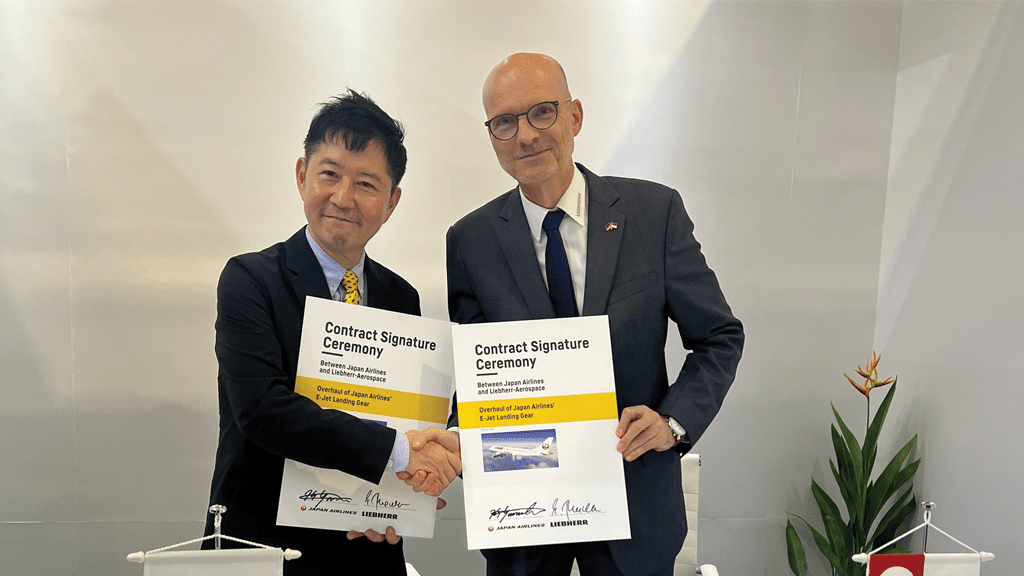

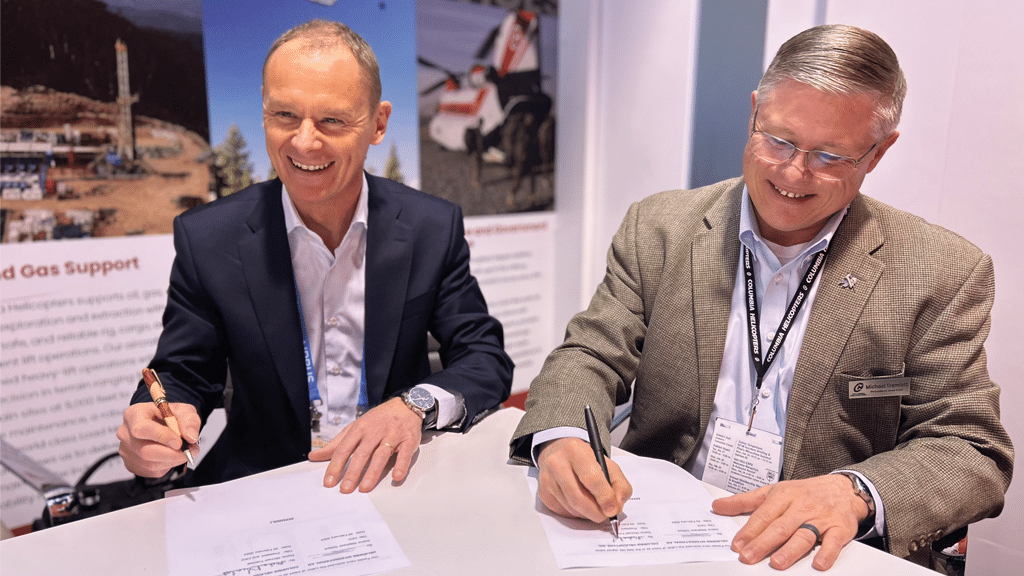

Liebherr-Aerospace and Japan Airlines (JAL) have signed a long-term service contract for the overhaul of landing gears. With this contract, Liebherr-Aerospace becomes the exclusive service provider for J-Air, a subsidiary of the JAL Group, for the maintenance, overhaul and repair of the landing gears of the airline’s E170 and E190 fleet.

Following the completion of the initial landing gear overhaul program which had started in 2019, this new contract renews the profound partnership between JAL and Liebherr-Singapore by extending the earlier landing gear overhaul program by another 17 landing gear sets. The new overhaul program is planned to start in mid-2024 and will extend until 2028.

“It is with great excitement that we embark on this continuous journey with Japan Airlines,” said Ekkehard Pracht, general manager aerospace at Liebherr-Singapore Pte Ltd. at the contract signing. “We are honored and grateful for their decision to once again entrust Liebherr-Aerospace with the overhaul of the landing gears for the remaining E170 aircraft and the entire E190 fleet. The contract is also proof of our continuous efforts to expand our footprint in the Asia-Pacific region.”

“JAL Group valued the high-quality maintenance standards that was provided by Liebherr-Aerospace and had chosen once again to collaborate with Liebherr-Aerospace. JAL Group is convinced that this partnership will further strengthen our long-term relationship,” commented Kojiro Yamashita, vice president of procurement at Japan Airlines.

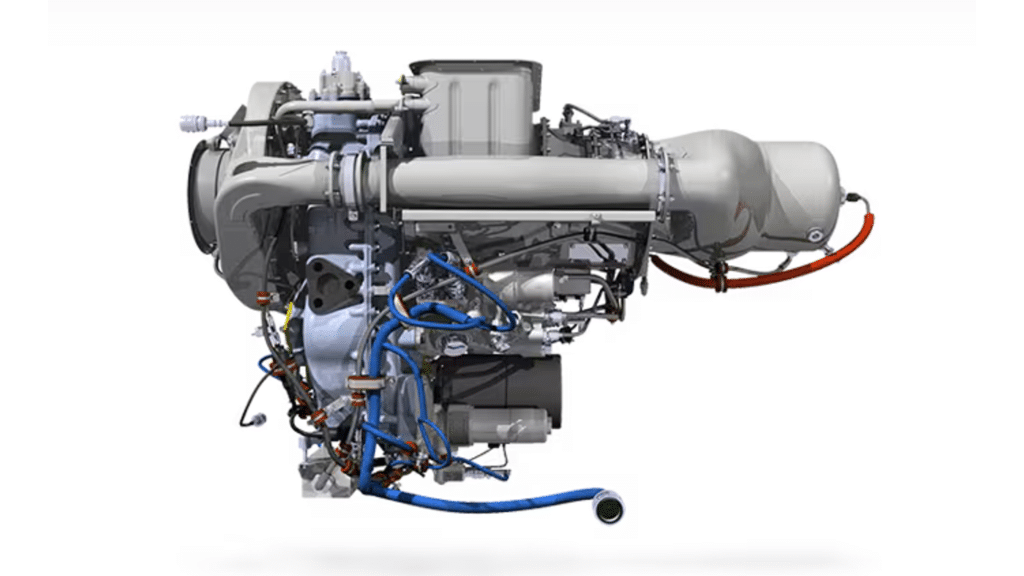

The complete landing gear system for the E-Jet family (E170/175, E190/195) was developed and manufactured by Liebherr-Aerospace Lindenberg GmbH (Germany), Liebherr’s center of competence for flight control, actuation, gears as well as gearboxes and landing gear systems.