Forget the COVID-19 economic downturn: Sales in the global commercial aircraft Parts Manufacturer Approval (PMA) aircraft parts market are surging ahead post-pandemic.

According to ReportLinker.com’s June 2022 report, the global commercial aircraft PMA market was worth $10.5 billion in 2020, with sales being depressed due to reductions in air travel. With airlines back in business, this market is now projected to grow to $14 billion by 2026, which represents a compound annual growth rate (CAGR) of 4.7% annually.

Shown above are gears from a Heico fuel pump. HEICO image.

This being said, the fact that PMA parts sales are rebounding doesn’t mean that the pandemic’s disruptive impact on this market has passed. Like other parts of the global aviation industry, PMA parts manufacturers are still dealing with the pandemic’s fallout, which is hindering their efforts to fully satisfy their customers’ demands. This being said, many of these companies are finding creative ways to turn COVID’s pain into financial gain, and aim the PMA parts industry towards a strong future.

Turning Pain Into Gain

As is the case with industries around the world, PMA parts manufacturers are struggling with a supply chain that is experiencing ongoing material shortfalls, labor shortages, and delivery delays.

This is a case of shared supply chain pain, according to Jason Dickstein, president of the Modification and Replacement Parts Association (MARPA). “I don’t think it’s going to be a surprise to anyone to say that COVID has adversely affected the entire aviation supply chain,” he said. “PMA companies have tried to be there for the air carriers, but it’s been hard.”

Thinking of airline supply chain challenges, Pat Markham, VP of Technical Services for HEICO Parts Group, shared, “PMA parts, by their nature, are a natural mitigation strategy for airlines. As a direct replacement for OEM parts, by including PMA parts in their maintenance programs, airlines are immediately opening up a second FAA-Approved source.”

Matters have only been made more challenging by the revival of commercial air travel. As airlines try to return more aircraft to service, their need for PMA parts is going up. So are the airlines’ orders for PMA parts, which can be difficult for PMA manufacturers to fulfill.

“The supply chain issues have really increased our supplier lead times driven by both staffing issues as well as raw material availability,” said Chris Hinkle, engineering manager at Core Parts. “Core Parts works hard to always have parts available on the shelf, but sudden increased lead times has made that challenging.” One saving grace: “COVID did not have any direct negative effects on Core Parts’ business as our aviation customer base is primarily in small turboprop driven aircraft and not the large commercial airline industry,” he said.

Core Parts isn’t the only PMA parts manufacturer to find the silver lining in COVID’s cloud. A case in point: “COVID is slowing down companies’ ability to produce new parts because of raw materials, labor, and recovery from the downturn in 2020 and 2021 where airplanes were not flying as much and requiring less maintenance,” said James Brooks, owner of Prime Propulsion, a certification company that helps manufacturers navigate the PMA approval process. The upside? “Thanks to the increased cost of doing business due to inflation, companies who were against using PMA parts in the past are now coming to realize the benefits and now buying them,” he said.

This assessment is endorsed by Alan Voeller, VP of sales and business development at PMA parts manufacturer Jet Parts Engineering. “COVID has obviously caused chaos with the global supply chain, especially in the manufacturing sector,” said Voeller. “As part availability has always been a key component of PMAs’ benefits to airlines and MROs, the supply chain challenges have had a positive influence on the acceptance of PMA parts by airlines. As global supply chain difficulties caused part availability issues, PMA companies that have been able to maintain stock on their shelves have had opportunities to solve supply chain woes at airlines and MROs further showing the value PMA can provide to operators.”

PMA parts manufacturer Certex Aviation is also finding opportunities in the post-pandemic market, but in a slightly different way. “Getting raw material has not been a problem for us, although prices are climbing,” said Tim Feeney, the company’s president. The result: “When the airlines started flying again and demand increased rapidly, we were able to grow by manufacturing our competitors’ products (for them, under contract) while investing in new products for ourselves.”

Business Coping Skills

Across the American PMA industry, a decision to use domestically-made materials is shielding many US manufacturers from international procurement/shipping delays, at least in those areas where they’ve been able to find what they need in-country. “While I don’t know every company’s supply chain issues, I do know that a fair number of MARPA members were very proud of the fact before COVID that their supply chain was all US-based, and they were proud to purchase from US sources,” Dickstein said. “I think that for them, these US sources have been a lot easier to continue to obtain materials from than some non-US sources.”

This being said, not everything that PMA parts manufacturers can be sourced domestically. Managing these supply chain issues successfully requires flexible, comprehensive and panic-fee coping skills, which these manufacturers appear to have in abundance.

“Not all fleets and airlines were affected equally, and the recovery has been far from smooth or even. HEICO has an interesting challenge,” Markham noted. “With 12,000 PMA approvals spread across multiple fleets and various regions/airlines, planning for the recovery requires constant attention, communication, and flexibility as we adjust for airlines’ changing plans.”

At Jet Parts Engineering, “we have not been immune to the supply chain disruptions: We mostly see issues on the raw material side such as plastics and specialty alloys,” said Voeller. To cope, this company has adjusted its Reorder Planning to account for these delays, along with “dual sourcing” materials from two or more suppliers and modifying its Scheduling systems to factor in delays.

Fortunately, “our customers are going through the same challenges, so they are understanding if delays occur,” Voeller said. To maintain goodwill with its client base and ensure repeat business, “the most important thing for us is to stay in close contact with our customers and our vendors to ensure we’re all working together to make things happen and eliminate any surprises.”

Jet Parts Engineering isn’t alone in accepting the realities of a COVID-battered supply chain and making allowances to cope with it. “Recently Core Parts has reviewed our entire catalog of parts and generated re-supply purchase orders from our manufacturers as much as six months prior to when our typical order window would otherwise normally be,” said Hinkle.

Certex Aviation is also adjusting its workflow to account for supply chain delays, while accepting an increasing number of post-pandemic PMA parts orders. “The growth we’ve seen is not always seamless, and we do sometimes have challenges with our promise dates,” Feeney acknowledged. “However, based on customer feedback, we seem to be doing much better than our OEM counterparts on lead times. Nevertheless, if there are issues, we manage customer expectations as early as possible and stay in constant communication with them with respect to our status in filling their orders.” Helping Customers

By its very nature, the PMA parts industry is built to help airlines and other aircraft operators find the parts they need when they need them. This has always been the case, even before the global supply chain was thrown into chaos by the pandemic. It is even truer today in COVID’s wake.

“Even before COVID, one of the PMA industry’s chief selling points is always having FAA-approved aircraft parts on the shelf so that air carriers and others could get them quickly whenever they needed them,” said Dickstein. “During COVID, many PMA parts companies took special care to make sure their shelves were fully stocked, because they anticipated that air carriers would start flying again and would need those parts fast.”

“That’s actually one of the things that I’ve heard from air carriers that they really appreciate about the PMA industry,” he continued. “Sometimes they go back to the production certificate holder and say, ‘I need this part’ and the production certificate holder quotes a long lead time. Meanwhile, the PMA companies offer FAA-approved alternatives that are drop-in replacements and are available today.”

HEICO’s Markham concurs. “Whether it is providing that FAA-approved replacement part for today’s AOG, or helping an airline with long term maintenance cost savings, the PMA industry is here to help,” said Markham. “The stress that the pandemic put on airlines has encouraged them to look beyond their ‘usual solutions’. We have had an abundance of new customers come to HEICO looking for tactical and/or strategic solutions through alternative parts programs.”

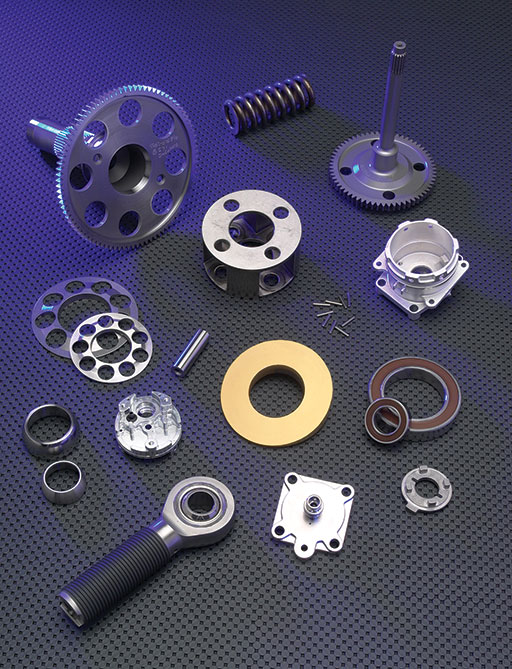

Solving customer problems is a top priority at Jet Parts Engineering (JPE). During and after the COVID, the company has been trying to be as communicative as possible with its client base, so that its staff understands which pain points its customers are experiencing due to their supply chain issues. With this knowledge, Jet Parts Engineering can step in with useful solutions in a fast and timely manner.

“Sometimes we’ve solved problems quickly by providing a PMA data package and part for a new approval for immediate use,” said Voeller. “Other times we’ve set up long term plans where we schedule blanket orders over the course of a year, so we can plan for the customer’s known demand. Where possible, to best serve our customers, JPE works to hold excess inventory in stock, so not only do our parts reduce maintenance costs on a per part basis but they’re also readily available. It’s these times that being flexible and creative really help.”

At Certex Aviation, helping customers cope is all a matter of inventory management. “Since we don’t have a long history of orders, our inventory levels may be higher than others,” Feeney said. “We also plan our reorder levels with a comfortable cushion to ensure there will always be parts when needed.”

Prime Propulsion is making a difference by helping customers who have their own PMA parts innovations achieve FAA certification in an efficient and expeditious manner. “Time to the market is critical,” Brooks explained. “We address our customers’ concerns with costs by keeping their certification process expenses down while maintaining their schedules.”

Finally, Core Parts is doing what it can to keep PMA prices down at a time of inflation-driven cost increases. “Many of our competitors raise their product prices each new calendar year because everywhere operating costs are rising,” said Hinkle. “At Core Parts, once we publish a price of a part, we will work to keep that the same price year after year so that our customers never need to feel like we are taking advantage of them.”

Looking Past the Fallout

As the old saying goes, “all things must pass.” This includes the current pandemic-driven problems in the global supply chain. Eventually, the scarcity dogging the availability of aircraft parts will ease, although they may not be resolved entirely.

With this reality in mind, the PMA parts manufacturers interviewed for this article are busy working on their plans for the future.

HEICO’s Markham is bullish on the future. “Throughout the pandemic we continued to fund our R&D, and kept up the tempo of 400 plus new PMA parts each year. Having experienced downturns before, we knew that the market would return and we needed to be prepared not only to service our customers’ current needs, but also those of an evolving fleet.”

Certex Aviation’s Feeney is circumspect in describing his company’s upcoming PMA parts. “One area we’ve focused our attention on is the Embraer 170/175 aircraft: They’re coming up on 20 year heavy overhauls and we’re looking at the areas that previously didn’t need attention,” he said. “In terms of other possibilities, I think the PMA market will enjoy continued growth. Cost pressure is heavy on the aviation industry as fuel prices rise, so the airlines are looking for opportunities like new PMA parts to save money on. As one airline customer said to me, ‘it’s a big airplane’ — meaning that there’s always new places to find nuggets of ideas for new PMA parts.”

As for Prime Propulsion? “As a Certification company we are currently working on a range of PMAs for companies, engine, cargo nets, filters, valves and more,” said Brooks. “Over the next two years, I see the PMA market continuing to grow thanks to companies who were previously hesitant to start to use PMA parts to keep their costs in line.”

At Core Parts, future PMA product development will continue to be driven by customer input. “We work with our customers and listen to their requests,” Hinkle said. “If a requested product fits within our capabilities for the right cost, we will add it to our product development queue. This being said, mandatory replacement turbine engine components during regularly scheduled overhauls are commonly our targeted products.”

The Time is Always Right for PMA Parts

There’s another old saying that applies to the PMA parts industry in the wake of COVID-19: ‘It’s an ill wind that blows no good’. This saying, which alludes to the winds used by sailing ships to reach their destinations, points out that being in the worst of situations offer opportunities for some good to arise. When it comes to the pandemic, the opportunity for acceptance of PMA parts by cash-strapped aviation customers who avoided them before the current supply chain crunch hit.

We have touched on this point throughout this article, but it is of such significance that it deserves spotlighting: The aftereffects of COVID-19 have created very favorable market conditions for PMA parts manufacturers. “Airline costs such as fuel, labor, cost of capital, and maintenance are increasing rapidly and saving money is becoming more and more critical,” said Voeller. “As a result, PMA is becoming a ‘need’ item, not a ‘nice- to-have’ and we are seeing more airlines factoring PMA into their cost reduction strategies. Additionally, while many global markets are more open and accustomed to using PMA parts, other areas of the world that were closed to this option are now beginning to adopt these practices and putting resources toward implementing PMA programs.”

The result? “The PMA market will continue to grow, both in overall share of material being consumed in aircraft maintenance and in the acceptance within more aircraft systems,” Voeller predicted. “Initial PMA programs at airlines who have never used PMA will typically start with interior parts, then expand into airframe, components, and engine parts. We’re seeing new airlines chasing PMA benefits their competitors may already enjoy and jumping in head-first by accepting any, and all, parts without limitations to specific aircraft systems. This will likely continue, which will be a nice tailwind for the PMA market.”

“Going forward, I think that the market for PMA is going to be very good,” MARPA’s Dickstein concluded. “In my experience, when there are troubles in aviation and the PMA industry steps up and supports the MROs and the air carriers, the MROs and air carriers recognize and remember it. As well, the fact that the PMA industry has provided that full level of support and customer service in the past and is providing it to their customers today is something that’s going to help them cement relationships that will lead to future business.”