The European MRO market needs to retain its flexibility in the face of uncertainty.

Europe is a large, mature, and slow-growing MRO market. But it will remain dynamic, thanks in part to planned aircraft purchases and – while fuel prices remain low – to the refurbishment of older aircraft. Flexibility, cost control, expansion (especially into lower-cost areas), partnerships, and innovation will be key. Traditional expertise in engine and component MRO, as well as bundled services such as pooling and inventory/asset management, will be drivers, along with new technologies such as big data/analytics and robotics.

The market is fiercely competitive, a condition which is leading to consolidation of capacity, according to Jeremy Remacha, CEO of SR Technics, the Swiss-based MRO now owned by China’s HNA Group. “The industry needs to continuously realign its costs, technology, and service delivery in order to keep up.” Remacha predicts that “activity is likely to be unsettled as the industry realigns” but asserts that “safety assurance must remain paramount” in MRO selection.

Robert Gaag, senior vice president, corporate sales, for Europe, Middle East & Africa (EMEA), with Lufthansa Technik (LHT), perceives overcapacity in some areas, as well as an increasing tendency towards intellectual property protection.

“Although the European aviation market is far less predictable than in the past, one thing is certain: it is still growing,” advised Vincent Metz, vice president, strategy, for AFI KLM E&M. “Our aim is, therefore, to be flexible … so that we can continue to develop the most worthwhile solutions.”

Changing Environment

MROs are experiencing “massive changes” in the demands on them as a result of an environment where the world fleet is growing but where aircraft, components, and engines require less maintenance, said Gaag. The financial challenges of many airlines and the growing presence of low-cost carriers intensify price pressures.

In its March 2017 market outlook report, Netherlands-based VZM Management Services underlines business risks, ranging from unpredictable behavior by the world’s major players to economic uncertainties created by Brexit and protectionist rhetoric. However, MRO globalization helps to mitigate those risks as well as to control costs and service far-flung customers.

Even Brexit has a silver lining. UK MROs have profited from the decreasing value of the pound after the referendum, explained Marcel Versteeg, VZM managing director. The effect of the UK’s exit from the European Union is expected to be bigger on airlines. Parts logistics, as well as the operations of English contractors in support of EU-based MROs, could become more complex, however.

Finding skilled workers is another issue. VZM often hears that western European maintenance organizations have trouble finding and keeping skilled technicians and specialists. “Manpower is a challenge, in the face of a growing number of opportunities where fleets are requiring heavier inspections and new platforms are being introduced,” agreed Pedro Raposo, MRO business development director with OGMA in Portugal.

Leaders also cite the decreasing popularity of technical skill training, demographics (ageing population), non-competitive salary levels, and the need for new skills to handle challenges such as big data, added Versteeg. What’s more, new engineers expect to be promoted to management positions within a few years rather than – as employers would prefer – stay in the engineering ranks long enough to be able to help develop repairs and process improvements.

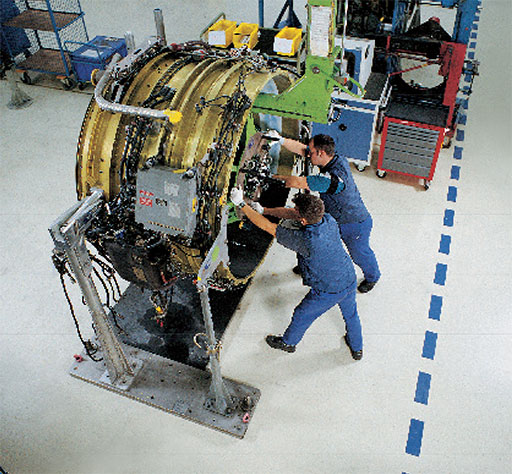

(Photo: Patrick Delapierre).

The European MRO market is $17 billion-$19 billion in size, with long-term growth of around 2 percent, Versteeg said. This is “well below the average of around 3 percent [for] the global MRO market,” which is estimated to be $65 to $70 billion in value.

Opportunities

LHT wants to exploit the big data analysis area early with new business models, so that the MRO “can play a decisive role in shaping the industry,” said Gaag. It also expanded its digital services portfolio last year with the acquisition of software firm, FlyDocs.

AFI KLM E&M also has made big data analytics a top priority. The Franco-Dutch MRO already has “industrialized” two data analytics solutions, Metz explained. Its Prognos Engine Health Monitoring suite is used to analyze engine data and predict faults. A second tool – originally developed for the A380 – is Prognos for Aircraft, which includes system performance monitoring and alerts.

When a weak signal is detected, suggesting the possibility of an impending failure, the MRO and the client can ‘optimally plan maintenance work in light of [the customers’] operational constraints.’ Thus fleets can be in the air longer, operations can be more efficient, and the amount of unscheduled maintenance ‘falls dramatically,’ lowering total cost of ownership, he said. AFI KLM E&M has expanded Prognos for Aircraft to cover all of the Airbus A380’s systems – prioritized according to the experience of Air France and KLM vis-à-vis delays and cancellations.

Lessor Services

Lease transition services and other lessor programs are a good fit for Europe, where a significant proportion of aircraft are leased, Metz said. AFI KLM E&M “can enable a smooth transfer … with all required maintenance, including cabin modification offers.” OEM-owned OGMA also has “a great working relationship” with lessors in lease transitions, Raposo pointed out.

MTU Maintenance is developing lessor lifecycle solutions, stated Katia Diebold-Widmer, head of marketing for the unit. Aircraft and engine lessors increasingly want to take a more active role in managing engines, their most valuable asset, she observed. “They want to be directly involved in engine maintenance decisions, particularly during the transition between lessees, in managing and optimizing maintenance reserves and choosing the timing of engine shop visits.” MTU’s services extend from engine purchase through maximizing value at the end of life through a sale, extended lease-out, or a teardown for serviceable material.

Rolls-Royce has launched LessorCare, which draws together a range of services into one framework yet allows lessors to adapt the level of service through the life of the engine, according to Tom Palmer, Rolls-Royce senior vice president -services, Civil Aerospace. Customers can sign one agreement covering all Rolls-Royce Trent engine types and services, such as customer support, transition services, and asset management.

Globalization

AJ Walter (AJW), the UK-based parts specialist and component MRO “is looking to expand in all regions,” said Dave Lewis, AJW Group chief technical officer. The firm recently opened a sales office in Moscow but also boasts a ‘significant presence in Asia,’ with its Singapore regional office, and in North America with AJW Technique. However, “the majority of our MRO spend is in Europe and will continue to be in Europe because of our current customer base.”

AJW also emphasizes partnerships with component manufacturers. “With the desire of the OEMs to get into the aftermarket, rather than go against them, we certainly take the view that we should partner with them,” Lewis said. These relationships allow AJW to get OEM products “at a very competitive price” and to have “an OEM tag,” which is seen as “a very good thing in the market.”

Last December AFI KLM E&M announced a new materials and logistics service center in Kuala Lumpur, Malaysia, to serve Asia-Pacific carriers. The decentralized facility will function as a local spares pool but will also deliver component services.

Meanwhile Spairliners, the joint venture (JV) with LHT, has opened a new warehouse and logistics center for component supply in the Singapore Free Trade Zone, Metz said.

LHT also is investing and expanding capabilities to maintain its No. 1 spot, Gaag stated. Late last year the German-based MRO announced a JV with GE in Poland. The new engine shop, XEOS, will focus on overhauling GEnx-2b and GE 9X powerplants. LHT also plans a joint geared turbofan (GTF) overhaul shop with MTU Aero Engines. And Lufthansa Technic opened its third narrow-body overhaul line in its Puerto Rico facility and a wheel & brake overhaul shop in Frankfurt.

LHT’s aircraft overhaul unit in Manila has been positioned to serve the entire region. And LHT component services “will acquire a second mainstay” in Hong Kong to complement the Hamburg site.

LHT plans to close its last overhaul line for commercial aircraft in Hamburg this year but will continue to expand commercial overhaul services internationally. The closure will not impact the MRO services for LHT’s VIP, government, and special-mission customers in Hamburg.

AFI KLM E&M signed a memorandum of understanding with OEM Safran Aircraft Engines to create a joint company for engine compressor airfoil repair. And CRMA, a subsidiary of the Air France KLM Group, has launched project Apollo to expand its production capacity for engine parts repairs.

Independent MRO: SR Technics

“A few years ago we opened a modern component facility in Malaysia, serving our global customer base, an administration center in Belgrade, and now we are looking into expanding our operations in Malta,” explained CEO Remacha.

“The Kuala Lumpur facility is part of our overall strategy to develop a comprehensive global operation, designed to bring the company closer to its customers.” Malaysia operations employ about 170 people and serve over 460 contracted aircraft. The shared service center in Belgrade now employs more than 240 people in areas such as finance and accounting, compliance, internal auditing, export control, indirect procurement, IT, HR, and engineering.

In April of 2017 SR Technics handed over its remaining line maintenance operations in France to a new operator. But the company has announced an extension of line maintenance capabilities for the A350 and A320neo in Zurich and Geneva.

Remacha revealed that engine visits are up by more than 20 percent. The MRO also is launching Material.Monetary.Solutions, a service to help engine customers reduce material inventories.

Engine Specialists

According to CAVOK’s February 2017 engine MRO forecast, the European engine MRO market will have a CAGR of 2.4 percent in unescalated U.S. dollars from 2017-2027, Diebold-Widmer said. This is low, compared to the global forecast of 5.1 percent CAGR (unescalated USD), she observed.

Shop visits are expected to be fairly flat, going from 1,983 in 2017 to 2,065 in 2027 with a CAGR of 0.4 percent for that period. “This is because Europe is a mature market,” she explained. “That being said, it is also an important market, as many key MRO players, including MTU Maintenance, have main locations in Europe from which they serve the international engine community.”

There also are opportunities in the region. MTU Maintenance, for example, provides “tailor-made service offerings,” which can combine engine MRO, leasing, and asset management.

MTU Maintenance’s revenue grew 21 percent in 2016, to $2.1 billion, according to Diebold-Widmer. The largest share of its turnover came from the V2500 engine family, for which MTU Maintenance claims to be the leadingMRO provider worldwide, with a 2016 market share percentage in the mid-thirties. MTU Aero Engines foresees around 10 percent overall growth (in U.S. dollars) in its MRO segment for the coming year.

The CFM56 family and the GE90 are also engines to watch, she said. The CFM56 installed fleet is large and the variants are starting to mature, which will translate to heavier shop visits – and material replacement – with increasing MRO costs. Many CFM56s will be retired over the next 10 years, increasing the supply of spare engines and used serviceable material (USM). “We’re looking forward to supporting operators through this phase of the engine’s lifecycle. For instance, through customized builds, green-time lease in or out, and teardown and remarketing of parts.” Interest in the GE90 is also growing.

And customers are increasingly interested in services that “go beyond traditional MRO,” said Diebold-Widmer. In the European market, MTU Maintenance Lease Services has partnered with Embraer to provide “comprehensive CF34-10E spare lease engine support.” This features the establishment of a CF34-10E pool service available to Embraer E190/195 operators in Europe, the Middle East, and Africa. Managed by MTU, the service provides guaranteed availability of CF34-10E spare lease engines through a monthly access fee. It also involves a pre-agreed daily fee, usage fees, and additional support services, as required, such as engineering, engine condition monitoring, and transportation.

MTU Aero Engines, meanwhile, plans to set up a 50/50 JV with LHT for GTF MRO in the second half of 2017, subject to regulatory approval. The new facility is expected to be operational by 2020, with over 500 employees and a total investment of around 150 million euros. The site, the exact location of which either inside or outside Europe will be decided in coming months. It is intended to accommodate over 300 shop visits of PW1000G-family GTF engines for A320neos and other aircraft.

Rolls-Royce has ramped up competition within its own network. It closed the TAESL (Texas Aero Engine Service Ltd) facility, a JV with American Airlines, due to reduced demand and lack of growth opportunities.

Delta TechOps, the first Approved Maintenance Center with no Rolls-Royce equity stake, will start work on a new facility in 2018, to go live in 2020. A second independent AMC, Mubadala, will build a Trent XWB facility. More than 20 percent of the 1,600 Trent XWBs sold to date will be operated by airlines in the region, Palmer said.

VZM anticipates opportunities as MRO work is “reshored” to Europe and North America. This is expected to occur as Asia-Pacific fleet growth displaces some offshored European and U.S. wide-body base maintenance.

But reshoring has not had much of an impact in Europe yet. When it happens, it’s “up to the MROs to take advantage of it by offering short, reliable turn times with flexibility and good aircraft reliability after the check, Versteeg advised. Quality of service will become a more important differentiator in this environment, as labor rate differentials decrease.