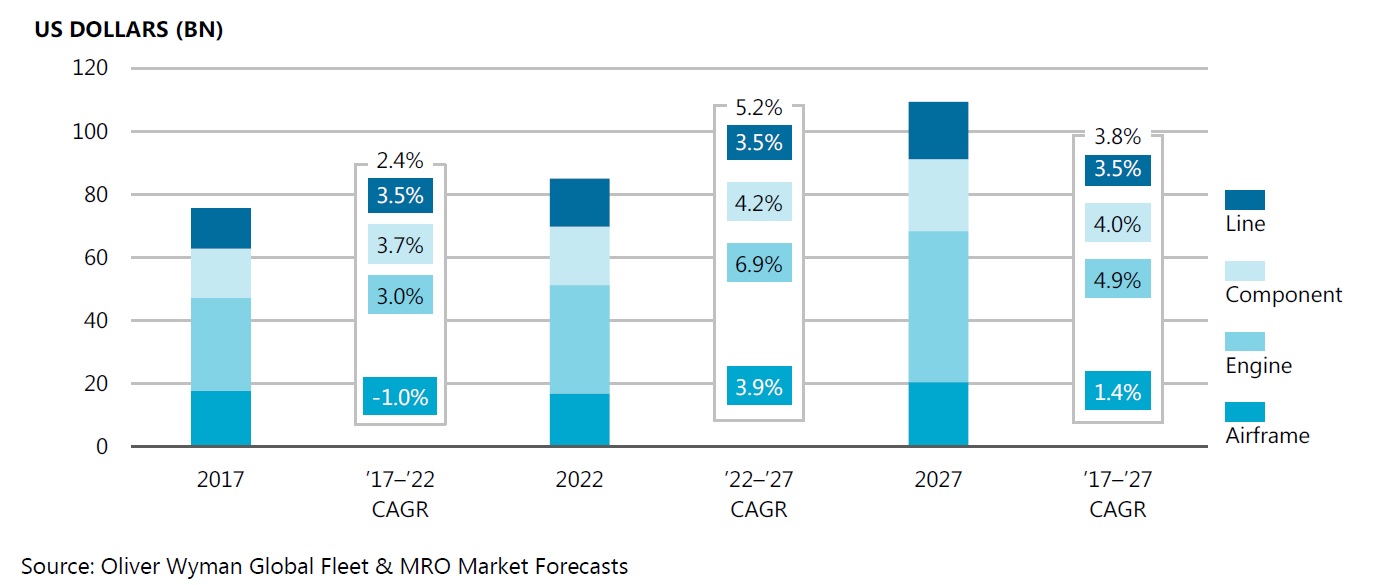

MRO Americas, Orlando, Fl: The current financial cycle for the airline industry has gone past its peak, after the airlines posted a net profit of $35 billion in 2016. The MRO industry, however, will continue to grow from a value of around $72.1 billion this year to $103.8 billion in 2027. So said Dave Marcontell, general manager, Oliver Wyman/CAVOK as he kicked off the industry forecast session at MRO Americas 2017 in Orlando, Florida.

An increase of 10,133 aircraft in service, to take the global fleet beyond 35,000 by 2027 will accompany that MRO industry growth, which means that 40 percent of today’s in-service fleet is forecast to retire by 2027, Marcontell noted.

US carriers contributed approximately $20 billion to 2016’s airline industry profit, with a good portion of it due to exceptionally low fuel prices. Although fuel prices have gone back up to around $55 per barrel, Marcontell believes the next couple of years will still be positive for North American airlines. One notable phenomenon from 2016 was that around 630 aircraft were removed from storage and put back into service.

Marcontell then brought up what he described as the “black elephant in the room”, namely the impending labour shortage of AMTs (aircraft maintenance technicians). “The median age of technicians is now 51, which nine years higher than average workforce,” he reported.

Moving on to predictive maintenance, big data and advanced analytics, Marcontell remarked that there has been limited evidence so far as to the benefits. While most companies are investing in these developments, 62 percent of respondents to a survey about their use said they were constrained by old technologies. Last year that old technology was seen as a small problem, but now organisations are realising how hard it is to make use of all those new technologies.

However, the survey did show that while many are ‘behind the curve’, most are not standing idly by waiting for things to happen. But about half of respondents said their IT budgets are not sufficient.

Richard Brown, principal at ICF, agreed that the North American market will have another good year in 2017, with a forecast EBIT margin of 12.9 percent. All other regions are also expected to be positive except for Africa.

Brown observed that more stable fuel costs slowed aircraft retirements, which has had an effect on the MRO market. “For example, United has been putting 777-200s back into the domestic market, while British Airways has been looking to refit the interiors of some of its 747s,” he remarked. Also, fewer aircraft are being cannibalised, with no more 5-year-old A319s being parted out.

ICF’s current forecast is based on the 2016-2026 period and features 3.2 percent a year global growth, taking fleet from around 28,000 to 38,000. However, the company expects the global MRO market to grow at 4.1 percent a year – faster than airline growth. North America’s MRO market will grow from $18 billion in 2016 to $21.4 billion in 2026.

Brown highlighted a number of trends to watch, including the rise of RONA (return on net assets)-driven airlines. For these carriers, capacity management and asset utilisation are replacing market share as the key metrics of the business. “And it’s all about sweating those assets,” he added.

Whole lifecycle solutions is another trend to watch, Brown continued, “With new aircraft orders softening, OEMs are even more focused on the aftermarket. Boeing, for example, is aiming to triple its services revenue to $50 billion over the next decade.” This involves developments such as building a hangar at London Gatwick to support Norwegian, which operates 787s and 737s from the airport and will also be taking a large number of 737 MAXs.

“With a highly competitive aftermarket ecosystem, MROs need to continually identify ‘how to win’ and invest to maintain leadership,” Brown concluded.

By Bernie Baldwin, Editorial Contributor