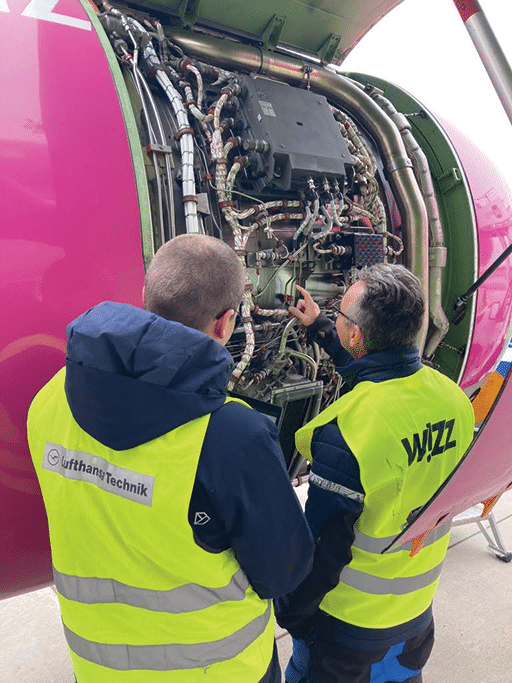

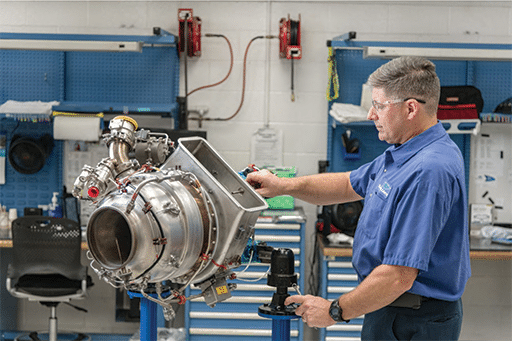

Now more than ever, airlines and maintenance, repair and overhaul (MRO) organizations are seeking ways to improve their engine maintenance programs in a bid to reduce costs and improve turnaround time. One way these companies are doing this is by applying advanced information technology (IT) systems to engine monitoring, maintenance, and troubleshooting. “There is an increasing focus to move more towards data-driven decision making as opposed to a hardware-driven process, which has traditionally been the dominating paradigm,” said Markus Wagner, head of digital maintenance services at MTU Maintenance.

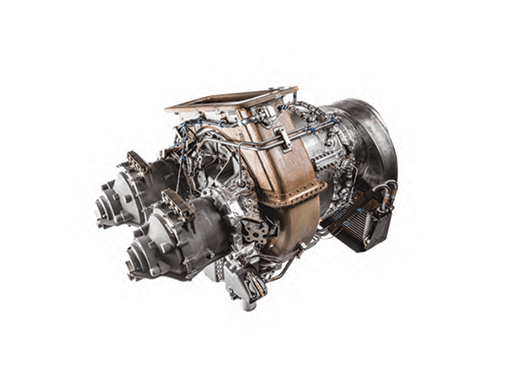

MTU Maintenance

Qualities of an Effective IT System

IT systems improve aircraft engine maintenance by analyzing the data being collected by engine sensors during flight. They then analyze this data to assess engine performance, alerting human technicians to any immediate issues and signs of potential problems.

To be truly useful, an engine maintenance IT system must possess certain qualities. One of these is the ability to analyze engine-related data with minimal human supervision, through a process that Prakash Babu Devara, head of marketing (aviation) for Ramco Systems (maker of the Ramco MRO Aviation Solution platform) refers to as “smart automation”.

Head of Marketing, Ramco Systems

“Engine maintenance processes generate a wealth of data pertaining to the defects, parts consumed, labor hours, and elapsed time to carry out repair and overhaul procedures,” explained Devara. “Accumulated over time, this data can become a goldmine of information to gain insights. Our solution derives insights into all key processes by analyzing this data, and provides Key Performance Indicators (KPIs) related to Turnaround Time (TAT), quality, cost, resource utilization, and warranties dynamically without any need for manual consolidation and preparation.”

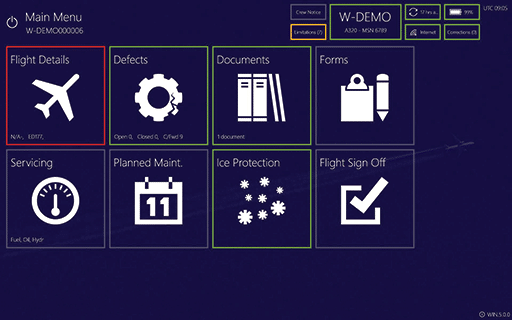

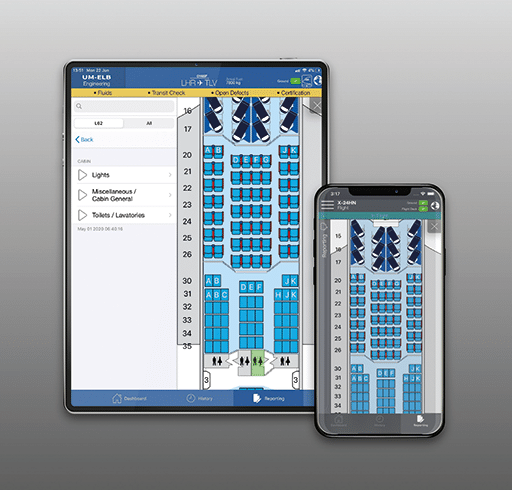

Worth noting: All of these capabilities must be made available to mobile devices on the shop floor. Doing so allows aviation mechanics to book appointments, report their findings, request parts and tools, and access technical documents everywhere — along with collaborating with other technicians through chat, videocall, and screen share from the same device.

Head of Digital Products Engine Service, Lufthansa Technik

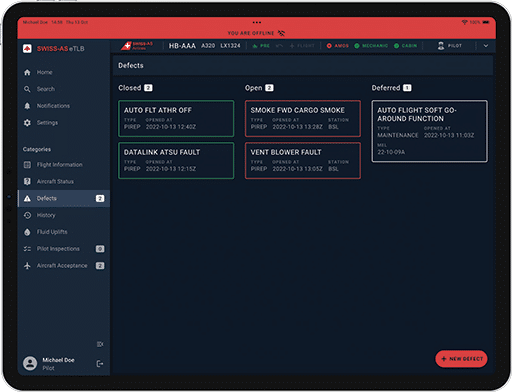

Lufthansa Technik is a strong believer in using IT systems to enhance its engine maintenance operations. But just extending these systems throughout the entire operation isn’t enough. To ensure that they deliver their promised benefits, “seamless and consistent user experiences across IT solutions are key,” said Matthias Beck, head of digital products/data & analytics engine service for Lufthansa Technik. In other words, these systems must be designed to be intuitive and easy to use, as well as far-reaching and being deployed enterprise-wide.

The payoff from these efforts are better results for all. “By digitalizing the entire process in our MRO Management platform, we simplify and streamline the vast amount of information and communication flowing back and forth between us as the MRO and the aircraft operator,” Beck said. “The accessibility independent of location and time, as well as the visualization of all details in a dashboard in a structured and standardized form, enables our customers to have a real-time overview of the status and shows where immediate action is required if necessary.”

Beck’s last point is endorsed by Devara, who emphasized that everyone in the engine maintenance supply chain needs access to this information to achieve maximum benefits. “The seamless flow of data between the ecosystem partners such as suppliers, contractors, shipping partners, banks is essential for augmenting operational efficiency,” he said.

VP, QOCO

Another necessary feature of an effective engine maintenance IT system is reliable, wide-ranging access to digital documentation. This requires the engine maintenance organization using the system to be paperless, “and also not to be reliant on PDFs and other non-machine-readable formats,” said Henrik Ollus, vice president of aviation data exchange business at QOCO Systems (maker of the cloud-based engine maintenance IT system Aviadex.io). “Only once the data is reliably available in a machine-readable format is real automation possible.”

Ollus added that rigorous data accuracy is a must for these IT systems, given how much is riding on aircraft engine maintenance. “Ninety-five percent data accuracy is not enough in the highly regulated aviation industry,” he said. “Proper data quality controls are needed. This again highlights the importance of machine-readable data formats, as automated data quality checks and cross-system reconciliation can then be applied.”

End-to-end coverage of all work functions is a further necessity for engine maintenance IT systems, since gaps can lead to errors. This is why “the IT systems in the GE MRO network cover all aspects of engine overhaul activities,” said Alf Cherry, CIO, Commercial Engine Services at GE Aerospace. As well, “consistency across the GE Aerospace MRO network drives quality data capture,” he noted. “This ensures efficient coordination, quick information exchange, and accurate customer updates, resulting in faster service delivery.”

Unfortunately, this level of connectivity can run counter to the traditional ways that many engine maintenance shops are structured. “In these organizations, the data points between Engineering, Supply Chain, Hangar/Shop Floor, and Finance sit in silos, for reasons that were chosen with a department’s interest in mind as opposed to a cross-organizational need,” said Sriram P. Haran, founder and CEO of KeepFlying Pte Ltd., which uses artificial intelligence (AI) to analyze risks in the aviation industry.

The same shortfalls apply to some vendor-provided software as well. “For instance, OEM-driven tools from GE, Pratt & Whitney, and Rolls Royce provide coverage as part of managing shop visits, exchanging trend and sensor data broadly within the spectrum of predictive maintenance,” Haran said. “However, this doesn’t encompass fundamental airworthiness data points inherent to each engine.”

The Power of AI

AI is at the heart of today’s engine maintenance IT systems. With its ability to process massive amounts of sensor data and apply them to digital versions of physical engines — a process known by the name of “digital twins” — AI makes it possible to track, record, and model every change occurring in an actual engine from the day it was designed to its service history. In this way, AI provides engine maintenance shops with an unparalleled ability to manage and diagnose every single one of their clients’ engines in detail. It also provides sufficient processing power to detect signs of problems as they occur, and even before!

VP of Data and Analytics, GE Aerospace

“These days, digital twins and artificial intelligence are playing a significant role in fleet management and MRO efficiency,” said Dinakar Deshmukh, vice president of data and analytics, GE Aerospace. “For instance, GE Aerospace has been using contemporary digital technologies to build the digital twins of every flying GE commercial engine, which are used to monitor and take appropriate action enabling optimized operations for both customers and the business. GE employs a unique approach of fusing deep domain understanding coupled with machine learning (aka ML, a subset within artificial intelligence) to build these differentiated twin models. This resulted in significant improvement in fleet management — namely a reduction in false positives, increased lead time and asset utilization.”

Deshmukh’s positive assessment of AI and the digital twins it enables is shared by every company who spoke to Aviation Maintenance for this story. The enthusiasm of their assessments is worth quoting, in order to drive home how strongly they support this IT system approach.

A case in point: at Lufthansa Technik, the employment of AI and digital twins “opens new possibilities for engine maintenance,” Beck said. “Through condition monitoring and the continuous assessment of engine parameters, such as temperature, pressure, vibration, and fluid levels, any abnormalities or early signs of malfunction can be identified. Advanced sensors and monitoring systems can collect real-time data and provide valuable insights into the engine’s overall health. By tracking these parameters, potential issues can be detected early, allowing for timely interventions and reducing the likelihood of failures.”

In plain language, “by leveraging machine learning and advanced analytics, AI can identify patterns and correlations that human operators might miss,” said Devara. “This enables proactive maintenance strategies, reducing downtime and increasing operational efficiency.”

AI can also reduce the occurrences of AOG (Aircraft on Ground), while also cutting scheduled maintenance costs and making preventive maintenance possible.

For example, “Lufthansa Technik has developed proprietary, physical-based (thermodynamics) models to apply AI and ML algorithms to predict aging, crack propagations, fouling and wear of compressor and turbine parts, amongst others,” Beck said. These predictions allow this MRO to take a more preventative approach to engine maintenance, including deleting scheduled service when the facts show it to be unnecessary.

“Rather than following a fixed maintenance schedule, operators and MROs can schedule maintenance activities when the engine’s condition indicates a need for intervention,” said Beck. “This proactive approach minimizes unexpected breakdowns, extends the engine’s lifespan, and optimizes operational efficiency and time-on-wing compared to traditional approaches.”

Founder and CEO,

KeepFlying

Then there’s the financial implications of AI, which are considerable in themselves. “Digital twins have been very useful to the aviation business,” said KeepFlying’s Haran. But their usefulness goes beyond keeping engines in service: “While we are still exploring extended uses of this technology, the moment has come to understand how commercial implications of decisions against your engines, for instance, can be represented as a digital twin,” he explained. “Thus, the FinTwin was born — a financial twin that allows you to visualize the commercial impact of a decision against an asset using its underlying airworthiness and maintenance data with AI-driven data models.”

In the same vein, “standardizing data exchanges between the ecosystem of lessors, OEMs, airlines, MROs, CAMO facilities and supply chain vendors — especially with the crisis around supply chain TAT today — is critical to ensure that the airline industry can make profit margins greater than the industry’s 1.8% predicted by IATA by the end of this year,” Haran added.

The Limits of IT Systems

So far this article has waxed poetic about the many benefits of engine maintenance IT systems, especially those enabled by AI/ML. But it is worth noting that, as good as they are, these IT systems have their limits. These limits need to be kept in mind when relying on these systems, because even the best of AI-enabled IT systems are not meant to run without human supervision.

One of the most basic limits is the quality of information being fed into an IT system. If this information is of poor quality, the same will be true for the data that the system outputs, even if it is assisted by AI.

Take digital twins, for instance. “The key for their usefulness is based on the granularity, quality, and timeliness of the data that built up that digital twin,” Ollus said. In other words, the quality (or lack thereof) of any digital twin is governed by the “garbage in/garbage out effect,” he observed. (Also known as GIGO, this is a longtime computer programming term, meant to caution programmers and clients of expecting too much from too little.) “AI-powered tools are at their best when based on large amounts of data.”

A lack of machine-readable data on specific engines — particularly older models — can also hamper an AI-enabled IT system’s ability to do its job properly. “Non-availability of key technical data for specific engines and its life-limited parts (LLP) is one of the challenges that Ramco is seeing in the market,” said Devara. “The fact that this technical data still resides in silos and paper formats is undermining the value of digital technology to engine maintenance. Accessing this data and utilizing it effectively remains a key area of focus in the industry.”

Finally, “the biggest challenge probably lies in the harmonization of newly-developed digital tools like AI-assisted MRO planning with legacy systems that have been around in the industry for decades,” Wagner said. “It is very much an ongoing discussion.”

All of these limits are not standing in the way of IT systems adoption by engine maintenance organizations. In fact, “nothing is changing the MRO industry and is driving the development of new solutions more than digitalization,” Beck said. “It is the only game changer of this decade. With 50 times more data generated by new aircraft types and approximately 50% of airline operating costs consisting directly or indirectly of MRO services, further cost reductions can only be accomplished through MRO and operational optimization driven by digitalization.”

What’s Coming Next?

As powered as today’s AI-enabled engine management IT systems, they will be able to do even more in the future as processing power increases and processing algorithms improve.

So what’s coming next? “I predict an extension in data exchange, as opposed to point-to-point integrations and manual data sharing,” said Ollus. “Data sharing platforms will ensure access to data from many/most airlines through the same platform, rather than just relying on one airline’s content.”

“Profitability margin improvement requires airlines to take a closer look at their data management/data exchange ecosystem,” Haran agreed. As well, “the time is ripe to latch on to the wave to explore avenues that can make it easier to transition towards a paperless ecosystem — not only within the hangar or shop floor but across departments to stick to net zero carbon goals.”

GE Aerospace is looking forward to AI-assisted automatic inspections where possible, with these IT systems “automatically feeding this inspection information to drive continuous improvement of predictive digital twins,” said Deshmukh. “Some of the low hanging improvements we can think of are processing customer workscoping data from PDF-based documents, leveraging the historical data and machine learning for estimating the scrap rates and workscopes,” Devara added. “We can also optimize the usage of specific serial numbers of parts for meeting the customer demands and reducing the cost.”

All told, the “digitization of TechOps will further gain importance in airlines’ value chain steering and optimization,” said Beck. In this digitalized world, “data access and ownership will be key for airlines to maintain independence.”

“We are always looking for ways to improve the IT-based services of the entire MRO process for two reasons,” Wagner said. “One is to increase the efficiency of our MRO processes and two is for business enablement purposes. If we can continue to develop newer and better ways of conducting maintenance work, we can offer the market exactly what it demands.”

Summing up, the integration of information technology into engine maintenance programs is significantly enhancing the accuracy and speed at which these services are being provided by airlines and MROs. Advanced analytics capabilities enable real-time monitoring and proactive detection of potential issues, while predictive modeling algorithms optimize maintenance schedules. Additionally, the seamless communication facilitated by IT systems ensures that all stakeholders have access to timely and relevant information. As this technology continues to advance, we can expect further improvements in AI-enabled engine maintenance IT systems and their processes, ultimately leading to safer and more efficient air travel.