With more than 30 years of experience in the aviation industry, Jean-Marc Lenz became CEO of SR Technics in September of 2019 just before the pandemic struck. Aviation Maintenance Editor-in-Chief, Joy Finnegan, had the opportunity to sit down with him in Atlanta, Georgia, recently to learn how the company navigated the past several years and their big plans for the future.

AVM: Give our readers some highlights of what SR Technics did to make it through the pandemic years and what you are working on right now?

JML: The company is coming out of the pandemic on the right spot. We designed our strategy by focusing mainly on the engine business. During the pandemic, we made sure that all the non-engine-related businesses, especially those that were loss-making, were completely removed or sold. Now, we have an 80% engine-focused business. This engine business basically has two pockets. The main business where we do a lot of activities on the PW 4000 and on the CFM 56, where we still have a really nice growth story for the next 10 years or so. That’s the cash cow for the company. And we continue to be focused on that business, especially on the repair side of the house. That’s exactly the core of the business.

AVM: What are you focusing on for the future?

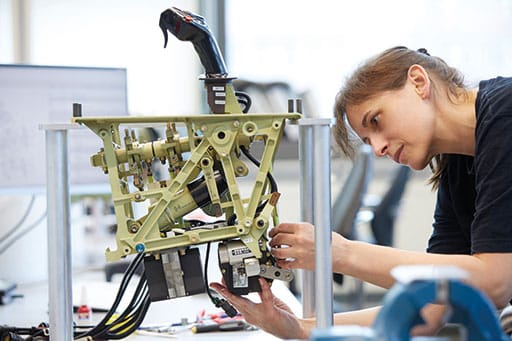

JML: The new business in the future is the PW1100G-JM (also known as the GTF – geared turbofan) and the LEAP-1B. [We have] a big contract for the PW1100G-JM engines for the A320neo with full disassembly, assembly and test; more than 1,000 shop visits for the next 10 years. We start next year, 2024, with the first engine induction. We are in a hiring phase, in a preparation phase, in the full industrialization process to prepare. Recently we announced the start of the construction work for reactivation of a second test cell to expand test capabilities and capacities at Zurich Airport, Switzerland. It will be redesigned for this new engine. That will be a rapid ramp up, basically going rapidly to up to 100 visits a year. The test cell 2 will be enlarged to a seven-by-eight-meter cross-section and will receive state-of-the-art data acquisition and instrumentation systems. SR Technics and Safran Test Cells have designed test cell with environmental compatibility and sustainability in mind, introducing fit-for-purpose equipment for the lowest energy consumption and technology, such as thermal waste heat recovery.

AVM: So far, how is the project of reactivation of the test cell going?

JML: Every big investment like that will have its challenges that’s for sure. But for now, basically the project is well set up, all the preparations are made. We had the groundbreaking event in April that indicates that the full planning and design phase is behind us. And we have good partners.

AVM: Talk about your goals for the company?

JML: Our goal is to double our business in the next five years. We are building infrastructure in Zurich, opening new production facilities and increasing our workforce with around 500 people within the next few years to extend our capabilities for the GTF and LEAP engines.

AVM: That is an ambitious goal to double your business in the next five years. How will you get there?

JML: Yes. The GTF and LEAP, of course, will be a large portion of it as they are the actual engine types which will be in a growth phase. Today, we are doing around 200 shop visits a year, and in five years from now we will do 350 – 400. That’s the goal.

AVM: What about your work on the LEAP-1B?

JML: The strategy for the LEAP-1B, it’s different from the GTF. Obviously, we cannot do two new engine types at the same time, at the same speed. So, on the LEAP, we start up on a different pace. We have already started on the hospital lines. We do smaller repairs on the quick turn lines. On LEAP-1A we are about to launch a couple of work scopes together with the OEM basically to also ramp up a little bit more rapidly on this quick turn line with dedicated work scopes.

AVM: What about ongoing work for other engines?

JML: Last year we introduced more than 50 new repairs on the CFM 56. So that’s something which is ongoing as we speak. It’s important and for me, that’s one of the most important points for the future. Those engines need to be repaired. And by having new repair capabilities, it also means we have availability on USM (used serviceable materials). The USM market is important also for the repair on that engine. That simply increases the service offerings we have for customers.

AVM: Talk a little bit about the USM market. How are you incorporating that into your business plan?

JML: We are working with a lot of partners on finding engines to be torn down now and we are supporting basically quicker turnaround times. We are making sure that the problems in the supply chains are overcome, especially with us. We were always doing that. But with that big increase in demand, it’s now very important.

AVM: How do you see the supply chain issues resolving in the near future?

JML: I’m optimistic. The supply chain issue will be resolved in the next six to 12 months. Even in a more pessimistic view it takes a little bit longer, but it will be resolved. It’s a matter of having raw material back and having the people back. Just needs a little bit of time.

AVM: With that growth comes the need for skilled labor. Everyone’s talking about how difficult it is to find skilled labor right now. Are you experiencing this as deeply as we are here in the U.S.?

JML: We also have issues with finding the right skilled labor. But I have to admit Switzerland is in a better position. First of all, we have a very nice apprenticeship program. That was ongoing and we didn’t stop it during the pandemic. It’s a self-feeding, in-house system. Secondly, we are hiring, obviously from all over the place (outside of aviation) in Switzerland and retraining those technicians, basically for the aviation business. And thirdly, we are hiring across all of Europe, so people are joining Switzerland because it is good place to live. So, in other terms, we are still finding the necessary people. We will have to hire 400 to 500 in the next three to four years. It’s over 100 a year.

AVM: Let’s talk about the digitization of business. SR Technics has done some serious work in that area. Tell us about what you’ve done and who you’ve partnered with?

JML: Yes, absolutely. Digitalization in our industry is very important for various reasons. The first is efficiency. The second is traceability. And also to make sure that interconnectivities in the processes are 100% understood. So, in the word digitalization, there is much more behind that than just a new IT system. It’s about making sure that all the processes in our industry are, as I said, interconnected reflected by bringing in a new agile cloud-based ERP platform. We redesigned all our operating processes to fit with that system. We are working with HCLTech to digitally transform SR Technics’ operations. HCLTech will implement a new greenfield SAP S/4HANA environment hosted on Microsoft Azure using RISE with SAP. We will implement iMRO, HCLTech’s MRO industry add-on for SAP. This new system will be implemented starting 2024.

AVM: Talk about the implementation process — how do you prepare?

JML: The implementation is much more complicated than just transferring data. You only do a digitalization project like this one every 20 years. The first thing you have to do is to clean up your processes. The second thing you have to do is to make sure that the processes are completely lean and ready to be digitalized. And then you need to ensure that your processes are fitting with the standard of the chosen systems. Then you have to make decisions about the needed add-ons and only then can you implement the system. So, it’s quite a major move for the company. And it’s a huge investment not only financially but in people, in processes.

AVM: How do you clean up these processes and make them completely lean, as you said? How do you determine where you need work?

JML: In the beginning to figure out which system would fit we worked with a consultant. But for this, that’s where we have a special team in place, a project team. That [internal] project team started those activities, I would say two years ago already.

AVM: It’s been about a year since opening the new six-bay hangar and back-shop facilities in Malta. How is that updated facility doing?

JML: We’ve been in Malta for more than 10 years. Why there? Because at that time we were choosing in different location in Europe where we would have a lower cost location. We started with a rented hangar. About a year ago we moved into the new hangar. Cost for us was a factor, but also location for our customer base and where do we find the necessary skills? Malta was, and still is, the right place because the availability of skilled labor was very good. It fit and was feeding very well to our customer base. After a while we realized that the two-bay operation was too small. We increased to three bays with temporary hangers. At that point in time, we decided to build a new hangar with the government’s help in supporting that kind of development. The new hangar was finalized last year and we moved into the new six-bay hangar. Now we are operating a five-day operation there.

AVM: You recently launched a new Sustainable Engine Alliance. Please tell our readers about this project.

JML: It’s something new, very important and is a strategic topic. We have a role to play in that. We decided to start an engine alliance about sustainability. The target is to reduce the footprint or avoid the CO2 emissions for the full cycle of a shop visit, starting from the removal of the engine at the airline and continuing in each stop of the process including transferring the engine to the shop, disassembling the engines, all the activities connected to logistics, on repairs, and also to reassemble and test the engine and to transport the engine again. So, the full repair cycle is managed and analyzed on the search. We’re going to be able to show the reduction of the CO2 footprint with this project. I think that will be much more important in the future and I’m quite sure that airline customers will be looking more and more at those kinds of activities when selecting their providers.