Thailand’s government is offering enticing tax and visa incentives for companies to bring aerospace and MRO businesses to their country. They believe their location, labor costs, technical base and work ethics make it the ideal location for those looking to benefit from the coming Asian aviation boom.

When you think of Thailand, what comes to mind? Tropical paradise? Tuk Tuk rides through Bangkok? The ornate temples? Incredible beaches like Phuket and Pattaya? The amazing cuisine? The kind people? While the Thai government is happy to have those things pop up as positive associations, they are striving diligently to attain another clear association: a high tech business and manufacturing hub perfectly situated to take advantage of the coming market boom in Asia.

As has been forecast for years, the “center of gravity of air travel” is shifting to Asia. The fully mature market in the U. S. and Western Europe will not see much growth in the coming 10-20 years. But there will be huge growth in Asia in aviation. Thailand is pushing hard to encourage businesses to come there and set up shop to prepare for this eventuality. It does seem to be a brilliant plan as they are perfectly located to support the needs of Asia as this growth market comes into reality. Air travel is on the upswing in Asia, markets are more favorable for this type of growth and regulations are beginning to accommodate the pent up desire for more. There are more aircraft on order in Asia than currently in service according to IATA and Flight Global.

Specifically relevant is their desire to focus on aerospace and they have identified MRO as an area of great interest. By 2034, according to IATA, the Asia-Pacific region will account for 42 percent of global passenger traffic and will have added 1.8 billion passengers. Thailand sees itself capitalizing on those predictions by offering alluring business incentives to entice MROs to set up shop and prepare for this aviation boom market.

With its status as a tourism favorite – Bangkok was the most visited city in the world in 2018 with 20.05 million people traveling there – the Thai government wants to parlay that success and other forays in technology and manufacturing into further growth and development. With China to the north, India to the west and Japan to the east, all are easily reachable from Thailand making it perfectly located, the Thai government believes.

Avoiding the Middle Income Trap

Developing countries that are experiencing growth and a positive, strong influx of money, can be victims of a theoretical economic development situation call the middle income trap. The middle income trap states that a country that attains a certain income (due to certain advantages – for example high rates of tourism) can get stuck at that level. The theory also says that countries that fall within these certain parameters can lose competitive edge in the export of manufactured goods because of rising wages but may be unable to keep up with more developed economies in the high-value-added market.

Thailand is such a country. And they are fervently trying to avoid the middle income trap by focusing on taking their successes to the next level. They are doing this by looking at sectors of business that can help drive their economy forward. Those businesses and industries include next generation automotive, biochemicals, biotechnology, electronics, automation and robotics, medicine and aerospace and specifically, MRO.

The country is determined to parlay their current booming economy to the next level. A major shift in thinking is being encouraged at all levels of the economy. They are working to improve education levels, increase research and development and to improve the environment for innovation. The country is urgently pushing to move from traditional thinking and unskilled labor to smart thinking and highly skilled labor.

Thailand first improved their agricultural sector. Then the country moved the focus to enhancing productivity in light industries and then on to improve labor and heavy machinery intensive production. Now, they are promoting startups, developing new technologies and providing high value services particularly as they relate to technology and innovation.

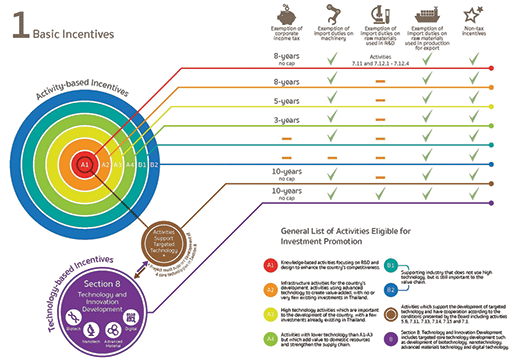

The Thai government has made it easy to bring and set up business in the country by creating a more streamlined system and offering incentives for foreign businesses. Thailand is a participant in many bilateral Free Trade Agreements (FTAs), as well as the ASEAN Free Trade Agreement (AFTA). “This allows businesses in Thailand to engage in virtually tariff-free trade with 17 different nations, including such major global economies as Australia, China, Japan, New Zealand, South Korea, and India,” a Thai government brochure says.

Eastern Economic Corridor

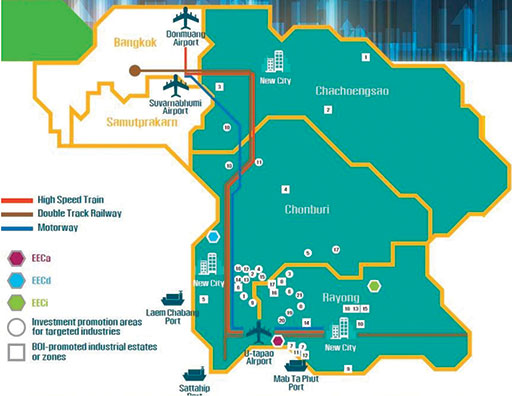

The country has developed a 20-year research and innovation strategy. Within that strategy, they have targeted aerospace and MRO as one of the keys to the plan, especially within their “Eastern Economic Corridor” or EEC, which is comprised of three provinces, Chachoengsao, Chonburi and Rayong. They are calling it a “growth hub” and this is where they hope to entice aerospace and MRO companies to come and build a launching pad for the coming Asian aviation tsunami.

Thailand has solid infrastructure already in place and plans for focused projects and investments during the next five years, especially in the EEC. The country is investing billions of dollars in the EEC. This trend is expected to continue, especially as companies begin to relocate in response to escalating US-China trade tensions.

There are three large airports in the EEC, Suvarnabhumi – the huge international airport near Bangkok; slightly northeast of there is Don Mueang Airport where they are currently increasing the capacity of the airport and runways; and a two-hour ride south of Bangkok is another large airport, U-Tapao, where a major expansion tailored to aviation and aerospace is beginning soon and Thai Technical already has facilities and is expanding as well. U-Tapao will add a second runway and redesign the airport space.

In addition to major investments in the three airports in the EEC, the Thai government and private investors plan on spending about $49.9 billion on upgrading or installing high speed rail and dual track rail, roads, hospitals, ports, city amenities and more.

A 92 hectare or 227 acre MRO hub with a dedicated apron for all hangars and additional aircraft parking areas is planned. Twelve Code F hangar bays and additional workshop space is also in the works. All of this is combined with a bonded free trade zone and access to large industrial estates nearby.

Already There

This Thai EEC area already is or will be home to automobile and auto parts manufacturing, smart electronics manufacturing, and companies for robotics, biochemical, digital and tourism. But importantly, there is the aviation and logistics already in the area. Some companies have seen the area as a key to future success in Asia and have already made the commitment to set up shop there.

Recently, a group of journalists from publications around the world, including Aviation Maintenance Magazine, were invited to tour the EEC and see some of the existing companies that are in place.

CCS

CCS, founded in 1989, is a Thai-owned manufacturing company with 1000 employees, 12 acres and 22,000 square meters of space, that says they can build to print one off, small batch and mass production. The company touts being the first Thai-owned company with AS9100 (achieved in 2005) and NADCAP certifications. They are manufacturing aerospace components for Collins Aerospace, Meggitt, Moog Triumph, Eaton and Tier 2 and 3 aerospace customers. In addition, in March of 2019, they completed the Boeing audit for special processes (chromic acid anodizing, fluorescent penetrant inspection and magnetic particle inspection) and added Boeing approval to their arsenal. Ketan Pole, CEO says this is “a very proud mile stone for our company and the employees.”

Pole says aerospace is only a quarter of their business now, but they are expecting to increase that rapidly, possibly doubling that amount in short order. CCS manufactured components are flying now and he highlighted sensing systems, nacelle, actuation, cargo, braking air management and interior systems parts. They utilize an SAP ERP system won a seven-year contract to supply parts and assemblies worth $50 million for B777, B787, A320, A350, A220 and others.

Pole is bullish on aerospace saying he sees the growth of his company coming from that sector rather than the already mature automotive industry. He is ready for the growth saying when they win a contract, they can acquire any additional equipment much more quickly than most countries due to the proximity to the machine makers. “It might take six months for a company in the U. S. or Europe to get the machine. But here, I can have it in seven days!” He expects to add 30 CNC machines in the next two years. “We have grown 400 percent between 2012 and 2016 with no marketing – all business development is by reference and by performance,” Pole says and stresses it has all been organic growth with no joint ventures and no parent company.

Looking ahead, Pole says they are targeting new processes that will be in demand soon such as zinc-nickel plating that is less harmful than cadmium plating, a process that could take the place of toxic and dangerous cadmium plating for landing gear parts. “We want to be the first Thai company to do this,” Pole says.

Triumph Group

Next, we traveled to see the Triumph Group operation in Chonburi. There they have 13,500 employees and five buildings. At this facility in Thailand, Triumph is Boeing and Airbus approved and doing nacelle repair, wheels and brakes, radome repair, flight controls and accessories as well as component repair and overhaul. The company is also a producer of composites including acoustic engine liners.

Triumph says it considers their facility in Chonburi one of their most efficient. Fifty-seven percent of their business is commercial, 20 percent is military, 19 percent is business jet. “These are exciting times for us at Triumph, especially here in the Asia Pacific region,” says, Gonzalo Salazar, vice president Asia Strategy at Triumph Group. “There will be a big demand for MRO and lots to do. Big years are coming ahead.” Earlier this year Triumph partnered with Thailand’s Civil Aviation Training Center to foster aviation talent development in the country. The partnership will lead to the development of aviation personnel to serve in the MRO industry.

Early this year, TurbineAero purchased the APU piece part repair business from Triumph Group. It is currently still located within the facility but was in the process of transitioning to TurbineAero’s 80,000 square foot facility nearby.

One of the advantages of their location, says Triumph, is the existence of a freezone with no duty or VAT. The best incentives for companies looking to set up shop exist within one of these free zones.

Amata Smart City

Private companies in Thailand are building what are touted as futuristic smart cities. These sites, like the Amata City Chonburi Industrial Estate where Triumph is located, are large – almost 11,000 acres within the Eastern Economic Corridor.

The goal for the area is connecting them transit and preparing with infrastructure. Within the Amata Industrial Estate at Chonburi, companies can lease land on which to build their own facility, lease a facility already built or they can purchase land, even foreign companies can own land 100 percent. They also say the government of Thailand will assist with visas for foreign workers and their spouses and families, easing the challenges some companies might see as barriers to bringing their business there. Within the estate, duty-free zones exist, as Triumph mentioned, which helps companies reduce tax burdens. These smart cities are also planned to be centrally located with shopping, healthcare and living facilities in close proximity for the future workers.

Airbus Helicopter image.

Airbus Helicopters

Airbus Helicopters has taken a lead by establishing a service and support center for their helicopters in the EEC. The company has set up shop to support the military, para-public and corporate use helicopters in Thailand.

The Asia Pacific helicopter fleet is the third largest in the world behind North America and Europe. There are about 9400 helicopters in the Asia Pacific region. About 5100 are military and 4200 civilian. Airbus has 2000 helicopters in the region, including with the Thai Air Force.

“Our duty is to support the recently delivered fleet,” says Pierre Andre, head of sales, Southeast Asia and managing director, Thailand. “Since 2008, we have been the only helicopter MRO in Thailand. It is absolutely strategic to provide service at their doorstep,” he stresses. Their capabilities include technical support, customized maintenance, logistics management, spares, tech pubs, etc.

Senior Aerospace

Next, we were off to another industrial estate to see Senior Aerospace. One of the first things Senior’s CEO, Simon Shale, told us is that Rolls Royce had just awarded the company “Most Improved Supplier of the Year” for 2018. Shale was also quick to predict the company’s $100 million annual revenue would more than double by 2024.

Senior manufactures complex precision components such as blades for the V2500, Trent and LEAP engines, aluminum and hard metal structure parts for the B787, A330 and A320, and aircraft seats. “Thailand has so much to offer. The support structure [for businesses to set up shop] to help you go through the process is second to none, one of the best in the world,” Shale says. However, he says “It’s a long game,” cautioning that some won’t get a return in quickly.

“We’ve invested $50 million in the facility. I spent a lot of money on safety. I’m audited once a week. You have to focus on the long term,” he says.

Shale praised the Thai people and work ethic. “Thai people work hard and follow the rules. If you understand the culture, you can motivate them. They never give up and have passion for their work,” Shale says.

U-Tapao and Thai Tech

U-Tapao Airport, located in the southern part of the EEC, is growing and the government of Thailand sees it as having huge potential. Together with Thai Airways and Airbus, they are betting on that huge potential. Thai Airways is investing $181 million into the airport infrastructure. They are also undertaking a major expansion of their MRO facilities there, pledging to spend about $114 million to upgrade and expand to be able to hold 12 narrow body or five wide body aircraft.

A joint venture between Thai Airways and Airbus was signed a year ago for this new facility. Their joint goal is the establish an advanced maintenance center capable of servicing the rapidly expanding Asia Pacific fleet which is set to triple during the next 20 years. The maintenance facility will offer heavy maintenance and line services for all widebody aircraft. They envision utilizing the latest digital technologies, advanced inspection techniques such as drones monitoring airframes, will have composite repair and other specialized shops and training.

Thai Airways flies the complete Airbus widebody family so the partnership seems inevitable. On the day of our visit to the hangar at U-Tapao, Thai Technical was celebrating what they called “Mission Impossible” the completion of an Airbus A380 C-check in 50 days, according to Catipod Keadmonkong, deputy director of Thai Technical. “The average time for this six-year check is 60 days. Our goal was 50 days and we achieved that,” Keadmonkong says.

This expansion at U-Tapao has Thai Technical setting its sights on third party maintenance. Currently they have an 80/20 split with 80 percent being work on Thai Airways aircraft and 20 percent on other airlines. They will look to expand and add additional customers. The new hangars and shops will make this possible, as they were at capacity both at U-Tapao and Don Mueong.

Keadmonkong is eager to take the Thai Technical team into the future with, big data, paperless systems and drone inspections. They are looking at 3-D mock-ups using augmented and virtual reality training. He says they are ready to move from traditional maintenance to predictive and on to prescriptive maintenance and will be investing heavily in new technologies. “Using big data analytics you can control costs. We are looking at Skywise [the data-mining analysis tool from Airbus],” he says. These new facilities are planned to open in 2022.

It appears there has never been a better time to set up shop in preparation for the Asian aviation surge. Not everyone we spoke to was so optimistic. One business owner in particular did not think it was as easy as depicted to get deputy director deputy director the necessary permits for starting a business venture in Thailand. But, those thinking hard about the possibility and thinking the time is right, take note. When asked what types of MRO support businesses are needed to help their business, Thai Technnical’s Songyot Tangtrakarn, chief production engineer, spoke up right away and said, “Landing gear overhaul shops are needed.”

For more information about investing or setting up a business to Thailand, contact:

Thailand Board of Investment, New York Office

7 World Trade Center, 34th Floor, Suite F,

250 Greenwich Street, New York, New York 10007, U.S.A.

Tel: +1 (0) 212 422 9009 Fax: +1 (0) 212 422 9119

Email: nyc@boi.go.th Website: www.thinkasiainvestthailand.com