What does it mean to be sustainable? Well, according to the United Nations Brundtland Commission, sustainability is defined as “meeting the needs of the present without compromising the ability of future generations to meet their own needs.” Hence, when it comes to MROs and their suppliers, being sustainable means serving their customers today while reducing their impact on the environment over time.

So, how does this form of sustainability translate into action? To find out, Aviation Maintenance consulted MROs and their suppliers who are taking steps to be sustainable. Their actions provide a roadmap for others in the industry to become sustainable themselves.

How Two MROs Are Becoming More Sustainable

MROs AJW Technique and Lufthansa Technik are both actively pursuing sustainability today. And they are doing so in concrete, practical ways that are delivering results right now.

Let’s start with AJW Technique. In a general sense, “AJW is driving sustainability by implementing more environmentally friendly products and practices into our operations,” said Louis Mallette, the company’s SVP Operations. “The inclusion of sustainable alternatives in our warehouses, such as eco-friendly packaging tape and materials, showcases our dedication to minimizing our environmental impact. This choice not only reduces waste but also aligns with the broader goal of creating a greener aviation industry.”

On the plant floor, “we are exploring innovations in materials used in the operations at our MRO facilities in Montreal, Canada, and Slinfold, U.K.,, ensuring the entire life cycle of aviation components is eco-friendly,” said Mallette. “This involves initiatives like recycling, repurposing, or using materials with lower environmental impact. We select and use the most eco-friendly alternatives available for chemical products, whilst ensuring these are equivalent to the materials used by the OEM and are OEM approved. Where parts cannot be repaired or re-used and disposal is necessary, we ensure segregation of materials to maximize recycling opportunities.”

Electricity consumption is another area where AJW is working to become more sustainable. They’re lucky to have a built-in head start in this area: “Our AJW Technique facility in Montreal is located in Quebec, Canada, where virtually 100% of electrical power is generated from renewable sources (primarily hydro power), making it the ideal location for Technique’s more energy intensive activities,” Mallette said.

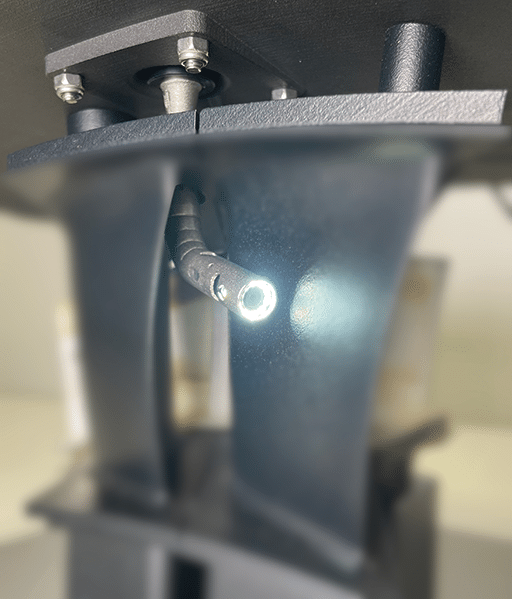

Even with this advantage, AJW Technique is continuously reviewing opportunities to reduce its energy consumption. “Recent examples include the full retrofit of lighting at our 220,000 square foot facility, and the replacement of our air compressors, which were notably oversized for the requirement with optimized units to meet our needs,” said Mallette. “Both energy saving practices have resulted in a significant reduction in energy usage in the facility.”

Becoming more sustainable also means reducing carbon dioxide (CO2) emissions. To this end, AJW’s Montreal headquarters has installed a rainwater harvesting system and solar panels at the facility. These efforts and other efforts have reduced AJW’s annual CO2 emissions by 425 tonnes. “Alongside this, we are well on the way to powering AJW Technique Europe (in Slinfold, UK) with solar energy, enabling the Battery Centre of Excellence to recharge aircraft batteries sustainably,” Mallette said. “We also take numerous measures to reduce operational power usage including scheduling plants and machinery to turn off when not in use and utilizing PIR (Passive Infrared) sensors on office lighting, which are set to the lowest timer.”

In a bid to expand sustainability beyond AJW’s four walls, this MRO’s Procurement Teams actively seek suppliers and partners who share similar sustainability principles. “Collaborating with like-minded partners ensures a more comprehensive approach to sustainability throughout our business operations,” Mallette said. “It’s not just about the product but about the entire process leading to it.”

AJW Technique is even applying sustainability to its housekeeping services by seeking more environmentally friendly cleaning solutions in its MRO facilities in Canada and Europe. “The use of aqueous cleaning agents wherever possible is standard practice within our facilities,” said Mallette. “Sustainable cleaning products contribute to a healthier environment and align with our commitment to the United Nations Global Compact (UNGC).”

The bottom line: When it comes to becoming more sustainable, AJW Technique is ‘walking the talk’ across its entire operation — positioning this company as a leader in fostering sustainability within the aviation sector.

Headquartered in Hamburg, Germany, with MRO facilities around the globe, Lufthansa Technik is equally committed to becoming more sustainable. “To enhance efficiency and conserve resources, we have integrated various products, practices, and solutions into our own operations,” said company spokesperson Lea Klinge. “Our commitment encompasses the implementation of energy-efficient facilities, waste reduction initiatives, and recycling programs within our maintenance processes.”

Another environmentally conscious solution developed by Lufthansa Technik (LHT) is its ‘Cyclean’ aircraft engine wash. “A cleaner engine operates more efficiently, requiring less fuel and maintenance, contributing to environmental preservation,” Klinge said. “Lufthansa Technik’s Cyclean Engine Wash system injects vaporized hot water directly into the core engine, effectively removing combustion residues and contaminants. Regular use of this system leads to a notable reduction in fuel consumption, cutting up to 80 metric tons of CO2 emissions per aircraft annually. Furthermore, customers benefit from increased on-wing time and decreased maintenance costs.” One nice feature: LHT ensures the clean and safe disposal of all wastewater generated by the Cyclean process, she noted, without causing any adverse effects on the environment.

LHT is also working to extend sustainability to the aviation world as a whole. To this end, this company provides MRO solutions that help its clients in minimizing their environmental footprints. “This includes innovative products like AeroSHARK, a bionic film developed in collaboration with BASF,” said Klinge. “AeroSHARK, featuring ‘riblets’ inspired by sharkskin, can be easily applied to large areas of commercial aircraft surfaces. By reducing the aerodynamic drag, this technology significantly reduces fuel consumption and emissions. Our observations on Boeing 777s treated with the currently certified expansion stage of the AeroSHARK modification already indicate a one percent reduction in fuel consumption, and initial calculations suggest potential savings of up to three percent at its maximum expansion level.”

What Suppliers Are Doing To Help

Aerogility and Aerotrax Technologies are two aviation suppliers who are supporting sustainability in their own right.

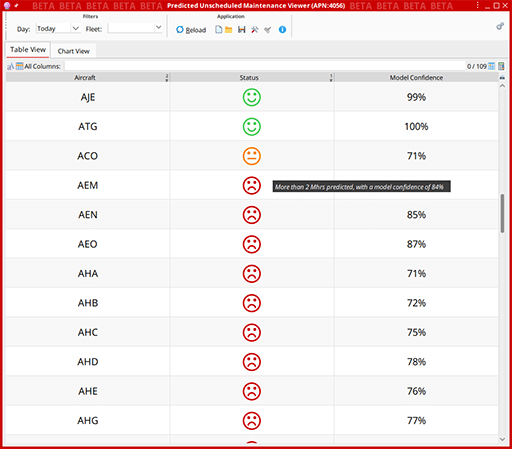

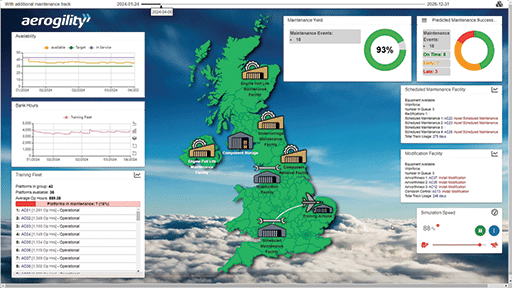

With offices in Atlanta and London, Aerogility uses model-based AI and enterprise digital twin technology to give aircraft operators a holistic overview of their operations. Its sector-specific AI models allow fleet and maintenance planners to simulate real-world scenarios to generate reliable insights for forecasting, planning and decision making. “The simulations can be used to assess the impact of a scenario and why the AI technology made a particular decision before they are implemented,” said Phil Cole, Aerogility’s airline business manager. “This can include the impact of bringing in a new fleet, changing maintenance schedules, or introducing sustainable aviation fuels (SAF).”

Aerotrax Technologies is a Dallas, Texas-based enterprise software company focused on data sharing and visibility in the aviation/aerospace supply chain. “We are a cloud-based software vendor, so the delivery of our products has negligible impact on the environment,” said David Bettenhausen, the company’s founder and CEO. “By focusing on small improvements on a daily basis, we drive positive, incremental change across the supply chain organization — which, as a business function, is the beating heart that drives all aftermarket success.”

In addition to helping its clients become more sustainable, Aerotrax is applying sustainability to itself. “We run a lean operation, continuously looking for ways to be more efficient,” Bettenhausen said. “When sustainability is embedded in your culture, it’s the little things that you commend. Whether it’s rearchitecting the system design from a blockchain-based, energy intensive platform to a serverless, pure cloud implementation, or if it’s prioritizing flight choices based on total carbon emissions rather than only convenience or only price as the sole decision-making driver — we are constantly holding ourselves accountable to our own internal bar. In both these decisions, our software and our people are able to perform better.”

“The picture I’m trying to paint is that sustainability is multi-faceted,” he added. “No single pledge, policy, product, or person automatically makes an organization sustainable. It’s the little things that are done on a daily basis. I also personally do not believe it is wise to look at sustainability in a vacuum of environmental sustainability, which is oftentimes the case. The most thoughtful decisions in this context artfully balance environmental and economic alignment in both the short term and long term.”

Airlines Want Sustainable MRO Solutions

There is no doubt that becoming more sustainable is a responsible social policy for MROs. But it is also good business. This is because airlines and other aircraft operators want to be more sustainable to satisfy environmentally conscious customers who pay their bills, and the governments that regulate their industry.

“Passengers are the lifeblood of our industry, and if operators do not listen to the needs of their customers, they may opt for a greener airline,” said AJW’s Mallette. “Our customers, being operators and those supplying operators, are looking for MRO operations that feed into their sustainability goals.”

“We are seeing a growing demand for more sustainable MRO solutions from our clients,” agreed LHT’s Klinge. “Airlines and aircraft operators are increasingly focused on reducing their environmental impact and operating more sustainably. This has led to a greater interest in MRO solutions that can help them achieve their sustainability goals.”

There are other ways that MROs can become more sustainable, at least from a regulatory standpoint. For instance, airlines have been strong buyers in the Carbon Credit markets to offset their CO2 emissions. “I have some friends over at Green Trade Solutions in the U.K., who have been supporting big, new carbon capture projects and helping airlines find projects they can get excited about that are in line with regulatory requirements,” Bettenhausen said. “While the MRO industry certainly recognizes the importance of sustainability, I haven’t seen as much activity or appetite for these carbon offset initiatives in the same way that I see airlines pursuing.”

A Necessary Commitment

“According to NOAA’s 2023 Annual Climate Report the combined land and ocean temperature has increased at an average rate of 0.11° Fahrenheit (0.06° Celsius) per decade since 1850, or about 2° F in total,” said the U.S. government website climate.gov (full link at end of article). “The rate of warming since 1982 is more than three times as fast: 0.36° F (0.20° C) per decade.”

With facts like these, there is no doubt that industry needs to take climate change seriously and address it through sustainability initiatives. “In 2022 aviation accounted for 2% of global energy-related CO2 emissions, having grown faster in recent decades than rail, road or shipping,” said the intergovernmental International Energy Agency at www.iea.org (full link at end of article). “Many technical measures related to low-emission fuels, improvements in airframes and engines, operational optimization and demand restraint solutions are needed to curb growth in emissions and ultimately reduce them this decade in order to get on track with the Net Zero Emissions by 2050 (NZE) Scenario.”

LHT takes its role in addressing climate change seriously. “It is vital for every company in the industry to use or even offer solutions for a more sustainable aviation,” Klinge said. “For us, this also means to engage in research activities that provide important impulses for a carbon-neutral and potentially hydrogen-powered future. To investigate the effects of the use of liquid hydrogen (LH2) on maintenance and ground processes already at an early stage, and to provide valuable impulses for the designers of future aircraft, Lufthansa Technik is partnering with renown research and industry institutions and will jointly operate a comprehensive LH2 field laboratory based on a decommissioned Airbus A320.”

The good news? In a very fundamental sense, “MRO and sustainability are actually quite harmonious concepts,” said Bettenhausen. “By choosing to maintain, repair or overhaul a part, purchasing managers are actually choosing the more sustainable solution than buying new. (In the Defense world, MRO is literally called Sustainment.) If we continue to find novel ways to extend the life of parts and aircraft — from more accurate aftermarket measurement and reporting, to feedback loops and data sharing with OEMs, to new breakthroughs in material and systems design — we can move the needle on ambitious sustainability goals. I believe these innovations are imperative to ensure the long-term economic health of the industry.”

The Big Picture

By actively pursuing sustainability, MROs and their suppliers are aligning themselves with the aviation industry as a whole, where achieving sustainability has become a priority. After all, being held responsible for 2% of global energy-related CO2 emissions is not a good position for any industry, whether on a social, environmental, or regulatory level.

“This is why “the International Civil Aviation Organization (ICAO) set a goal in October 2022 to achieve net-zero carbon dioxide emissions from aviation by 2050, prompting a shift towards sustainability in the aviation sector,” Mallette said. “If we are to ensure the economic health of our industry going forward, MROs such as AJW Technique must adopt and provide sustainable solutions within their business and MRO operations. The world and passengers are demanding it from the industry.”

“As the aviation industry continues to focus on sustainability and environmental responsibility, MROs that can offer innovative and more eco-friendly solutions will be well positioned to attract and retain clients,” added Klinge. “Additionally, sustainable practices can lead to improved operational efficiency and long-term cost savings.”

A case in point: “By using safe and trusted AI solutions, MROs can model carbon outputs for example, enabling them to meet carbon emissions targets,” Cole said. “MROs and airline maintenance departments can also use the insights generated by AI to efficiently implement optimized maintenance schedules, reducing unnecessary part wastage or aircrafts operating without the latest emission-reducing technologies.”

If there is a lesson to be drawn, it is that sustainability is a necessary commitment for the MRO industry, and a requirement that will shape its economic viability going forward. Thankfully, the sincere efforts of the MROs and suppliers noted above, along with those of others in the aviation industry, offer a good chance of delivering on this promise.

“Remaining economically viable in the MRO industry requires staying at the forefront of sustainable practices,” concluded Mallette. “Collaboration will drive the health of the industry while also protecting the planet and its people.”

Aerogility