Bernie Baldwin reports from Orlando, Florida, on the discussions at the largest dedicated aviation maintenance event on the calendar.

Data, and how to get the most out of it, threatened to swamp the discussion at MRO Americas 2017, but the balance was restored when delegates were reminded of the physical nature of the industry.

That reminder came from Lufthansa Technik’s chairman, Dr. Johannes Bussmann, during a presentation in which he was actually launching the company’s Aviatar platform of MRO digital products and services. He emphasised though, the importance of bridging the digital–physical gap in the supply chain. “If I were an operator, it would not help me to know what is going to break if I cannot get the right part at the right time,” he stressed.

As for Aviatar, Bussmann equated it to a “world where you can monitor your entire fleet at a glance, check the conditions of your components in real time, prevent failures before they occur, have the solution in the place when needed, while your supply chain perfectly matches your demand with no paper recording necessary”.

Adi Bernstein. (Photo: Bernie Baldwin)

The system is an open platform, with app developers invited to contribute. Bussmann explained that while some apps may deliver modest savings on their own, added up they become truly significant. Currently there are seven apps on Aviatar, including the first third-party app from FLYdocs.

Peak passed?

In the regular forecast session opening the conference, Dave Marcontell, general manager, Oliver Wyman/CAVOK, reported his belief that the current airline industry financial cycle passed its peak in 2016. The MRO sector, however, will continue to grow from a value of around $72.1 billion this year to $103.8 billion in 2027.

An increase of 10,133 aircraft in service, to take the global fleet beyond 35,000 by 2027 will accompany that MRO industry growth, which means that 40 percent of today’s in-service fleet is forecast to retire by 2027, Marcontell noted.

Richard Brown, principal at ICF, observed that more stable fuel costs have slowed aircraft retirements, which has had an effect on the MRO market. “For example, United has been putting 777-200s back into the domestic market,” he remarked, adding that fewer aircraft are being cannibalised.

ICF expects the global MRO market to grow at 4.1 percent a year over 2016-26, faster than the predicted airline growth. North America’s MRO market will grow from $18 billion in 2016 to $21.4 billion in 2026.

Both Marcontell and Brown offered trends to watch, the former focussing on an impending labour shortage of AMTs (aircraft maintenance technicians). “The median age of technicians is now 51, which nine years higher than average workforce,” he warned.

Brown highlighted the rise of RONA (Return On Net Assets)-driven airlines. For these carriers, capacity management and asset utilisation are replacing market share as the key metrics of the business. “And it’s all about sweating those assets,” he added.

In a session examining the globalisation of the MRO sector, better delivery in the right place at the right time, and an increase in partnerships between global MRO players and regional players were the emerging themes.

Jim Sokol, president of MRO Services at HAECO Americas, epitomised the former when commenting on how globalisation plays out differently for heavy maintenance. described his company as being “agnostic” in its view and emphasised that it “makes sense to do the right work, with the right level of talent in the right place at the right time”.

Hisham Nasser, chairman and consultant, Egyptair Maintenance and Engineering, believes globalisation will activate new ideas, including the possibility of affiliating with some major MROs, such as Air France Industries KLM Engineering and Maintenance (AF KLM E&M). “First, the region has to reach a certain level of stability, but I think we will see a lot of [these affiliations],” he commented.

One region not being seen as an attractive opportunity is Europe. Sokol confirmed that HAECO has “had some customers approach us to do that, but we’re currently not seeing it. The cost of labour and the issues surrounding that need to be sorted out first,” he explained.

One partnership announced at the show was a new services agreement between Airbus subsidiary Satair Group and VAS Aero Services to offer surplus and used serviceable material for Airbus aircraft to the market alongside new parts. VAS will assist Satair with servicing, certification, warehousing and distribution of OEM excess parts inventory, be it simply surplus or used serviceable material (USM).

Satair CEO Bart Reijnen called the deal “a clear commitment” to offer more to its customers, who will be able to view and purchase the surplus/USM parts through the Airbus online portals. His counterpart at VAS, Tommy Hughes, explained this his company will “bring all the intellectual property data of pricing, demand, fair market value assessment of each part to the partnership. By working with us, Satair will shorten the learning gap of utilising such data, as VAS is already there.”

Such deals signal one way that the components sector is changing. Others include the increase in data available to predict the requirement for replacement parts plus a shift in the types of components which are most in demand.

Discussing the last of these, Tom Covella, group president of STS Component Solutions, highlighted how equipment and furnishings have become a driving force in components, representing 26% of the market. “That is almost equal to APUs, engine components, landing gear and thrust reversers combined,” he commented.

According to Covella, interior retrofits represent a supply chain challenge. “You have to maintain two inventory levels – one for the existing parts and one for the parts going into the new configuration,” Covella commented. Better use of data will help, he acknowledged, but “access to data is only relevant if you are using it to identify issues and change the way you operate”.

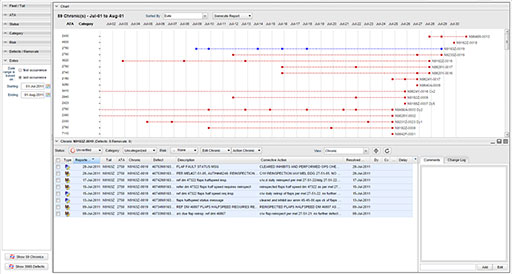

Aiming to provide more key data to airlines is Aircraft Technical Publishers (ATP) which announced Custom Alerting, a new customer-driven addition to its ChronicX Solution that enables the automatic detection and management of chronic and critical defects. The company’s vice-president of sales, Steve Lightstone, explained ChronicX 2.0 goes beyond simply bringing together defect reports identified by ATA codes. “It adds the ability to define rules for alerts through text searches in the Description field and/or the Corrective Action field. It then sends and e-mail to the user when a rule is met,” he said.

ChronicX Solution, it provides automatic detection and management of chronic and critical defects.

(Photo: ATP)

In those two fields, ChronicX can now find synonyms to identify recurring problems, for example when a problem with nose landing gear is not just entered as those three words, but also as “nlg” or “nose gear”. Lightstone confirmed that the dictionaries for these synonyms are constantly being updated.

Pratt & Whitney has been investing considerably in data products and announced the bringing together of these under a new brand, EngineWise. According to head of marketing, John Renehan, the brand underlines the company’s commitment to helping its customers run their businesses more efficiently.

Leading the EngineWise services portfolio are the aforementioned data analytics and real-time intelligence solutions for predictive maintenance, designed to prevent disruptions to service. These are particularly important as the amount of data being produced by aero engines is increasing by several orders of magnitude. “For example, the PW1100G-JM engine for the Airbus A320neo has 40 percent more sensors than the V2500 which powered the previous generation of A320s,” explained Renehan. “And they are producing four million data points per engine per flight.

“The important thing is what you then do with the data,” Renehan observed, highlighting that this is where EngineWise products support the customer. Other offerings under the brand include Fleet Management Programs (FMPs), engine overhaul services and material solutions.

Moving to slightly different materials, Sherwin-Williams Aerospace Coatings introduced a new clear, external coating for aircraft which provides a shimmering finish, extra protection and reduced costs. The SKYscapes Shimmer Basecoat 850 Series adds the type of finish provided by mica without affecting the colour of the paint underneath. This is something that can occur when mica is introduced into a paint. Any blemish can be rectified without having to touch the basic paint colour or go down to the metal of the aircraft skin.

Sherwin-Williams also displayed a new soft suede product, JetSuede, which is due for release in the third quarter of this year. Initially available in six colours, JetSuede can be used on interior surfaces including armrests. Here, when scuffs occur, repairs are easy as the surface is paint rather than leather.

Embraer arrived at MRO Americas with a new support structure – an integrated business unit focused on services and customer support, led by vice-president Johann Bordais. Previously each of the company’s commercial, executive and military aviation businesses had its own customer service operation.

Bordais admitted that the previous strategy might not be one from the company would start nowadays but it was one which fitted its time. “For example, we now don’t need three planning operations,” he remarked.

The VP said that the new strategy has been driven partly by the rapid growth of the executive aviation division. “And then we have projects like the KC-390 [military transport aircraft], which require new, more efficient support methods,” he noted. “We held a day to celebrate 20 years of the ERJ family and the military operators learned – and liked – a lot of what they saw about our support of the commercial community. Basically we are looking to deliver cross product packages.”

Like others, Embraer is bringing in more data scientists than many other areas. “Smart integration of support is what the market wants,” Bordais emphasised, before concluding that he expects the transfer of ideas on customer support to flow between all three areas of the company’s products.

As one might expect at an event with 15,000 attendees plus around 850 exhibitors from 87 countries, the breadth and depth of topics at MRO Americas is vast. Solutions is a word often treated pejoratively, but among the maintenance community it is clearly everyday reality, whether electronic or physical.