In this second part of our two-part series looking at European MROs, we turn our attention to Western Europe (see part one, focused on Eastern European MROs, in the June/July issue). Long-established MROs lead the vanguard of change and innovation not just in the region, but worldwide. Yet, challenges exist, including a lack of skilled workers.

Western European MRO is growing at a modest rate but faces labor woes plus the possibility of painful shifts if airframers should tip the balance in the aftermarket.

The MRO market in Western Europe is expected to expand at about a 2.1 percent compound annual growth rate to about $16 billion by 2027, according to ICF. Europe is a mature “re-fleeting” market, whereas China, the Middle East, and Asia Pacific are being powered by strong fleet growth on the back of rising GDP and a growing middle class, explains Richard Brown, principal with ICF.

Western Europe and the U.S. — where much of the MRO infrastructure is located — are able to “punch above their weight,” he says. Europe imports a lot of component and engine work to facilities owned by OEMs and major MRO integrators.

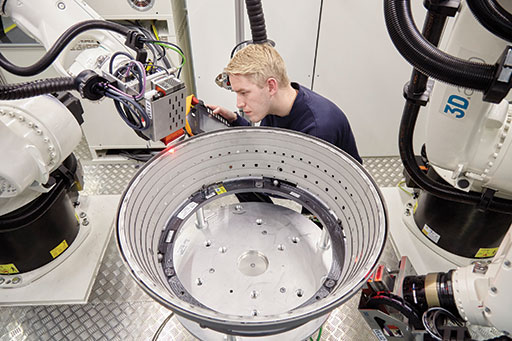

This high-end expertise is driving expansion in European engine maintenance capacity by GE in Wales, for example. Air France Industries KLM Engineering & Maintenance (AFI KLM E&M) and Safran Aircraft Engines are also constructing a joint venture (JV) facility for compressor aerofoil repair in northern France. In Germany Lufthansa Technik (LHT) has established a center of excellence for engine casing overhaul and opened an X-ray center, whose expansion is already being planned.

Engine leasing is important, as well, and MTU Maintenance Lease Services in Amsterdam, a JV with Sumitomo Corp., more than doubled sales in 2017 vs., 2016. MTU Maintenance, as a whole, enjoyed a “record” year in 2017, with $3.7 billion in contract wins and more than 1,000 visits across locations, says Leo Koppers, senior vice president of MRO programs with MTU Aero Engines.

The European narrow-body and wide-body MRO market has enjoyed strong growth in the last few years, thanks to fleet expansion, slower retirements, and additional engine shop visits associated with aging airplanes and next-gen aircraft issues, says Marcel Versteeg, VZM Management Services owner. “Most of the MROs have been profiting from this positive market” and have seen their contracted volume go up and their shop/hangar filling rates increase, he says.

European MROs are keenly focused on the global market as the majority of real growth and revenue opportunity is outside the region. To tap into that growth, “being closer to customers is often better for customs and tariff purposes,” Brown says. AFI KLM E&M’s Shanghai component facility, for example, is handling a recent avionics support contract from Chinese LCC, Spring Airlines.

AFI KLM E&M’s “first mover” strategy on new platforms and its “think global and act local” slogan epitomize the European approach to reducing exposure to market cyclicity and spreading risk. LHT is pursuing a similar strategy, recently attaining “approved outfitter” status for the ACJ350 XWB from Airbus Corporate Jets. LHT also has expanded in Puerto Rico and the continental U.S. MTU, with facilities in the Americas, Asia, and Europe, also stresses the need for customized solutions in this mature market.

Labor Market

The most significant MRO challenge is the tight labor market, evidenced by the shortage of skilled aircraft engineers, particularly in northern Europe, says Chris Dare, managing director of Monarch Aircraft Engineering (MAEL), a British MRO. (See how MAEL has added in-house training to compensate in our training story, starting on page 44). Monarch recently announced its assumption of line maintenance services for Thomas Cook Airlines at five UK airports. MAEL is doubling the number of trainees it inducts into its four-year apprenticeship program from 20 to 40.

A related challenge will be “how to adapt to the new generations and their expectations,” says Mário Lobato de Faria, chief technical officer, TAP Maintenance & Engineering. “For sure state-of-the-art technology will be part of it, but readiness to adapt and adjust will be key if we want to keep feeding the MROs with young people.

“We need to understand them better instead of thinking that they will learn our way of doing things in time. That will be a big mistake since we’re dealing with people that are … used to get answers within a click … and [for whom] the future is today, right now.”

Higher shop/hangar loads have only increased the workforce challenge, Versteeg says. Finding new employees has been especially difficult in Western Europe, making it tougher to meet commitments to customers. “Therefore, it was no surprise that most of the technical staff from the bankrupt Air Berlin was quickly picked up by the competition, like Lufthansa Technik.”

Europe is one of the costliest regions for MRO, Brown says. Labor rates are higher, it’s more restrictive, the work force is aging, and it’s challenging to recruit employees. However, Europe has important capabilities and expertise. European MROs are also having to invest in new technologies to address next-gen aircraft, new engines, composites, electrics, and data analytics.

Brexit?

According to a Deloitte report, the UK’s aerospace and defense industry is the second-largest in the world, generating $94 billion in revenues in 2016, $48 billion of which was exported. What’s more, A&D is the UK’s “top manufacturing subsector.” So, if trade is reduced or EU customers, suppliers, skills, and R&D funding become more difficult to access, competitiveness could suffer.

The main impact so far has been on airlines – several low-cost carriers have “launched a second AOC [air operator’s certificate] to protect their traffic rights,” Versteeg says. Although the chance of a real “disaster” — if the UK fails to arrange traffic rights for its airlines in a timely manner — seems low, “any disruption of, or negative effect on, European growth will also have a negative effect on the MROs, although most probably with some time delay.”

UK-based Monarch Aircraft Engineering doesn’t expect to see much impact on the MRO market from Brexit “unless the EU introduces a tariff driven by a common market agreement,” Dare says. Backing up this confidence, MAEL is putting about $2.6 million into a UK-based component maintenance facility expected to open this fall.

Brown is “anxious but not worried” about Brexit. The UK is part of EASA and is likely to continue to be part of EASA, he says. The challenge for a UK-only MRO would be if there is a “hard” Brexit. If the UK “comes crashing out,” regulatory agreements would have to be revisited. He thinks that the UK will try to make aviation “the softest Brexit possible.”

Airbus, however, fired a shot across the bow in late June, warning of the risks posed by a possible “no deal” Brexit to the airframer’s large footprint in the UK. “Until we know and understand the new EU/UK relationship, Airbus should carefully monitor any new investments in the UK and should refrain from extending its UK suppliers/partners base,” the company said.

Opportunities and Threats

MROs are expanding in Scotland, Wales, France, and Germany, Brown says. Investment continues in Western Europe, particularly for wide-body engine maintenance, but some more labor-intensive activities are shifting to Eastern Europe, North Africa, Asia, and South America.

Perhaps the biggest long-term challenge to traditional MROs is posed by airframe OEMs. “There are still a number of respectable independent aircraft maintenance providers available today around the world,” says Robert Gaag, senior vice president for corporate sales, EMEA, with LHT. “However, if the airframe OEMs manage to gain and control a sizeable foothold in the after-sales market as successfully as the engine OEMs have done, we will certainly miss some … competitiveness in the industry.”

“It is very important to me to stress that customers will make a decision today about the future of the MRO industry tomorrow,” he says. What lies behind this is the notion that in a few years there may no longer be a competitive aircraft maintenance industry as we know it today.”

It’s a battleground, Brown agrees, noting that at the moment the advantage appears to be with the engine and airframe OEMs because of the scale that they offer and their place at the table at the point of aircraft or engine sale.

TAP M&E image.

At the moment, however, competition is benefitting airlines that can choose their maintenance approach, he says. If consolidation causes a reduction in choice, then of course that’s not good for airlines. But there’s “little sign that this is happening … as the MRO market is highly competitive and OEMs and MROs continue to battle.” The focus at the moment is on the latest-generation aircraft where MRO supply is slanted towards the OEMs. That’s to be expected, he says, since many aircraft are under warranty. As the fleet matures, “we’d expect new MROs to enter the market just as they have done on previous-generation aircraft. Airlines like choice and I fully expect they’ll be able to find it.”

The ambition of OEMs to “tighten their grip on the aftermarket intensifies the already fierce competition [and] changes the nature of the game,” counters Vincent Metz, head of strategy for AFI KLM E&M. “Finding a balanced symbiosis with OEMs is key,” so the MRO continues to forge partnerships with them on platforms such as the A350 and 787 in order to get access to licenses.

MTU also collaborates and competes. As part of GE’s network on the GEnx, MTU’s Hannover facility completed its 250th turbine center frame overhaul earlier this year.

Airbus

It’s difficult to know how much profit Airbus is making on Skywise, its data analytics platform, but the airframer can afford to play the long game. And Skywise appears to be a key component in its reported plan to triple service revenues to $10 billion in seven years.

Skywise Core, which is free, allows airlines to store, access, manage, and analyze “selected Airbus data together with their own data” on the Skywise cloud in return for sharing operating data with Airbus, the OEM says. But access to predictive maintenance capabilities is tied to the “premium” service level. Airbus also has extended Skywise access to certain “early adopter” suppliers, including Thales, Liebherr Aerospace, and Parker Aerospace.

“The crucial question for a healthy aftermarket and lively competition is, ‘who owns the data produced by an aircraft,’” LHT’s Gaag says. “It seems to be clear that for safety reasons an airline has to be in charge of all data” concerning the technical status of their airplanes, he says. This would also allow them to give independent MROs access to their data or integrate it into independent platforms.” But “up to now,” he contends, “no one has answered the question.”

Barring airframers’ attainment of monopoly status, the various parties can coexist. MAEL sees “plenty of opportunity for collaboration” — MAEL itself is a Boeing Global Fleet Care partner for 787 and 737 aircraft. In addition, “more and more carriers are looking for a single maintenance provider across their fleet to drive efficiency,” Dare says.

TAP’s Lobato de Faria agrees. “Clearly size matters, but I believe there’s still room for small players like ourselves.” To adapt to changing conditions, “one needs to know which changes are required, to have the means and the will and power to implement those changes. Those able to do so will continue, no matter the size, either standing alone or cooperating with others.”

Technology

Topping the charts for buzz is big data analytics, which potentially could shave billions off airlines’ fuel and maintenance costs. AFI KLM E&M’s big data platform, Prognos, has expanded to include engines, APUs, and airplane systems. Metz cites the ability “to create data sets that combine and link unfiltered operator experience data with up-to level-3 shop findings and combine this with … engineering experience … to address the real root causes impacting aircraft reliability and maintenance cost.”

Digitalization is the biggest transformational force in the industry, according to LHT. It’s a business boost through paperless maintenance, it enhances performance via predictive maintenance, and it will enable a more integrated approach to MRO. LHT’s open IT platform, AVIATAR, “aim[s] to integrate various valuable digital solutions coming from various partners.”

But MRO is the slowest airline operations sector to digitize, according to ICF. The reason is that “we’re a safety-conscious, highly regulated, paper-driven industry where everything has typically been signed off on paper,” Brown says. Records are only just beginning to be digitized, which leaves a lot of room to increase efficiency.

The growing reliance on big data will also require more attention to secure data storage and transmission. “Cyber security is not talked about enough,” Brown says.

Irish Bloom

Although there are numerous Part 145-approved organizations in the Republic of Ireland, Shannon has become an MRO magnet. The Shannon Group, a state-owned commercial company, is expanding the aviation cluster at Shannon, increasing the number of companies from 45 in 2014 to 60 this year. The company, which receives no government funding, supports 46,000 jobs with an annual economic impact of 3.6 billion euros and 1.1 billion euros in annual exchequer returns, based on 2016 data, says Patrick Edmond, managing director of the International Aviation Services Center (IASC), part of the Shannon Group.

LHT’s Shannon facility, which focuses on overhaul of short-haul aircraft for European customers, employed about 470 people in 2017, generating 61 million euros.

Eirtech Aviation Services, another Shannon MRO, specializes in services such as engineering, composite repair, CAMO, and asset management. The nine-year-old firm expects to open a Part 145 facility for repair and overhaul of composite parts in Belfast this year, says David Kerr, deputy CEO. There is “always room for fast responding, professionally run smaller players,” he says. Versteeg also points to Dublin Aerospace as a promising Irish MRO.

Ireland holds some strong cards. Irish MROs historically have performed well in lease transition work, which “requires a higher level of flexibility and expertise than ‘commodity’ heavy maintenance,” Edmond says. Since many of the senior technical staff of lessors spent part of their careers at Shannon, lessors know about Shannon MROs’ lease transition and lessor support capabilities, he adds. “We’re planning for additional hangar space in the coming years, and we see a particular interest from lessors who want to ‘insure themselves’ against future shortages of MRO capacity.”

He also notes that Ireland is the only English-speaking Eurozone member and soon will be the only English-speaking EU member state. With Brexit in the future “we are seeing interest in Shannon … from the UK,” as well as other countries, Edmond says. “UK players are looking to preserve EU advantages” in the event of a possible UK exit from EASA. Companies from other countries, such as the U.S., “are no longer viewing the UK as an ‘obvious’ beachhead for European market entry,” he adds, situating Ireland “very favorably in this regard.”