There are some surprising developments in the world of aircraft paints and coatings, and not necessarily to do with materials. Ian Harbison spoke to some of the leading players.

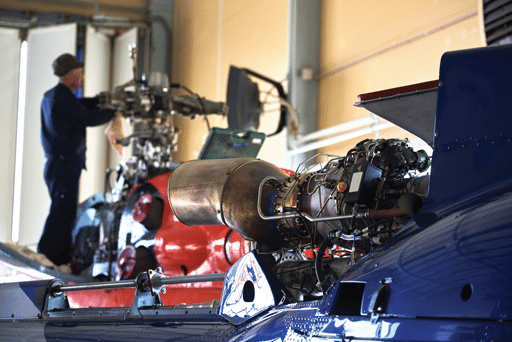

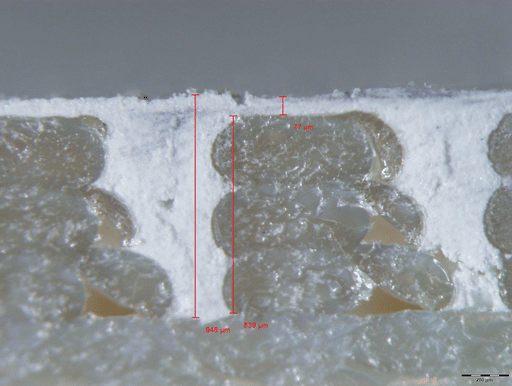

René Lang, executive managing director aviation at Mankiewicz Coating Solutions, says base coat/clear coat paint systems predominate on airliners these days, perhaps as high as 95% of the total fleet. Using this method, the color scheme is applied first and then given a protective layer that also provides a high gloss finish. The two coats are optimized for UV resistance as well as having some flexibility to cope with movement of the aircraft structure.

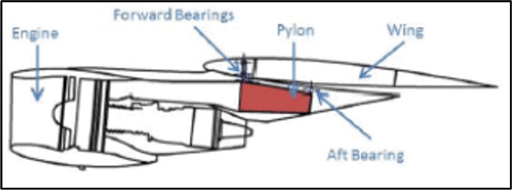

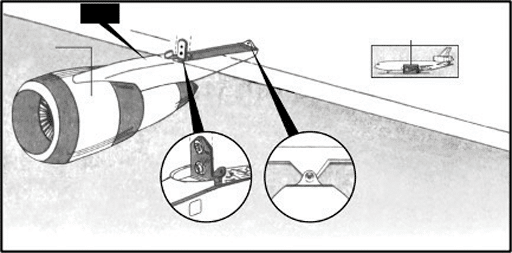

However, this combination cannot be used on all wing surfaces. Currently, these usually have different topcoats for the upper and lower wing boxes. On top, maximum flexibility is required as the wing continuously moves in flight. Underneath, high resistance to chemicals is paramount, as it is subject to being splashed with fuel and hydraulic fluid. This necessity to have two products leads to extended process times, inefficient procurement and storage of products, and reduced longevity with a deterioration in appearance.

Mankiewicz has developed a new product — ALEXIT WingFlex — that has the necessary flexibility and chemical resistance to allow it to be used over the entire wing with no intermediate masking and drying. It is easy to repair and touch up in case of “ramp rash” and also produces a high gloss finish that matches that of the clear coat on the fuselage. This improved appearance can be important in reassuring nervous passengers that they are flying with a safe and professional airline. The new product can be used on the production line and during maintenance. For MROs, the faster turnaround time is a particular benefit, she says, as they do not like putting an aircraft into a paint shop for minor wing work.

Julie Voisin, Sherwin-Williams Aerospace Coatings segment market manager, says the company has just introduced Jet Prep Pretreatment, a chrome-free, water-based, translucent, sol-gel metal pretreatment solution. It can be sprayed, brushed or wiped onto the aircraft. A slight blue pigment tint provides a visual cue to where it has been applied and a flat appearance when dry confirms that it has been successfully applied. It has also introduced a chrome-free primer as well, meaning it can provide a chrome-free paint system from substrate to topcoat.

Michael Green, segment business services manager at AkzoNobel Aerospace, concurs that the majority of aircraft these days are painted with a combination of base coat/clear coat. Such a combination will have a service life of around eight to ten years. One market advantage for AkzoNobel Aerospace is that, at present, it is the only base coat/clear coat paint system qualified for new Boeing aircraft — the SAE AMS 3095 specification gives airlines more choices for refurbishment.

Of course, structures of composite aircraft have a primer applied and then an intermediate coat to protect the material from attack by paint strippers. A side benefit of this is that milder strippers can be used. Composite parts also have a rougher surface, requiring a range of fillers to be used to produce a smooth finish suitable for painting — even slight unevenness will show up with a high gloss finish. The problem is even greater with 3D printed parts but Mankiewicz have developed Primefill, which acts as a primer and filler. Lang says the development challenge was to produce a material that also met fire, smoke, toxicity and heat release requirements (FST) and not adding much weight.

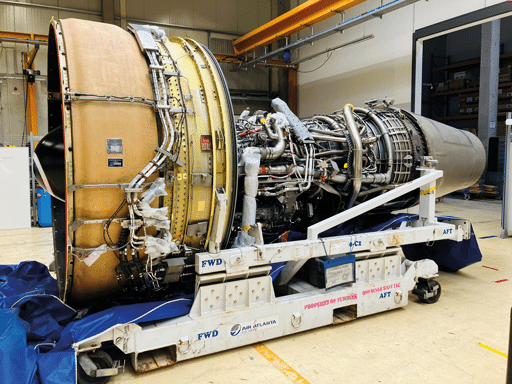

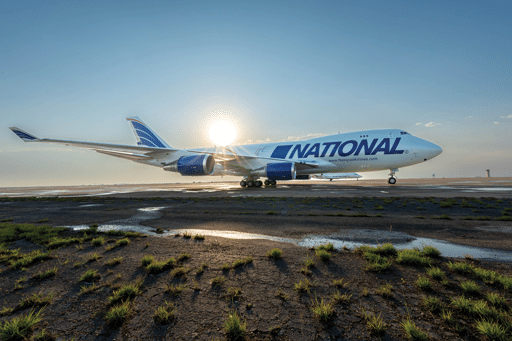

David Patterson, executive vice president and head of sales, North America, at International Aerospace Coatings (IAC), says there is a definite move away from mica paint because of the difficulty in application. Green adds that American Airlines have dropped it, replacing it with Silver Eagle, a solid grey. Lang explains that overlapping passes of the spray gun can cause areas of darker color, or “tiger stripes” and requiring experienced painters and a forgiving and robust paint system. Having said that, Mankiewicz and IAC recently collaborated on a Boeing 747-400F of National Airlines featuring a striking grey mica paint scheme.

Voisin says that special finishes have maintained a steady demand. There are two camps when it comes to design in this market: classic understatement or eye-catching. Of course, the pandemic increased demand for private aviation, while the overall airline fleet has declined. She comments that some special finishes are difficult to repair, which is perhaps why airlines could be less likely to adopt them.

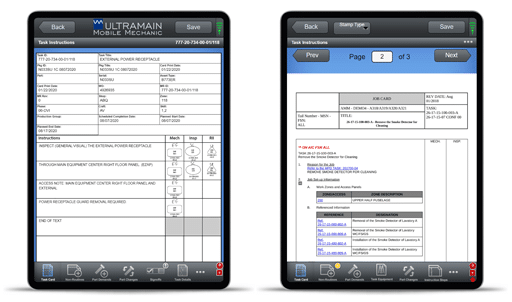

Obviously, the best way to resolve application problems is proper training. Méabh Tobin, global marketing manager at IAC, says new hires at the company’s global facilities undergo a 26-week training course that equips them with the skills required to strip aircraft of existing finishes, prepare aircraft for refinishing, and apply aircraft paint by hand and by spray gun in a safe and professional manner, moving from test panels to real aircraft. She says that, on average, 90% of apprentices successfully complete the program and begin work as full-time employees with IAC. Even new recruits who have experience still have to do familiarization training.

The company has recently set up a facility at Teruel, the location of Tarmac Aerosave, sending trainers to Spain while trainees have been coming to Shannon. This is one of Eleven IAC paint facilities (the others are Ostrava in the Czech Republic, Dublin and Shannon in Ireland and Amarillo, Everett, Fort Worth, Greenville, Portland, Spokane and Victorville in the U.S.). Patterson says there is regular communication across the network to exchange ideas and process improvements.

This is particularly important for new facilities — the company was recently awarded a long-term contract to operate both of the Boeing widebody paint facilities in Portland from January 2024. Capable of accommodating up to a Boeing 777, they will be primarily used to paint new production aircraft. IAC has partnered with Boeing since 2012, with Victorville and Spokane both supporting the OEM alongside airline customers.

Sherwin-Williams runs several training courses a year at its Wichita site while, for major MROs and OEMs, it supplies on-site training. Voisin comments that the Wichita courses allow people to get away from their normal working environment, allowing them to focus on the training and to interact with other people. For the on-site training, they are using familiar tools and processes but the Sherwin-Williams trainers can also provide advice based on their experience of multiple paint shops.

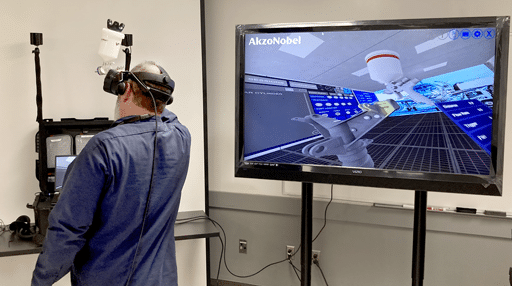

Green says AkzoNobel has started using virtual reality for training. As well as reducing the length of the course, it also reduces the amount of paint used, making it more sustainable. The system can measure speed of application, any overlap, calculate the thickness of paint being laid down, and the cost. As well as new trainees, it can be used by more experienced personnel to analyze their techniques and improve.

Lang adds that Mankiewicz always works closely with customers, with training for them at its training centers as well as being in the hangar with them for the first aircraft.

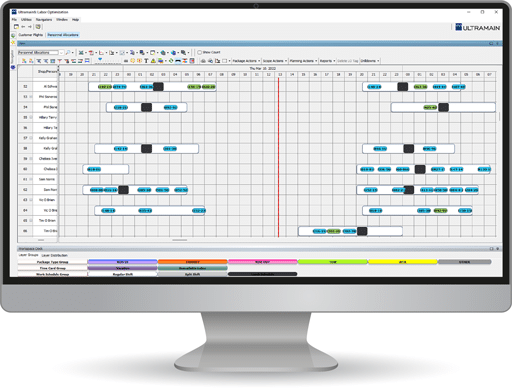

That close connection with the customer has been strengthened by AkzoNobel with the launch in March of Aerofleet Coatings Management, a digital management system that uses data gathered over several years to help ensure that aircraft are only repainted when needed, not to a fixed time schedule. Green says this is part of a strategy to become more of a partner than just a paint supplier, particularly for airlines with fleets in excess of 100 aircraft. He adds that two of the biggest advantages of base coat/clear coat for these huge airlines are its longevity (eight to ten years) and the reduced turnaround time to repaint the aircraft. This reduces the annual repainting requirements to manageable proportions. However, aircraft can still be stripped and repainted even with useful life remaining.

The new system, which is part of AkzoNobel Aerospace Business Solutions, a new entity combining many of the services already provided by the technical support teams, uses an app that stores all the information collected, such as dry film thickness, color variation, gloss and general appearance, as well as flight path data — such as weather conditions — which can affect the longevity of the coating. This is fed back to a database, which tracks the fleet’s performance over time. By analyzing this information and mapping it over several years, it becomes easier and more accurate to determine when an aircraft needs to be repainted, rather than simply using time or flight hours. Over time, the frequency with which aircraft need to be repainted will fall, reducing costs, material use and waste.

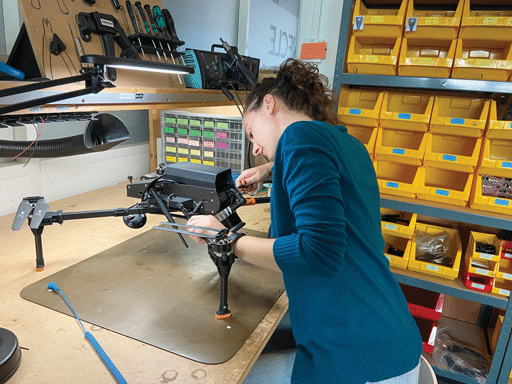

Manual inspections can be further enhanced by automated inspections conducted by drones. These are already being used for general visual inspections (GVI), lightning strike inspections, paintwork and regulatory marking inspections. Here, AkzoNobel has taken a further step by investing in French drone company, Donecle. The drone flies in a set grid over the plane’s surface — taking up to 1,000 high-definition photos — and the built-in software analyzes the images to flag any issues or wear of the coatings. This standardizes the inspection and is less subjective. It’s also faster and more in-depth than a manual inspection — an automated drone can scan an entire narrowbody aircraft in less than an hour. The Donecle drone is also used to check for surface damage using the DentCHECK software from 8tree.

While there have been advances in paints and coatings technology to make it more environmentally friendly, Green says there is still a tendency for airlines and MROs to be led by regulatory requirements and local health and safety rules, rather than pushing ahead with innovations. This is partly because the returns are limited. In fact, the rules can sometimes seem to work against the industry. Matz points out that chromates are only dangerous to personnel during the application process, which can be mitigated by personal protection equipment, extractors with filters and proper disposal of any waste. The biggest advantage of those materials, she says, is that if the chromate layer is damaged, it will leach out of the surrounding material and self-restore the surface. Voisin cautions that the apparent lack of progress in improving environmental standards might be misleading. There needs to be a lot of development and then testing, including in the real world, to ensure that any new product will not damage an aircraft skin. That requires a lot of time (and money) so there is a careful balance to be struck.

While there is still a problem with VOCs, this has been significantly reduced by a shift to water-based paints for interiors and structural parts. Mankiewicz has developed a metallic paint for interiors that is not only water-based but can be applied in a single layer, rather than the usual three. Another way of reducing emissions is to allow airlines and MROs to mix their own paints on site. The company supplies mixing benches that are computer controlled to produce the precise brand colors in small quantities, rather than shipping from its various facilities.

In response to the pandemic, Mankiewicz also carried out a large survey of cleaning and disinfecting materials to see how well their paints stood up them, since they were being worked on more often. There were no adverse findings, which also means that gentler and greener cleaners can be used successfully.