Covid-19 Impact on Aircraft Utilization

On March 11, 2020, the World Health Organisation (WHO) declared Covid-19 a pandemic. By April 6, 2020, the United Nations World Tourism Organization reported that 96% of all worldwide destinations were subject to some form of travel restriction. Using AviationValues data we examine the impact Covid-19 had on the commercial passenger industry.

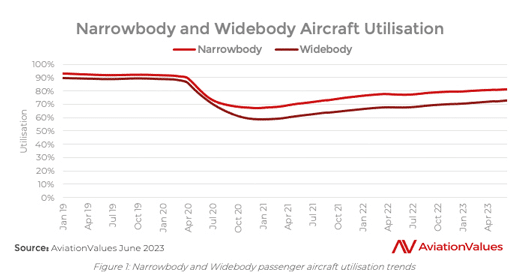

The severity of the impact on the commercial aviation industry, due to the unprecedented drop in passenger demand, is illustrated by the chart below. AviationValues tracks the positions of the global passenger fleet daily using each aircraft’s ADS-B signal. This enables a picture of each aircraft’s activity to be built, showing when it is in active service versus temporarily parked or in longer term storage.

In the years leading up to 2020, the percentage of the fleet in active service was relatively stable at around the 90% level for widebodies, slightly higher for narrowbodies. By April 2020 the imposition of travel restrictions, particularly into and out of major travel markets, forced a large proportion of the fleet to become inactive.

Understandably, the closing of borders, and the resultant impact on international regional and long-haul travel demand, has had the most lasting effect on widebodies, which today have a fleet utilisation of 77%, lagging behind narrowbody fleet utilisation at 84%. Restrictions on the all-important transatlantic and transpacific markets were only fully relaxed in May 2023 with the removal of the United States’ Covid-19 vaccine requirement for all non-US travelers. Travel to the United States had been restricted in some shape or form from January 2020 when non-US travelers from China were first barred entry. China itself closed its borders under a ”zero tolerance” Covid-19 policy in March 2020, and was the last major air travel market to reopen, only doing so in January 2023.

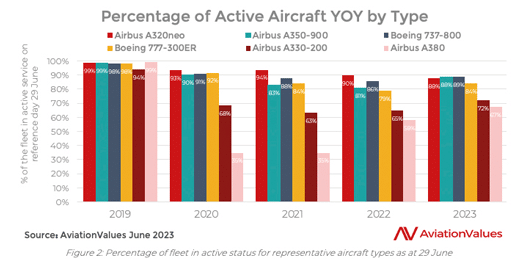

Because relaxation of travel restriction policies were not always coordinated, the recovery on international routes, predominantly served by widebodies, was much slower than recovery in domestic markets. By looking at snapshots of the fleet on the same day (June 29) between 2019 and 2023, we can see the impact of travel restrictions on representative aircraft types in the figure below.

Narrowbodies, represented by the Airbus A320neo and Boeing 737-800, exhibited the highest resilience in terms of utilization, followed by widebody twins such as the Airbus A350-900 and Boeing 777-300ER. The Airbus A380, like the competing Boeing 747 quadjet, suffered the most significant drops in activity.

Covid-19 Impact on Values

At the start of the pandemic, there were expectations from opportunists that the drop in passenger demand would spark a wave of airline restructurings that would result in a flood of aircraft available for outright sale. There were certainly a number of restructurings that occurred, but lessors and financiers largely acted to avoid large numbers of repossessions, opting to renegotiate financing and lease terms and keep the aircraft with the operator who would contract to keep the aircraft looked after while in storage, itself a very costly exercise.

In addition, a number of the more creditworthy airlines moved to sell and then lease back their aircraft to lessors, who, with cheap capital in plentiful supply, were able to increase their share of the commercial passenger fleet. As a result, there were relatively few (particularly considering the severity of the downturn) open market distressed trades occurring during the pandemic.

Nevertheless, it was clear that the market had moved, and that an aircraft on the open market would simply not command the same price in 2020 that it would have done a year prior.

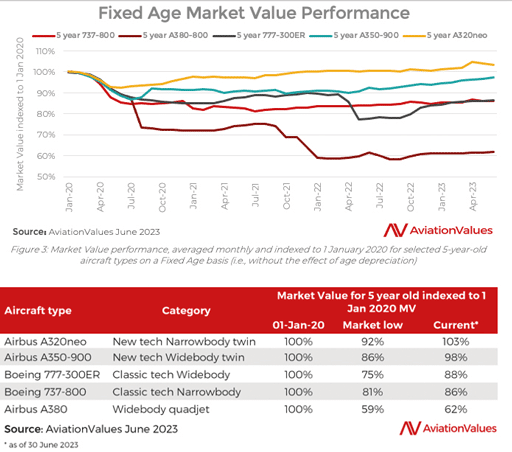

Using utilization as a proxy, together with transaction prices that AviationValues’ analysts and researchers uncover, AviationValues plots the daily market value performance for the entire range of commercial passenger aircraft types. A selection of these, averaged by month, are presented in the figure below, plotting the value that a five-year-old aircraft would have achieved at any point during the Covid-19 period. For comparison purposes the values of each aircraft type are indexed to its value of just before the start of the pandemic, on January 1, 2020. This enables a view of how aircraft values have been affected by the market, rather than by natural age depreciation. The index of the market low for each aircraft type, as well as its current value, is called out in the following table.

Figure 3 illustrates a trifurcation of the market among:

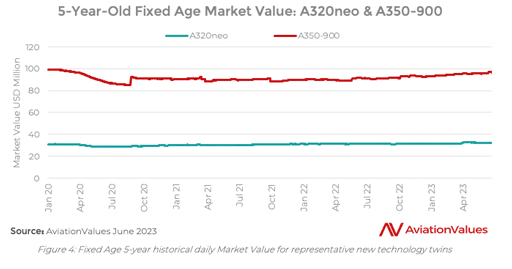

1. The top performers: new technology narrowbody and widebody twinjet aircraft such as Airbus’ A320neo and A350, Boeing’s 787 families (the 737 MAX was already grounded during much of the pandemic).

2. The middle performers: classic technology narrowbody and widebody twinjet aircraft such as the Boeing 737-800, Boeing 777-300ER, Airbus A320ceo and Airbus A330ceo.

3. The low performers: the large widebody quadjets: the Airbus A380 and Boeing 747.

Top Performers

New technology twins refer to aircraft types with two engines that have been recently introduced into service or whose features, e.g., new technology engines, and/or fabrication of the primary fuselage structure, is out of composite rather than aluminium. Representing a significant technological or fuel efficiency advance over the preceding generation of aircraft. They include the following aircraft types:

• Airbus A220 family

• Airbus A320neo family

• Airbus A330neo family

• Airbus A350 family

• Boeing 737 MAX family

• Boeing 787 family

• Embraer E190/E195-E2 family

Market values for these aircraft types have largely recovered to their pre-Covid-19 (January 1, 2020) levels on a fixed age basis, and in some cases have now exceeded them.

Middle Performers

Classic technology twins refer to aircraft types with two engines that have recently ceased production having been superseded by new technology twins. However, they still retain a substantial presence of the overall fleet in current service. These include:

• Airbus A320ceo family

• Airbus A330ceo family

• Boeing 737 Next Generation family

• Boeing 777 family

• Embraer E190/E195 family

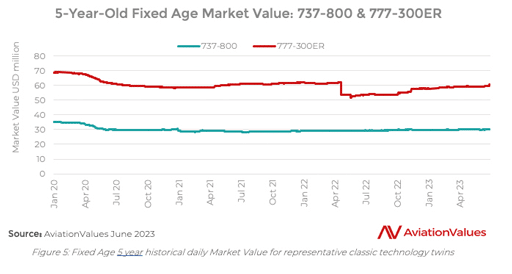

The demand for classic technology aircraft is driven to a large extent by their cost benefit relative to the new technology types that supersede them. In recent months, the availability of new technology replacement aircraft has been constrained by supply chain issues across all the manufacturers, and this has increased demand for classic technology aircraft as alternative lift.

Market values for the middle performers are generally still below their pre-Covid-19 levels on a fixed age basis, but are increasing.

Low Performers

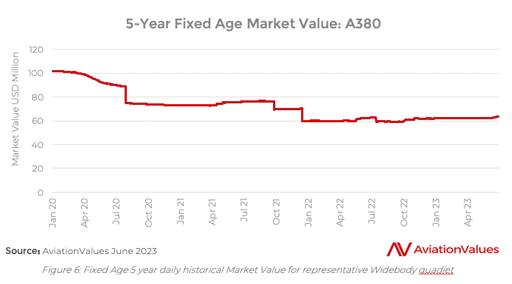

The swift drop in international demand following the imposition of Covid-19 travel restrictions impacted the largest passenger aircraft, all of which feature four engines, particularly heavily:

• Airbus A380

• Boeing 747-8I

• Boeing 747-400

Market values for these types remain significantly below where they were prior to the pandemic.

Traditionally reserved for the longest range and highest capacity routes, the widebody quadjets have for decades seen a steady erosion of their market share in favor of higher frequency services operated by medium and large twinjets that can service long-range routes more efficiently.

This “fragmentation” effect first became noticeable in the 1980s on transatlantic routes where the advent of the Boeing 767 twinjet enabled direct services between secondary city pairs rather than funnelling passengers into Boeing 747s flying the New York London route. The introduction of the Boeing 777-200ER in 1997 and 777-300ER in 2004, enabled a similar expansion of transpacific routes beyond trunk routes such as Los Angeles Tokyo. New technology types have accelerated this trend, with even single aisle types such as the A321neo now used in regular service across the Atlantic and the 737 MAX 8 serving London Heathrow from Halifax, Canada.

This has left the largest quadjets deployed on high-capacity trunk routes where they were dependent on high passenger demand to offset their high trip cost. It was inevitable that they would be parked.

As demand has returned, the quadjets face the additional hurdle of being the most expensive to prepare for return to service and have lagged the recovery of smaller aircraft.

That being said, a number of operators have now reactivated at least a portion of their quadjet fleet, including Air China (747-400, 747-8); Asiana (747-400, A380); All Nippon Airways (A380); British Airways (A380); the dominant A380 operator Emirates (A380); Korean Air (A380, 747-8); the dominant 747 operator Lufthansa (747-400, 747-8, A380); Qantas (A380); Qatar (A380); and Singapore Airlines (A380).

Conclusion

The impact of the Covid-19 pandemic on the commercial passenger aircraft industry was unprecedented. Faced with near-zero passenger revenue opportunities on most international routes and severely curtailed demand on domestic services, airlines made drastic cuts to their active fleets.

AviationValues’ data shows a clear distinction between the highest performing aircraft, mostly new technology twin engine types; and the large four-engine widebodies that have struggled the most from a utilization and value point of view.

The market has proved largely resilient, but the recovery in both utilization and market value has very much depended on the aircraft type. Passenger demand rebounded first in domestic markets, for which smaller narrowbodies were the initial beneficiaries. Only more recently has the long-haul international travel on which widebody utilization depends started to come back.

The recovery in demand for passenger aircraft has been coupled with a constraint in supply of new deliveries, as well as available slots for maintenance due to well publicized supply chain issues. This has resulted in upward pressure on market values across the board for aircraft that are already in service.