Those who think the pandemic-induced drop in both activity and revenues for the maintenance, repair and overhaul (MRO) industry have ended the industry’s workforce shortage are dead wrong and, in fact, some experts predict it will be further exacerbated by emerging technologies.

“We were in a labor shortage pre-COVID-19 and this current situation isn’t going to fix that,” Duncan Aviation President Jeff Lake tells Aviation Maintenance. “We anticipate that once conditions improve, the industry will once again have a crunch on high-quality candidates. The aviation industry needs to continue to focus on marketing and educating young people to attract them to career opportunities we provide.”

Indeed, experts queried by Aviation Maintenance magazine predict accelerated retirement and emerging technologies could make that shortage more acute once Covid-19 is behind us.

In the meantime, they see less destruction than anticipated. However, they worry about losing talent to other industries, that initiatives to attract youngsters to the discipline will falter and about antiquated regulations that leave aviation maintenance students unprepared for today’s demands much less those of the future. And, of course, they worry about being paid.

The Aeronautical Repair Station Association (ARSA) conducted a survey in June to better understand the economic and workforce challenges the pandemic has created for the industry. (See sidebar)

“We’ve heard from many members that their customers – both airlines and general aviation operators – have stopped paying even for work that was done before the pandemic started,” says ARSA Executive Vice President Christian Klein. “That ripples through industry and is compounded by rising costs owing to sanitization, new protective equipment, safety measures, social distancing and moving to shifts.

“The survey is not final, but it gives you a sense that, while it is really terrible out there, it is not an absolute bloodbath…at least not yet. It’s amazing to think that prior to March 13, we had large number of members turning away customers owing to the workforce shortage.”

In fact, ARSA estimated its members were potentially foregoing as much as $1.4 billion in business annually for lack of workers. For that reason, ARSA is at the forefront of initiatives to boost the ranks of maintenance technicians. The industry developed impressive programs to attract young people. Congress funded a new grant program, proposed by ARSA, to help attract and retain technicians. New internships, scholarships and apprenticeship programs were being offered.

Efforts to boost interest in the profession were paying off, according to Aviation Technician Education Council (ATEC), the other leading force in workforce development.

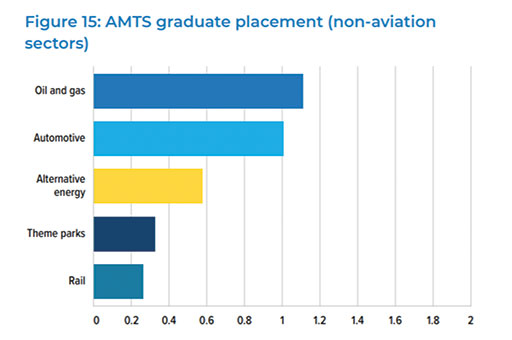

“More individuals achieved FAA mechanic certification in 2019 than in any of the previous 17 years,” it reported in its 2020 Pipeline Report, its survey of Part 147 schools done before the pandemic. “The agency issued 7,363 certificates last year, the largest number since 2002, and a near 10 percent increase over 2018. A&P school enrollments also grew by 2 percent, the biggest jump in five years. AMT school respondents estimate that only 8 percent of 2018 graduates took jobs outside aviation, down from 13 percent in 2017 and 20 percent in 2016. More good news: 81 percent 2018 graduates took the FAA test for A&P mechanic certification, a jump of 10 basis points in each of the last two years. The number of certificated mechanics has steadily increased 1-2 percent a year since 2001, with 2019 seeing its biggest jump in recent years at 3 percent.”

Technical high schools report an uptick in interest with far more applicants than spaces as parents realize such an education could be part of a strategy to pay for college. Many graduate with an A&P license, joining the workforce while attending college. Employers are also offering tuition benefits.

Still, the Pipeline Report indicated two out of every five A&P seats at AMT schools remain open meaning more needs to be done to boost the image of the career from wrench-turner to the analytical technician it really is.

Klein worries, as happened after the Great Recession, workers would not be enthusiastic about returning to industries that laid them off because there are other sectors where technicians are in high demand. This challenges industry to develop a separation package that will make laid off workers want to return.

“Airlines and MROs alike will need to consider how to maintain the existing talent in the market, so whenever the industry finally begins to get back on its feet the necessary experienced personnel are there to support renewed growth,” Oliver Wyman counseled in its latest Market Outlook update.

By the Numbers

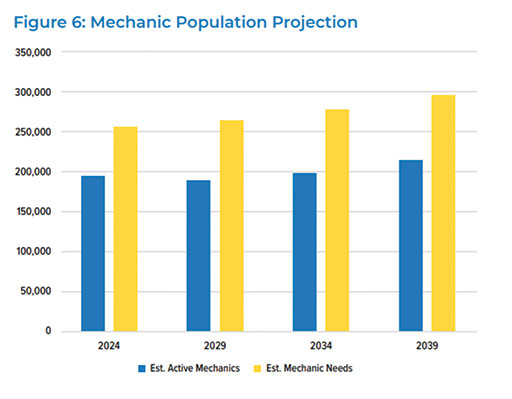

Everyone is familiar with Boeing’s Pilot and Technician Outlook predicting the need for 769,000 maintenance technicians by 2038 and it would be surprising if its latest forecast, due out in July, changes that.

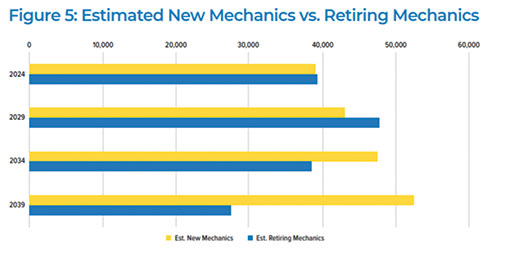

“Mechanics are still retiring faster than they are being replaced; new entrants make up 2 percent of the population annually, while 33 percent of the workforce is at or near retirement age and over 60,” says the ATEC report, foreshadowing the number that could take the early-retirement packages being offered. “The industry will need to produce an additional 2,700 mechanics annually over its 2019 output to meet the 20-year demand.”

The report cautioned that new mechanics addressed new demand instead of replacing retiring mechanics.

“At current certification rates, the mechanic population is expected to increase 12 percent over the next 20 years, but still fall 79,000 mechanics short of projected needs by 2039,” says the report.

Today’s Hiring Opportunities

While the report reflected the industry before the pandemic, Executive Director Crystal Maguire says this is no time to curtail your education given the return on investment resulting from an AMT education.

“The average A&P student is in school for 21 months and pays $16,321 in tuition,” says ATEC. “The average starting annual pay for a certificated mechanic is $45,000 and rising.”

Indeed, Ken Herbert, managing director at Canaccord Genuity Inc. indicated the dramatic decline in revenues does not necessarily mean an equal decline in workforce,

Jeff Richards, JS Firm operations manager says the industry is still hiring and candidates should be updating resumes. The company is offering a series of webinars for job seekers to help navigate this unprecedented time.

“Hiring is all over the map,” Richards tells Aviation Maintenance. “Some days are good and some bad. My bigger fear is losing techs to non-aviation companies as we saw a decade ago when people left for wind turbines and high-speed trains. Our technicians are highly sought after. This will have a dramatic impact which will strain workforce availability as we come out of the recession.”

Mike Challey, Aviation Technical Services vice president marketing agrees. “There is still a need for qualified aircraft technicians,” he says, noting his company connects structure technicians with MRO/airline employers. “I don’t see that going away.”

So does Duncan’s Lake. “We are still open at all of our main facilities, avionics satellites, and engine rapid response launch locations,” he says. “Our facilities are operating at full staff, and we are staying busy. COVID has not had a significant effect yet on our workforce numbers. Our contingency plan and cost-saving measures have so far been enough to allow us to avoid reductions in force. Our employee numbers have not changed significantly. We saw business levels and corresponding revenue drop, but not as significantly as we feared.”

Duncan focuses on business aviation and Lake noted some operators continued to fly and some even saw an increase in flying as airlines shut down. Some have opted to move maintenance and other aircraft projects up in the schedule to ensure they are ready to respond to flight needs.

“When the necessary travel restrictions are lifted, business aviation will lead us through the coming economic and societal challenges by providing necessary travel in smaller environments where people will feel safe while traveling,” he says.

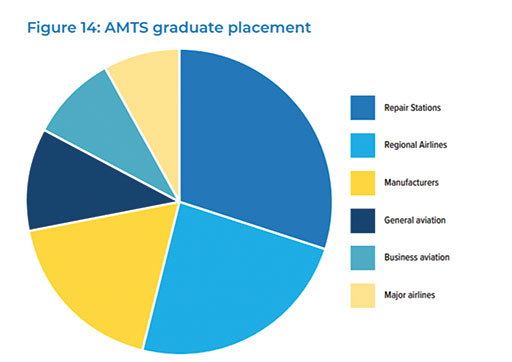

Alton Aviation Consultancy Managing Director Jonathan Berger put shortages in perspective. “There are different segments to the industry,” he tells Aviation Maintenance. “It is not a huge monolith. There was no shortage in engine maintenance and at OEMs and [major] airlines haven’t had trouble hiring. That is over 40 percent of MRO with component shops accounting for another 20 percent. Airline line maintenance is another 20 percent. So, it is really the heavy airframe business that had hiring issues. North America has the most issues with labor shortages.”

But, says ARSA’s Klein, there are six times more technicians working at repair stations than there are mechanics working at airlines.

“Almost 288,000 Americans support aviation maintenance and manufacturing, producing more than $52 billion in economic activity each year,” ARSA wrote in April. “FAA-certificated repair stations are the largest employers with almost 194,000 people at work in their U.S. facilities.”

That is why it continues its legislative and regulatory efforts to boost the ranks. Congress provided full funding for a new aviation technician workforce development program. Spearheaded by ATEC, bipartisan legislation is also moving through Congress to reform Part 147 curricula to force a reluctant FAA to address reform

“We need to get the grant programs up and running,” Klein says. “That money is even more valuable now and could provide opportunities to take on laid-off workers. We need to update the regulations covering the curricula at AMT schools which date to the 1970s and are completely ossified and out of step with how and what should be taught. If you’re looking for a way to make industry more efficient, this would do it. There is also legislation to create public-private partnerships to make is easier for aerospace and MRO repair stations to retain workers.”

Indeed, Stephen Ley, associate professor, Utah Valley University School of Aviation Sciences, suggests the industry was so focused on the acute needs, future needs, urban mobility, unmanned cargo and commercial space, aren’t yet on the radar.

More importantly, he tells Aviation Maintenance, these technologies have not stopped with the pandemic. They continue to test, continue to be certificated such as the Pipistrel electric aircraft. MagniX has already converted Harbour Air aircraft to its electric engine and its electric Caravan just took its maiden flight. Sabrewing just rolled out its Rhaegal unmanned cargo aircraft.

“This will change how MRO is delivered,” says Ley. “UAM will need mechanics on site. Shipping a vehicle to the OEM or repair facilities is not practical. They need instantaneous repair because their business model is on demand. These aircraft are a massive gamechanger driving up the number of A&P technicians required to work on composites, electrical components and who can work on airframe and powerplants but also avionics. We will see a greater need for skills that integrate everything.”

Ley already integrated these new technologies into his coursework creating research projects to answer many of the questions remaining about the integration of this technology.

Quantifying Pandemic Impact

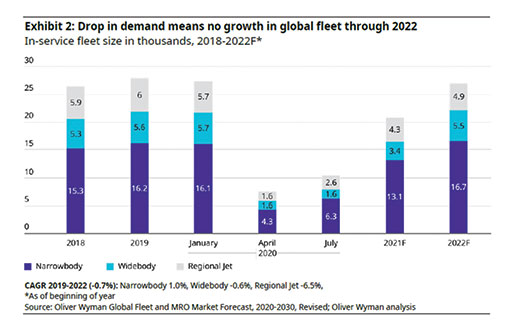

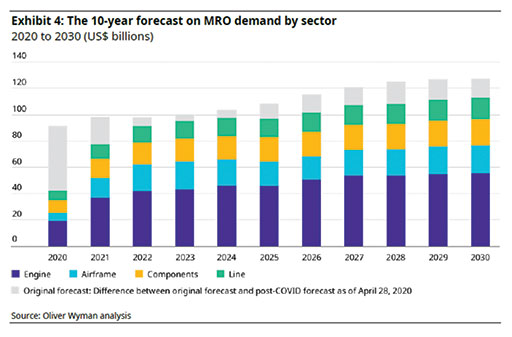

“The current trajectory for fleet reductions and lower aircraft utilization would reduce global MRO demand in 2020 by over $26 billion, or almost 30 percent with no global growth in MRO until 2022,” says Oliver Wyman in its update to the ARSA-sponsored MRO Market Outlook produced in February. “North America and Western Europe would suffer the largest impact and independent MROs are most at risk.”

“Pre-COVID, we forecast global commercial MRO to be $91.2B for 2020. The market is expected to incur a 53percent decrease from that forecast to $42.7B in 2020. For the last five years annual retirements have ranged from 550 to 750 planes, we expect to see a surge to well over 2,600 during the next 12 months.”

“I believe, we are on the edge of a technological explosion of new technologies and modalities of air passenger and cargo transportation which will lead to opportunities for new career entry, growth, and advancement,” he says. “In addition, we are on the edge of an explosion in space transportation which will also require robust MRO capabilities. integrate autonomous, UAM and space into an A&P program.”

He believes this will force a step change in qualifications and skillsets to bring them closer to industry needs and demands.

Duncan is already preparing. “We believe EVTOL and urban mobility will be a growth sector in the future,” says Lake. “There are numerous start-ups in this area and there are many who are willing to invest. The regulatory agencies have also been supportive of this new technology. [We will support] this new technology as a service and support organization. Our satellite network is a great conduit for supporting aircraft in the field. We’re a part of the RoboticSkies worldwide UAV service network already and are staying in touch with these industries to offer our services when/where the demand will be needed.”

But not in the next few years. “It is still struggling to build infrastructure,” cautioned Herbert. “I don’t see it pulling people away from traditional aircraft maintenance efforts because it will be several years for those business models to take off.”

Aviation’s digital transformation puts further pressure both on maintenance schools as well as companies who must transition workers for the digital information and artificial intelligence age, which requires retraining for much of the current workforce.

“Those technologies can help,” says Berger, “but I don’t see the business case in the near term because of the ROIC.”

However, Klein says companies are taking this opportunity to do more training to make them more productive and efficient.

“This is an opportunity for companies to become leaner and streamline their operations and ensure the workforce they have in place are their best workers,” he says. “The industry has been slow to adopt technological advances, but the pandemic might provide the catalyst for remote connectivity and correcting other digital efficiencies.”

Berger sees acceleration of consolidation within the industry which could be hampered by the changing valuations of companies owing to the pandemic. As for opportunities, he cast back to 9/11.

“I wouldn’t be surprised if there were a similar emergence of an aviation health industry as there was for aviation security,” he says. “I agree the burgeoning space tourism industry is also just starting with reusable rockets and boosters which means MRO work. I see MRO growing for urban mobility, but I don’t see it in the near term like the space industry.”

This makes ATEC’s effort to reform government-mandated education requirements that much more important as it continues efforts on the Promoting Aviation Regulations for Technical Training (PARTT) 147 Act

In addition to legislation, it created a new non-profit – Choose Aerospace – to develop high school aviation maintenance curricula. The organization is also focused on developing recruiting programs to attract more youngsters to the craft.

While the industry may be undergoing a dramatic downturn, there is widespread agreement that it is only temporary and, when it comes back, in just about the time it takes to complete A&P school, there will be more opportunities than ever.

At press time, ARSA’s member survey on the impact of COVID was incomplete, but the early results provide initial insights.

Scheduled for publication in July, the survey found more than three quarters of respondents have seen a decline in company revenues as a result of the pandemic and more than two thirds expect 2020 revenues to be below 2019.

“With those numbers in mind, it’s little surprise that approximately half of ARSA’s survey respondents have reduced workforce between January 1 and June 1, 2020,” says Christian Klein, ARSA executive vice president, who expects to see an aggregate drop of between 10 and 20 percent in the total number of employees when the final survey numbers are calculated,

He cautioned the association is still crunching numbers and determining whether the respondent pool is representative of the industry. However, he says that if you project a 15 percent decline in the workforce across the entire industry it could mean the loss of around 25,000 of the nearly 194,000 technicians who were working at repair stations as recently as early March, when ARSA and Oliver Wyman released their annual industry assessment.

And the numbers could worsen given that roughly a third of respondents are apparently considering additional workforce reductions.

“While the sector’s job losses are startling,” Klein says, “there are some silver linings. Access to credit doesn’t seem to be a problem, as it has been during past downturns. Also, the Paycheck Protection Program (PPP) created by the CARES Act has also apparently helped, with roughly half of respondents having received forgivable PPP loans.

“Interestingly, more companies reported salary cuts to administration and management than tech personnel,” says Klein. “I’d like to believe it’s because management values its technical talent, but it could also be because technician jobs have simply been eliminated.”

But, Klein says, the full effects of the pandemic, and how long disruptions will continue, likely won’t be known for a long time.

“One of the biggest challenges for our members is the uncertainly,” Klein adds. “It’s hard to plan when you don’t know things will return to pre-pandemic levels. Around a quarter of our respondents are saying it’ll be before the end of the year but almost as many think it will be sometime after the beginning of 2022. And close to 20 percent of the folks we’ve heard from so far admitted they had no idea.”

Similarly, schools are expecting a decline in enrollment, according to a recent ATEC survey.

Some 60 percent of schools expected graduations to decline by 28 percent and, enrollments in 2020/21 by 31percent. Pre-pandemic, 60 percent of 2020 grads were expected to have a job but that is down to 45 percent since December.

The majority of schools report a hybrid curriculum — a combination of online and in-school instruction with 15 percent reporting they have suspended operations completely. Nearly half of schools say they are completing labs in person with a similar percentage indicating they are not facilitating labs. The majority of schools see labs as their biggest challenge.

Satisfying FAA requirements is seen as the second biggest challenge and more than 50 percent of schools expect to seek permanent approval for distance learning. Indeed, ATEC continues to seek relief on short-term expiration of distance learning temporary authorization.