The number of widebody commercial aircraft in the world is increasing, and so is the need for these aircraft and their engines to be serviced by MRO shops.

Oliver Wyman

“We see the widebody fleet growing at about 2.6% over the next five years and widebody overall MRO growing at 3.9%,” said Derek Costanza, a partner in Oliver Wyman’s Aviation and Aerospace Practice. “Widebody engine MRO will approach 4.3%, and engines will represent almost 50% of the total MRO dollars spent in the next five years, so that brings up the average. Growth will come mostly from China and the Middle East.”

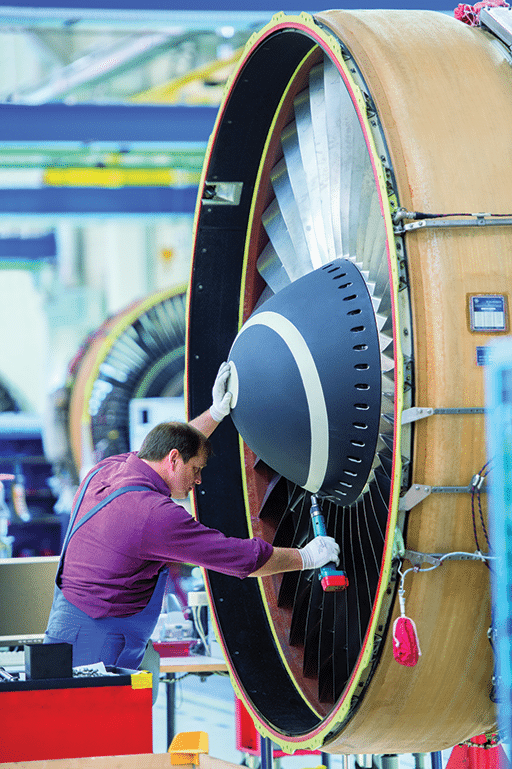

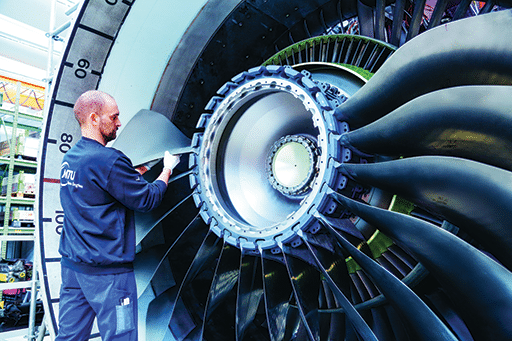

(MTU Maintenance)

“For mature widebody engines such as the GE90, MRO demand has increased significantly in the past year and will continue to grow over the next few years as passenger flying returns to normal,” added Alistair Forbes, senior market analyst with the MRO MTU Maintenance. “These engines are very reliable, with the vast majority of shop visits being scheduled.”

At the same time, grasping the full profit potential of the widebody maintenance market is apparently out of reach for airframe and engine MROs. The reason: “The WB (widebody) MRO market recovery is slower due to slower recovery of long-haul traffic” after Covid-19, said the 2023 VZM Market Outlook for Commercial Aviation & Maintenance. But it could be worse: The pandemic also slowed down the production of new widebodies, forcing airlines to keep older aircraft like the A380 in service, it said. More older widebodies flying means more business for MROs, even with a slower-than-expected return to normal airline traffic levels.

“Airlines are struggling to get new widebody aircraft from Airbus and Boeing,” said Gilles Fossecave, CEO of the MRO Vallair. “That’s why they are asking for maintenance on their existing widebodies, in order to keep their fleets as large as possible and able to fly.”

The State of the Industry

There is no doubt that Covid-19 disrupted the growth of the world’s widebody aircraft fleet. According to Oliver Wyman’s ‘Global Fleet and MRO Market Forecast 2023–2033′ report (the Market Forecast report), “we project the worldwide commercial fleet to expand 33% to over 36,000 aircraft by 2033 — a compound annual growth rate of 2.9%. Today it numbers almost 27,400, just short of its size in January 2020 — the last month before Covid changed the economy and everyday lives around the globe.”

This report then observed, “while aviation is most assuredly on a growth trajectory after a devastating two years of losses, it’s currently carrying a lot of baggage that can’t be easily checked. With Covid-19 ostensibly behind us, the [airline] industry will be dealing with a series of new and old challenges over the next 10 years that will test its resilience and may temper how fast it continues to expand.” The same is true for the MROs that serve them.

Let’s look at these challenges in depth.

The Impact of Slowed Widebody Production

When Covid hit in 2020, airlines delayed their widebody purchases with Airbus and Boeing in order to save money. “The greatly reduced levels of passenger traffic impaired airlines’ ability to pay for aircraft and so they often requested deferred delivery dates,” explained Forbes. This, in turn, slowed widebody production, which put the OEMs and airlines in ‘catchup’ mode once the crisis eased and normal air travel started to resume.

AFI KLM E&M

The same penny-pinching mentality also guided airlines’ approach to widebody maintenance during the worst of the pandemic. “I think all the airlines in the world were trying to save cash as much as they could,” said Derk Nieuwenhuijze. head of strategy, marketing and communication with Air France Industries KLM Engineering & Maintenance (AFI KLM E&M). “So they postponed their narrowbody and widebody maintenance as much as they could.”

But there were a few exceptions: “Widebody MRO for the GE90-115B and CF6-80C2 engines remained strong during the pandemic, driven by the cargo market,” MTU’s Forbes noted. “Other engines that mainly catered to the passenger market suffered much larger MRO demand reductions, particularly for older less efficient aircraft.”

Even today, the impact of Covid-19 lingers on. “We expect an average of 240 new widebodies to be produced each year over the next five years, which is considerably lower than the annual average of 370 produced across 2018 and 2019,” said Costanza. “We do not see widebody production recovering to 2018/2019 levels until the end of the decade.”

The Impact on Widebody MROs

As mentioned above, the slowdown in new widebody deliveries has forced airlines to keep their older widebodies in service longer. The result: “Lack of widebody replacement definitely has created more MRO demand,” Costanza said.

Demand for widebody maintenance services is likely to increase further when world airline travel matches and then exceeds pre-pandemic levels. “This is one reason why MTU is confident that we will continue to see strong widebody growth over the next few years as passenger activity returns to the long-term growth trend,” said Forbes.

This said, there are a number of post-pandemic problems that are taking the bloom off this particular rose. One of these problems is inflation, which is affecting all aspects of MRO operations.

“Inflation is a huge issue for all MROs,” Constanza said. “Depending on the parts, inflation has been right about the double-digit level. The trouble is that many airline operators cannot afford those increases while many MROs are trapped in contracts that limit price escalation due to inflation, so yes, it’s a big issue for everyone involved. In response, airlines and MROs have opened up to using more USM (used serviceable material) and PMA (parts manufacturer approval) parts rather than new OEM parts, but the historical savings are not there due to increased buyer demand.”

Inflation is also driving up labor costs, due to “consumer inflation leading to demands for higher wages across the supply chain,” said Nieuwenhuijze. “This is affecting everyone from the mechanics who are working on the aircraft to the people who make the parts, and those who gather the raw materials that these parts are built from.”

Then there’s the costs of keeping the lights on and the MRO hangars heated, which also keeps going up. At MTU Maintenance, “Energy is one of the drivers for cost increases, especially at our German locations,” Forbes said. “Further, we have experienced increased cost for material and outside vendor services, both reflecting the overall inflation trend in combination with scarce resources — the latter being driven by worldwide capacity adaptations in the supply chain and caused by Covid-19. Naturally, the share of material cost represents a major portion of our maintenance services and is therefore a significant driver for overall cost increase.”

In a bid to drive down at least some of these inflationary costs, MTU is investing in self-sustainable energy infrastructure such as photovoltaic technology and dual-use heat pumps. “These measures do not only help to better manage energy cost but also support MTU’s strategy towards a lower carbon footprint,” said Forbes.

Unfortunately, the only way for MROs to survive rising costs and stay in business is to pass on those costs on to their widebody customers. According to Vallair’s Fossecave, raising prices is a necessary move, but not a popular one. “Some airline customers don’t understand why prices have gone up to service widebodies, and we have to explain it to them,” he said. “Other airlines do understand, but they don’t like it because they have inflationary issues of their own to deal with.”

Supply Chain Issues Remain

Supply chains were seriously disrupted when the pandemic hit in 2020, and they have yet to fully recover. This is why “Supply chain challenges have hindered aerospace production lines, causing both Airbus and Boeing to fall short of production and delivery targets for 2022,” said the Market Forecast Report. “2023 is unlikely to be different for either, given that the two rely on many of the same suppliers and sources of raw materials, and the conditions remain about the same this year. Of course, many of the same parts are used on the A320 and Boeing 737, meaning that the pressure on some suppliers is multiplied.”

“For the older widebodies, the challenge is always getting parts,” Costanza observed. “For these older widebodies, engine maintenance continues to be a particular challenge as does landing gear, both of which are very dependent on the OEMs.”

“A strained supply chain is an issue that is currently affecting the entire industry, including OEMs, MROs and suppliers,” said Forbes. “At MTU, we are working closely across our entire network and in all regions to limit the impact on customers as much as possible.

As for the immediate future? “Supply chain issues will limit OEMs’ ability to ramp up production quickly to match the rapidly rising demand from airlines,” said Alton Aviation Consultancy’s ‘Skyward Bound: 2023-2033 Commercial Aircraft and Engine Fleet Forecast’. “As a result, OEMs have substantial order backlogs which stretch until late in this decade for most of the popular in-production aircraft families. It is not expected that OEMs will bring into service additional new cleansheet aircraft designs in this decade beyond the 777X, despite industry sustainability commitments.”

Ironically, the only reason this situation isn’t worse is due to the current level of widebody flights. They still haven’t recovered from Covid-19 either.

“At a global level, the amount of widebody flying in Q3 this year was only 92% of the Q3 2019 level (with Q3 usually being the busiest quarter of the year for flying), so the widebody market overall still has a little way to go to get back to pre-pandemic levels of flying,” Forbes said. “This shortfall is even more marked if you consider that the market was growing quickly before the pandemic hit. If 2019’s flying had continued to grow 4% per year, we would have had global flying at 117% of 2019 levels this summer, so the 92% figure mentioned earlier reflects a significant reduction compared to where the market would have been without the pandemic.”

A Lack of Labor

It is difficult to service any aircraft if you don’t have the technicians on hand to do the work. This also applies to flying commercial airliners if you don’t have the pilots.

According to Oliver Wyman’s Market Forecast report, this one-two ‘lack of labor’ punch is knocking the entire aviation industry for a loop.

A case in point: “In North America, the industry is facing two potentially severe shortfalls in the ranks of commercial airline pilots and aircraft mechanics,” said the Market Forecast report. “By our analysis, the supply gaps will amount to 18% of the total pilot workforce in 2023 and 14% of aviation mechanics. The outlook is for those deficits to grow or at least linger through 2033. The gap between the number of pilots needed and those available has already led to reductions in service to less popular and more rural destinations and has hit regional airlines hardest.”

Worse yet, “the shortfall of aviation workers is a global problem,” the Market Forecast report continued. “European ground crew shortages were so ubiquitous and severe in 2022 they led to the imposition of capacity limits at some European airports, including London’s Heathrow and Amsterdam’s Schiphol. In India — the fastest-growing aviation market, according to our latest Fleet and MRO Forecast — the desperate need is for more air traffic controllers. But because so many aviation jobs are critical to operations, any ongoing shortage can eventually result in the industry’s growth being limited not by a lack of demand but by supply constraints.”

According to MTU’s Alistair Forbes, hiring enough qualified personnel and managing parts supplies are the two main challenges facing MROs today. “The skilled and experienced workforce shortage will be around for some time mirroring the demographic development — especially in the Western world,” he said. “MTU was fortunate enough to retain its workforce during Covid and we are now partnering with schools, colleges and universities to recruit and train new hires on a continual basis all over the world. We also continue to invest into our in-house mechanic apprentice programs and training centers: For instance, MTU Maintenance opened a dedicated training center at its facility MTU Maintenance Zhuhai earlier this year and announced its training academy, a collaboration with the British Columbia Institute of Technology, at MTU Maintenance Canada in Delta, BC.”

The Impact of Cargo Conversions

When passenger traffic fell off during the pandemic, many airlines converted their idle widebody airliners into cargo carriers, in a bid to capitalize on growing traffic in this area.

For a while this worked. But in 2022 “the cargo market started to soften while capacity increased further,” said the VZM Market Outlook 2023. During most of that year “demand was declining despite higher world trade than the year before,” it said. To make matters worse, “cargo revenues remained almost flat, supported by even higher yields than the previous year.”

As a result of these trends, VZM is not bullish about the air cargo market as a money-maker for airlines post-pandemic. “Air freight demand is expected to be weaker in 2023 but to recover in later years,” the VZM Market Outlook said. “Global cargo revenue will decrease 25% in 2023 but still be 50% above pre-corona revenues. [The] main reason is the still strong cargo yield expected in 2023, although also sharply declining. The weaker market is forcing cargo airlines to cut costs after very profitable corona years.”

So what does this mean for those MROs who convert widebody passenger aircraft to freight (P2F) carriers? “Over the next five years we expect widebody P2F conversions to double to an annual average of just below 40,” said Costanza. “This is about double what we have seen yearly since 2018. These conversions drive more demand for MRO services, but it’s fairly minimal in the context of the overall MRO market.”

“I would expect the demand for cargo conversions will be a little bit lower going forward than it has been,” Nieuwenhuijze said. “And I’m always a little bit skeptical about the importance of cargo conversions in the overall MRO market: Of course, the numbers we saw the past years were huge comparatively to what we’ve seen before. But as a whole, the cargo aircraft market is relatively small if you compare it to commercial airlines.”

The Bottom Line

Clearly, the widebody MRO industry is facing a number of challenges in the wake of Covid-19. However, these challenges don’t change the fact that global air travel is increasing, and on track to exceed pre-pandemic levels in the future.

As a result, “we see a huge appetite of airlines worldwide to buy new aircraft,” said Nieuwenhuijze. “So the world’s widebody and narrowbody fleets will grow quite significantly going forward. This means that MROs such as AFI KLM E&M will have to ramp up capacity. My only concern is that we will have enough suppliers to support us in our work, especially in the area of widebody engines.”

“The big challenge for airlines will be to find widebody MROs with enough available slots to service their aircraft in a timely manner,” Fossecave concluded. “Our challenge will be to find and retain sufficient skilled technicians to do the work.”