of their suppliers in their production process to eliminate … bottlenecks.” However, this could also improve spare parts supply, he says.

GE is “fully committed to offering maximum choice to customers – now and in the future,” says Bill Dwyer, general manager, services marketing. The CFM56, for example, is the “most widely produced engine in commercial service with more than 33,000 engines built.” He points out for CFM56 shop visits. “Customers want that choice, they value that choice, and that’s one of the factors that drives the preference for our engines.”

GE is expanding internal and external capacity. GEnx engines, for example, are starting to see their first performance restoration shop visits. To meet the demand, it’s added capacity at its shops in Scotland and Brazil. GE also touts joint ventures (JVs), such as XEOS in Poland — with LHT — which will service the GEnx-2B, and eventually, according to plans, the GE9X. The OEM also has announced a JV with SIA Engineering Company for a GE90 and GE9X overhaul facility in Singapore. Another JV, GE Evergreen Engine Services in Taiwan, targets the GEnx.

Dwyer estimates about 4,800 commercial engine shop visits were made at GE and its JVs in 2017, a number he expects will grow by about 5 percent a year through the end of the decade. “It’s a large fleet with some 36,000 engines, and it’s a young fleet. Approximately two-thirds of the fleet has one shop visit or less, so there is a lot of activity to come as the fleet continues to grow.” GE’s services backlog is more than $160 billion.

GE is investing in its Lafayette (Ind.) Engine Facility, which will offer LEAP overhauls, as well as in its Malaysian facility, which will expand LEAP capacity. It’s also expanding on-wing support (OWS) capabilities worldwide, including a new base in Dubai and facilities in Brazil and South Korea. GE has more than 300 technicians globally and expects that to grow to nearly 500 by 2020, Dwyer says.

Pratt & Whitney is expanding its geared turbofan (GTF) MRO network. Pratt, in addition to MTU (now in a JV with LHT) and Japanese Aero Engines Corp., is partnering with Delta TechOps, says Paul Finkelstein, director of marketing. In April P&W also announced that Turbine Controls, StandardAero, TWIN MRO, ACMT, and Lewis & Saunders are the first third-party suppliers to join the GTF repair network. The GTF, which incorporates 40 percent more sensors than the V2500, can generate about 4 million data points per engine per flight.

In the last year Pratt has received more than 2,000 new GTF orders and commitments from 22 customers. In addition, the V2500 – with a fleet of more than 7,000 in service — will continue to be in high demand for the next decade or more, he says. And PW2000-powered 757s are “in very high demand in the used aircraft marketplace.”

Golden Opportunity

“In the next few years newer-generation engine MRO requirements will displace the capacity currently allocated to previous-generation engine MRO workload, most notably at OEM shops,” says Peter Turner, president of StandardAero’s Airlines & Fleets division.

“Our discussions with OEMs in general indicate that they do not prefer to invest in brick and mortar to support engine MRO workload and hence need to outsource engines to make way for the newer variants,” he adds. “Therefore, we anticipate the OEMs will come to their trusted partners, such as StandardAero, to provide capacity to handle this growing workload.” He stresses, however, that “our corporate strategy is not to compete with OEMs… .”

Hirth Expands Support

Hirth Engines, the German manufacturer of engines for ultralights, experimental aircraft, and drones, is expanding aftermarket support in areas such as “just-in-time parts,” updated maintenance manuals, and an updated Web page to help its many international customers find the right parts, says Peter Lietz, head of international sales and service. The company also is “actively searching for partners to provide local first-level support in their local area, time zone, and language.”

Hirth is registering growth in the UAV sector and the spare parts/replenishment segment, Lietz says. An example is Hirth’s support of Airflite, an Australian MRO which has partnered with Hirth’s new parent company, UMS SKELDAR, the UAV joint venture between Sweden’s Saab and UMS AERO of Switzerland.

Airflite has been contracted to maintain UMS SKELDAR’s V-200 unmanned helicopter, along with the UAV’s Hirth 3504HF, a two-cylinder, in-line, two-stroke, liquid-cooled derivative of Hirth’s 3503 E/V engine. Hirth will help Airflite to develop 3504HF maintenance schedules.

Hirth UAV customers can interface with its Florida-based partner, UAV Propulsion Tech, which ships engines back to Germany for repair and test. Or customers with organic capability can perform MRO on site or in theater, supported by OEM training, manuals, and optional in-person technical support.

Another partnership involves U.S. distributor, Recreational Power Engineering, which provides in-house engine maintenance and overhaul in the sport light and experimental aircraft sector.

“We are currently seeing slot capacity constraints worldwide,” MTU’s Koppers says. This, he explains, is the result of new-generation engines entering shops earlier than planned, continued high demand for current-generation engines, and sustained demand for mature engines, such as the CF6-80C2, which are being flown longer or even revived – in some cases resulting in an immediate need for MRO services, from smaller workscopes to heavy maintenance.

President, StandardAero Airlines & Fleets Division

Asia

“The Asian region … produces around a quarter of all shop visits and is expected to make up around 35 percent of world demand by 2027, Koppers says. Within that region China is the largest single MRO market – both in shop visit volume and revenues, he says. By 2027 over 40 percent of all Asian shop visits – approximately 1,400 visits or more – will be generated from the Chinese market, most of them generated by narrow-body engines, he predicts.

MTU Maintenance Zhuhai, “the largest narrow-body shop in Asia,” is increasing capacity by 50 percent – from 300 to 450 shop visits annually by 2021, he says. Although this JV with China Southern relies on the Chinese partner for baseload, “around two-thirds of shop visits come from independent business around the globe.”

Convergence Dividends

LHT “absolutely” sees the convergence of new and old engine demand as an opportunity, Wilken says. All players will be challenged in preparing for new engines while supporting current and mature engine types, as they “tend to fly longer than predicted,” he says. “Market capacity is not expected to grow faster than MRO demand for the next five years,” he adds.

LHT and MTU have partnered on EME Aero, a GTF JV in Poland. Expected to open in 2020, the facility has a planned annual capacity of over 400 shop visits, Koppers says. LHT has also established a partnership with GE, XEOS, to service GEnx-2b and later the GE9X engines. LHT is a member of OEM networks “in all major future engine types,” Wilken says.

He estimates that the number of shop visits for the CFM56-5B/-7B and V2500 engines will increase by about 5 percent per year from 2018 to 2023, when demand is expected to peak. Within this group the -7Bs, as the sole engine option for the B737NGs, will increase in visits by 9 percent per year, Wilken says, while V2500 visits will grow at a more modest 2 percent per year until 2023. He expects overhaul demand for new engine types to start growing quickly in the mid-2020s, but until then these powerplants are expected to involve smaller workscopes.

MTU expects its commercial maintenance business – with revenues expressed in U.S. dollars — to increase by “mid-teen percentages” in 2018, Koppers says. The MRO expects growth in CFM56-7 and -5B shop visit volumes in the neighborhood of 20 to 30 percent for this and next year.

MTU Maintenance is expanding capacity at all locations, Koppers says. “By 2027 around 50 percent more capacity will have been added.” In Hannover it’s planning additional buildings to increase shop space. And it is expanding a logistics center in Berlin. MTU Maintenance Canada introduced V2500 capabilities in late 2017 and may add CF6-80C2 capacity as well.

StandardAero’s capacity has mushroomed in the last two years. It acquired high-thrust test cell capability at Kelly Aviation Center in San Antonio, followed by the RB211-535E4 award from Rolls-Royce. This designates StandardAero as the OEM’s “end-of-life engine maintenance service partner for these engines,” expected to remain in airline service until 2040, Turner says.

The company has nearly doubled component repair capacity – including engine component repair – in Cincinnati. Turner predicts further consolidation within engine component repair, “given how fragmented the space is.”

“We also still have capacity available for incremental engine programs, and we’re in the final stages of industrializing a second large facility in Winnipeg to accommodate … requirements from GE and operators of CFM56 and CF34 engines, as well as distributing cycle 2 repair work around our increasing, specialized piece part … repair division.”

AAR also enjoys new as well as legacy engine business. A recent power-by-the-hour (PBH) agreement with Air Malta, for example, involves nose-to-tail support of A320neos, including airframe, APU, and engine LRUs plus on-site inventory.

Aero Norway sees convergence as “an opportunity since some of the engine MRO shops will need to deal with the new-generation engines at an early phase due to some startup problems with the new-generation engines.”

Keep ‘Em Flying

AAR provides full engine management solutions including support programs, overhaul management, and engine exchange/sales/leasing/ plus access to parts through its global supply chain and repair facilities.

It’s been working with several large operators and MROs “on used content maximization … to reduce their cost/available seat miles [CASM] during engine shop visits,” Glover says. This is a trend in both mature and current engine fleets, he says.

“We anticipate some customers will want to continue their CASM reduction and cash smoothing,” Glover says. “AAR recently signed a large multiyear mature engine CPH [cost per hour] program and structured a flight-hour solution for the same customer.” AAR forecasts and holds the inventory, its “MRO partner overhauls the engines, and the operator enjoys cost predictability for their operations.”

Customization

MTU sees airlines “moving away from fly-by-hour [FBH] contract[s] … as engines mature, and increasingly desiring individualized solutions and workscopes,” Koppers says. “We pride ourselves on our customized workscoping, as well as our solutions for mature engines.” FBH contracts are very common for newer-generation engines, however, as a way of reducing risk, he adds.

LHT’s Wilken also perceives a trend towards “highly customized engine MRO solutions,” exploiting potential savings. “The demand for standard, non-optimized engine MRO offerings is declining as airlines increasingly want to carve out additional savings.”

Tailored workscopes are typically used in support of older-generation engines, Glover agrees, where work is performed on engine modules. Further repair options are available at the piece part level. Targeted repairs preserve the engine’s efficiency, time on-wing, and performance. “An example would be a repair or overhaul on a CF6-80C2 engine [that] would focus on a core restoration, say every 3,500 cycles, but the LPT [low pressure turbine] and fan may be repaired every other shop visit.”

Some of AAR’s recent bespoke engine management/engine material management programs use tailored workscopes, material management, and engine spares provisioning. AAR also has “partnered with engine and component MROs who understand used content, designated engineering representative [DER repairs], PMA use, and the need for differentiated repair schemes for individual engines.”

Used content also helps to “bring some predictability to some of the engine maintenance costs” in maturing engines. “This pro-active approach has become common practice over the last few years,” Glover adds.

MTU also supports used serviceable material (USM). The CFM56 and V2500 engines are exciting to observe, Koppers says, as the installed fleet is large and the newer variants – such as the CFM56-7 and V2500-A5 – still have their shop visit peaks ahead of them. But as these engines mature, MRO costs will increase due to need for heavier shop visits and material replacement.

In fact, many will be retired over the next 10 years, which will increase supply of spare engines and USM. “We find developments like this particularly interesting, as our mature engines program is perfect for such fleets.” And more material in the market means that the options within this program will be even more flexible and cost-effective, he says.

“We’re looking forward to supporting operators … through … customized builds, green-time lease in or out, and teardown and remarketing of parts.” High shop visit demand is also boosting demand for spare engines, as provided by MTU Maintenance Lease Services, he says.